3D Rendering Market Outlook:

3D Rendering Market size was over USD 6.4 billion in 2025 and is poised to exceed USD 40.97 billion by 2035, witnessing over 20.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of 3D rendering is estimated at USD 7.58 billion.

The 3D rendering industry is increasing significantly due to the need for precise rendering and animation. Many industries rely heavily on 3D rendering software, including automotive, architectural engineering, construction, healthcare, and manufacturing. Therefore, the growth of the market is being driven by factors such as the increasing use of 3D visualization in various sectors and the popularity of gaming and entertainment. The 3D rendering market development is marked by the launch of new software solutions. In August 2023, HYBRID Software released iC3D Suite Version 9, the latest version of 3D rendering automation. It offers automation capabilities, along with new improvements to enhance the user experience.

Key 3D Rendering Market Insights Summary:

Regional Highlights:

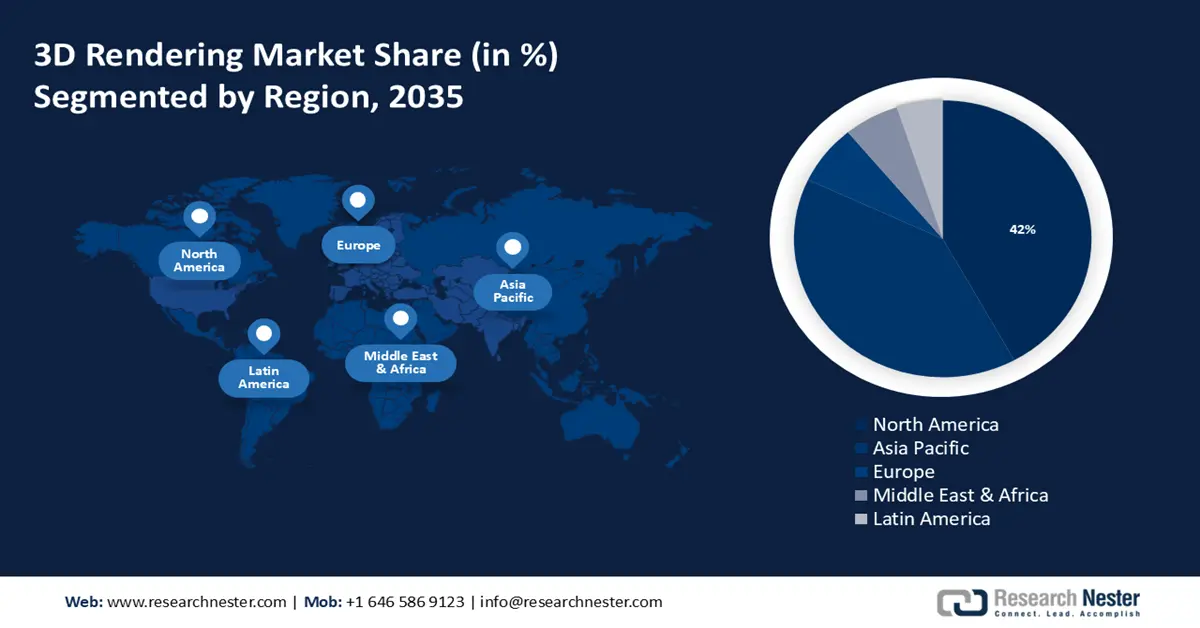

- The North America 3D rendering market will account for 42% share by 2035, driven by dominance in industries like construction, manufacturing, healthcare, education, real estate.

- The Asia Pacific market will achieve substantial share by 2035, driven by increasing building and construction projects, especially in China and India.

Segment Insights:

- The windows os segment in the 3d rendering market is projected to maintain an 85% share by 2035, driven by Windows’ global user base and technical features.

- The software segment in the 3d rendering market is expected to dominate by 2035, driven by increased scalability and user-friendly advancements.

Key Growth Trends:

- Technological advancements

- Increasing interest in gaming and videography

Major Challenges:

- Security and privacy concerns

- Lack of technical expertise

Key Players: Next Limit Technologies, Dassault System, Siemens, Trimble, Chaos Group, The Foundry Visionmongers, Newtek, MIMAKI ENGINEERING CO.,LTD.

