Global 3D Printing Medical Implants Market

Table of Contents

1. Report Overview

1.1. Global 3D Printed Medical Implants Market Overview

1.2. Why You Should Read This Report

1.3. How This Report Delivers

1.4. Key Questions Answered by This Analytical Report

1.5. Who is This Report For?

1.6. Methodology

1.6.1. Primary Research

1.6.2. Secondary Research

1.6.3. Market Evaluation & Forecasting Methodology

2. Introduction to the 3D Printed Medical Implants Market

2.1. 3D Printed Medical Implants Market Structure

2.2. 3D Printed Medical Implants Market Definition

2.3. Global 3D Printed Medical Implants Market Taxonomy

2.4. Global 3D Printed Medical Implants Market Snapshot

2.5. Global 3D Printed Medical Implants Market Dynamics

2.5.1. Global 3D Printed Medical Implants Market: Driver

Growing Technological Developments

Increasing Applications of 3D Implants

Several other benefits associate with 3D implants

2.5.2. Global 3D Printed Medical Implants Market: Restraints

High Cost of 3D Printed Implants:

Lack of Skills and Reimbursement Policies:

2.5.1. Global 3D Printed Medical Implants Market: Trends

2.5.1. Global 3D Printed Medical Implants Market: Opportunities

Raw material management and focus on development of technical skills

3. Global 3D Printed Medical Implants Market, By Component, 2019-2027

3.1. Introduction

3.2. Global 3D Printed Medical Implants Market Size and Forecast, By Component

3.2.1. Material Segment

3.2.2. Services Segment

3.2.3. System Segment

4. Global 3D Printed Medical Implants Market, By Implementation Technology, 2019-2027

4.1. Introduction

4.2. Global 3D Printed Medical Implants Market Size and Forecast, By Implementation Technology

4.2.1. Laser Beam Melting Segment

4.2.2. Electronic Beam Melting Segment

4.2.3. Droplet Deposition Segment

4.2.4. Others Segment

5. Global 3D Printed Medical Implants Market, By Application, 2019-2027

5.1. Introduction

5.2. Global 3D Printed Medical Implants Market Size and Forecast, By Application

5.2.1. Dental Segment

5.2.2. Orthopedic Segment

5.2.3. Cranio-Maxillofacial Segment

6. Global 3D Printed Medical Implants Market, By End User, 2019-2027

6.1. Introduction

6.2. Global 3D Printed Medical Implants Market Size and Forecast, By End User

6.2.1. Hospitals Segment

6.2.2. Medical Device Companies Segment

6.2.3. Research and Academic Institutes Segment

6.2.4. Others Segment

7. Global 3D Printed Medical Implants Market, By Region, 2019-2027

7.1. Introduction

7.2. Global 3D Printed Medical Implants Market Size and Forecast, By Region

7.2.1. North America

7.2.2. Latin America

7.2.3. Europe

7.2.4. Asia Pacific

7.2.5. Middle East and Africa

8. North America 3D Printed Medical Implants Market Analysis and Forecast, 2019-2027

8.1. Introduction

8.1.1. North America

8.2. North America 3D Printed Medical Implants Market Forecast, By Country, 2019-2027

8.3. North America 3D Printed Medical Implants Market Forecast, By Component, 2019-2027

8.3 1. North America 3D Printed Medical Implants Market Forecast, By Implementation Technology, 2019-2027

8.4. North America 3D Printed Medical Implants Market Forecast, By Application, 2019-2027

8.5. North America 3D Printed Medical Implants Market Forecast, By End User, 2019-2027

9. Latin America 3D Printed Medical Implants Market Analysis and Forecast, 2019-2027

9.1. Introduction

9.1.1. Latin America

9.2. Latin America 3D Printed Medical Implants Market Forecast, By Country, 2019-2027

9.3. Latin America 3D Printed Medical Implants Market Forecast, By Component, 2019-2027

9 4. Latin America 3D Printed Medical Implants Market Forecast, By Implementation Technology, 2019-2027