Global 3D Rendering Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.4 billion

- 2026 Market Size: USD 7.58 billion

- Projected Market Size: USD 40.97 billion by 2035

- Growth Forecasts: 20.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 17 September, 2025

3D Rendering Market Growth Drivers and Challenges:

Growth Drivers

-

Technological advancements- Digital transformation and emerging technologies like 3D printing, artificial intelligence, machine learning, virtual reality, augmented reality, and metaverse are expected to impact the 3D rendering market growth in the future years. These new technologies improve user experience and 3D rendering and visualization software potential.

In March 2024, Stratasys Ltd., a pioneer in polymer 3D printing technologies, stated that it aims to supply 3D-printed materials for a lunar trip to verify their performance as a part of Aegis Aerospace, Inc.'s first Space Science & Technology Evaluation Facility mission. Aegis Aerospace in Houston, Texas developed SSTEF under NASA's Tipping Point program to support lunar R&D. SSTEF-1 develops space infrastructure and moon and near-earth space capabilities. Northrop Grumman Corporation funds Stratasys experiments. Therefore, such technical breakthroughs are expected to propel market applications during the forecast period. - Increasing interest in gaming and videography- The 3D rendering industry is growing due to gaming and videography demands. These businesses are using 3D rendering software to produce immersive games and lifelike movie effects.

According to the Entertainment Software Association (ESA), around 227 million Americans engaged in playing games in 2022. Around two-thirds of adults and about three-quarters of youngsters under 18 plays electronic games every week. Of all ages, 80% of gamers are above 18, and the typical video game player is 31, with many playing consistently. These innovative games and video graphics are driving the 3D rendering market growth. - Improved innovations with AI & ML- The 3D rendering sector is being transformed by machine learning and artificial intelligence, improving user experiences and rendering productivity. Users may create more realistic and attractive 3D renderings by using ML to cut down output preparation time and effort. PrintWatch, launched by U.S.-based company Printpal in February 2022, shows how AI may be used in 3D printer fault detection software. PrintWatch uses real-time monitoring to detect and fix printing problems, streamlining the printing process by reducing resource wastage and hardware damage. Hence, this effective usage of technology increases the 3D rendering industry's expansion.

Challenges

-

Security and privacy concerns- The usage of pirated software is increasing in the 3D rendering sector since there is a rising trend of using unlicensed software. Consequently, this leads to monetary detriment and a reduction in the profit margin of crucial establishments. This factor ultimately serves as a challenge for the 3D Rendering industry.

-

Lack of technical expertise- Additionally, there is a deficit of technical professionals available to provide assistance and expertise in the field of 3D rendering technology. Restricted adoption of 3D imaging solutions is mostly attributed to insufficient software training, lack of executive endorsement, and a scarcity of 3D imaging-compatible hardware such 3D displays. In addition to this, the 3D rendering business is hindered by a lack of flexibility to adjust to current infrastructure.

3D Rendering Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

20.4% |

|

Base Year Market Size (2025) |

USD 6.4 billion |

|

Forecast Year Market Size (2035) |

USD 40.97 billion |

|

Regional Scope |

|

3D Rendering Market Segmentation:

Component Segment Analysis

Software segment is estimated to dominate around 75% 3D rendering market share by the end of 2035. The 3D rendering industry is growing because advances made it more prominent among end users, enhancing its use on a wider scale. Some software companies only focus on product scalability and adding user-friendly features.

For instance, Adobe announced significant enhancements throughout its industry-leading Substance 3D tools in October 2022, giving creators and brands an end-to-end solution for generating independent 3D content and metaverse-ready immersive experiences. The entire Substance 3D portfolio serves skilled 3D designers and 2D creatives wishing to expand their work. Adobe will also introduce Substance 3D capabilities to Meta's Quest platform to produce and share immersive 3D content, while Meta will give users Adobe's sophisticated, easy-to-use 3D creative tools.

Operating System Segment Analysis

By 2035, Windows operating system segment is projected to hold more than 85% 3D rendering market share. The Windows operating system already has a substantial user base globally. Furthermore, the increasing need for 3D rendering output on Windows is being fueled by technological breakthroughs such as mixed reality.

Windows has several benefits, including regular updates and superior services, which contribute to its dominance in the market and make it the preferred choice for 3D rendering programs. As of February 2023, Windows dominates the desktop operating system market in the US with a share of 57.37%, followed by macOS with 29.62% and Chrome OS with 7.47%, as reported by patentlyapple, Linux has a market share of 2.55%, while other miscellaneous desktop operating systems have a market share of 2.97%.

Application Segment Analysis

In 3D rendering market, visualization and simulation segment is predicted to dominate over 39% revenue share by 2035. The visualization and simulation area has experienced growth due to the vigorous efforts and marketing methods employed by numerous software businesses. Furthermore, the process of updating software versions encompasses several elements that mitigate the risks connected with the final products and improve the overall user experience, hence strengthening the key considerations for the 3D rendering industry.

In June 2024, Nvidia, an AI computing solutions company, introduced a product called Nvidia Omniverse. This Cloud Sensor RTX produces artificial data to accelerate the advancement of AI in the development of self-driving vehicles, robotic arms, mobile robots, human-like robots, and intelligent environments.

Our in-depth analysis of the global 3D rendering market includes the following segments

|

Component |

|

|

Organization Size |

|

|

Operating Systems |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

3D Rendering Market Regional Analysis:

North America Market Insights

North America industry is expected to account for largest revenue share of 42% by 2035. This region dominates the market due to its growing use in industries including construction, manufacturing, health care, education, and real estate.

Technological innovation in the U.S. is rising as architectural visualization solutions in real estate, construction, and engineering are driving market growth in the country. Capgemini and Unity announced a strategic relationship expansion to include Unity's Digital Twin Professional Services arm. The deal will speed the development and implementation of the market-leading real-time 3D (RT3D) visualization software for industrial digital twins. The regional 3D rendering market has grown due to the increased use of cutting-edge technology across numerous industries.

Advancements in the market are high in Canada. In addition, firms such as Team Designs provide world-class 3D rendering services at reasonable prices without compromising quality or timeliness. Its solutions to most designs simplify execution, manufacturing, and production thus driving the market expansion.

APAC Market Insights

By the end of 2035, Asia Pacific 3D rendering market is set to hold substantial share. The expansion of the market in the region can be credited to the increasing number of building and construction projects, particularly in China and India.

The growing market penetration of animation tools in China is expected to provide impetus to the market's growth over the forecast period. In addition, there is an increasing demand for 3D modeling, 3D imaging sensors, and visualization and rendering software tools across various verticals, including manufacturing healthcare, life sciences, media and entertainment, and construction.

India is one of the largest economies in Asia. The increasing growth in the real estate sector in the country is propelling the 3D rendering market expansion. Furthermore, rising population and developed technological infrastructure along with prominent tech giants, are a few factors that also drive the market growth in the country.

Japan 3D rendering market is driven by the increasing demand for enhanced visual effects, including texture-mapping, shadows, motion blurs, and other effects in architectural visual photography. Moreover, many organizations in the country are investing in implementing on-premise solutions to tackle issues such as data privacy concerns and inconsistent internet speed, which is driving the growth of the market.

3D Rendering Market Players:

- Autodesk

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Adobe Systems

- Next Limit Technologies

- Dassault System

- Siemens

- Trimble

- Chaos Group

- The Foundry Visionmongers

- Newtek

The key players offer a range of 3D rendering software and solutions for industries such as architecture, engineering, construction, animation, and design. They play a crucial role in providing innovative technologies, user-friendly interfaces, and competitive offerings to meet the growing demand for 3D rendering market.

Recent Developments

- In May 2024, Autodesk, Inc. announced that it obtained Wonder Dynamics, developers of Wonder Studio, a cloud-based 3D animation, and VFX solution that integrates AI with widely recognized tools. The compatibility of Wonder Studio with Autodesk Maya makes it easier for artists to animate, light, and compose 3D characters in live-action situations. With Autodesk's acquisition of Wonder Dynamics, more artists can add 3D animated characters to their projects and stories while reducing the learning curve and automating complicated and time-consuming processes.

- In June 2024, Siemens Digital Industries Software and Samsung Foundry announced compelling new capabilities for multi-die packaged designs at advanced nodes, many new product certifications, and verification technologies. Siemens and Samsung Foundry jointly updated process design kits (PDKs) to seamlessly integrate with Siemens' Xpedition Substrate Integrator (XSI) and Xpedition Package Designer (XPD) software, enabling Samsung to update customers' PDKs without disrupting design processes. Siemens' XSI software lets engineers build a digital twin model of a multi-die device for smooth design integrations that drive downstream design, analysis, verification, and signoff.

- Report ID: 6300

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

3D Rendering Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.