9.5. Latin America 3D Printed Medical Implants Market Forecast, By Application, 2019-2027

9.6. Latin America 3D Printed Medical Implants Market Forecast, By End User, 2019-2027

10. Europe 3D Printed Medical Implants Market Analysis and Forecast, 2019-2027

10.1. Introduction

10.1.1. Europe

10.2. Europe 3D Printed Medical Implants Market Forecast, By Country, 2019-2027

10.3. Europe 3D Printed Medical Implants Market Forecast, By Component, 2019-2027

10.4. Europe 3D Printed Medical Implants Market Forecast, By Implementation Technology, 2019-2027

10.5. Europe 3D Printed Medical Implants Market Forecast, By Application, 2019-2027

10.6. Europe 3D Printed Medical Implants Market Forecast, By End User, 2019-2027

11. Asia Pacific 3D Printed Medical Implants Market Analysis and Forecast, 2019-2027

11.1. Introduction

11.1.1. Asia Pacific

11.2. Asia Pacific 3D Printed Medical Implants Market Forecast, By Country, 2019-2027

11.3. Asia Pacific 3D Printed Medical Implants Market Forecast, By Component, 2019-2027

11.4. Asia Pacific 3D Printed Medical Implants Market Forecast, By Implementation Technology, 2019-2027.

11.5. Asia Pacific 3D Printed Medical Implants Market Forecast, By Application, 2019-2027

11.6. Asia Pacific 3D Printed Medical Implants Market Forecast, By End User, 2019-2027

12. Middle East & Africa 3D Printed Medical Implants Market Analysis and Forecast, 2019-2027

12.1. Introduction

12.1.1. MEA

12.2. MEA 3D Printed Medical Implants Market Forecast, By Country, 2019-2027

12.3. MEA 3D Printed Medical Implants Market Forecast, By Component, 2019-2027

12.4. MEA 3D Printed Medical Implants Market Forecast, By Implementation Technology, 2019-2027

12.5. MEA 3D Printed Medical Implants Market Forecast, By Application, 2019-2027

12.6. MEA 3D Printed Medical Implants Market Forecast, By End User, 2019-2027

13. Company Profile

13.1. Company Share Analysis

13.2. Materialise NV

13.3. Renishaw PLC

13.4. 3D Systems Inc

13.5. STRATASYS LTD

13.6. EnvisionTEC

13.7. Arcam AB

13.8. SLM Solutions Group AG

13.9. Oxford Performance Material

13.10. Bio3D Technologies

13.11. Cyfuse

14. Acronyms

3D Printing Medical Implants Market Outlook:

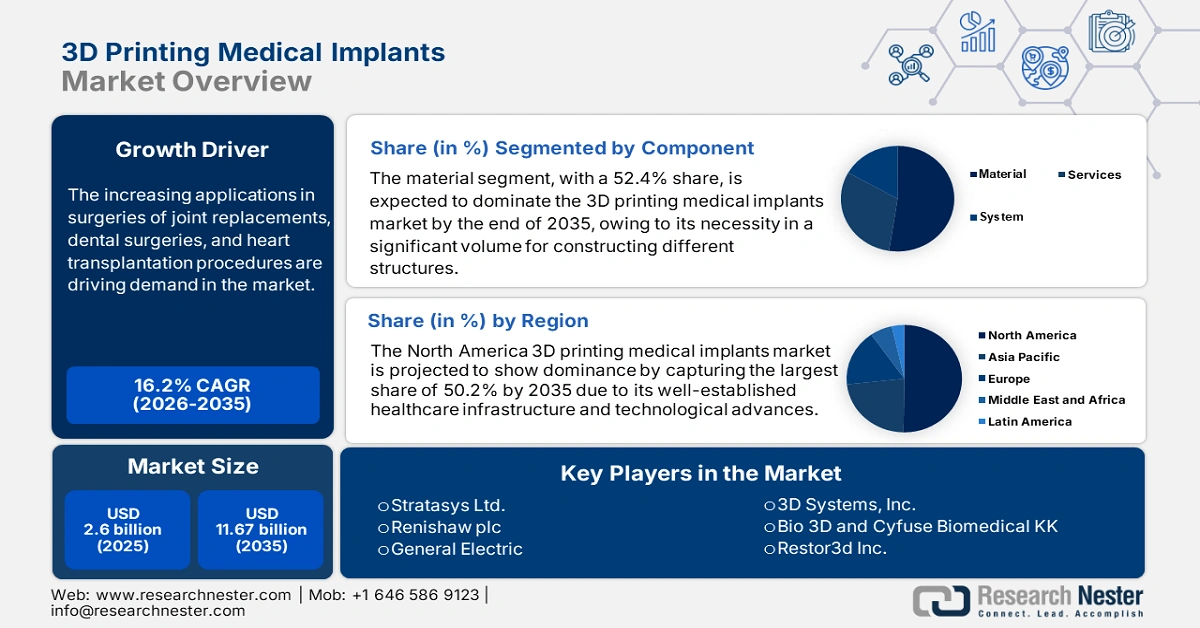

3D Printing Medical Implants Market size was over USD 2.6 billion in 2025 and is poised to exceed USD 11.67 billion by 2035, growing at over 16.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of 3D printing medical implants is evaluated at USD 2.98 billion.

The increasing applications in surgeries of joint replacements, dental surgeries, and heart transplantation procedures are driving demand in the market. This technology empowers healthcare specialists with the ability to create customized anatomical parts as per the need of the patient, making them a perfect solution for implantation. Thus, the growing number of associated diseases, such as osteoarthritis (OA), and required surgical interventions, joint replacement surgeries, are fueling this sector with a continuous business flow. For instance, by 2050, the increment in the global prevalence of OA is expected to range between 60.0% and 100.0%, as per a study based on the MEDLINE database. Similarly, NLM projected the worldwide need for hip and knee joint replacement to grow by 40.0% by 2060.

According to a 2024 Osteoarthritis and Cartilage journal, the net expense on early-onset OA across the globe surpassed USD 106.8 billion. The market has a wide range of products such as cranial and orthopedic implants, titanium replacements of jaws and hips, surgical apparatus, dental fillings such as crowns, and external & limb prosthetics. With such variety, this merchandise not only helped in reducing the risk of any error but also brought a scope of affordable payers’ pricing. On this note, NLM published a study in August 2021, which demonstrated a USD 3720.0 saving as a result of using 3D printed anatomic models for each orthopedic and maxillofacial intervention. These constructs contributed to such cost reduction by decreasing operating time (mean 62 minutes).

Key 3D Printing Medical Implants Market Insights Summary:

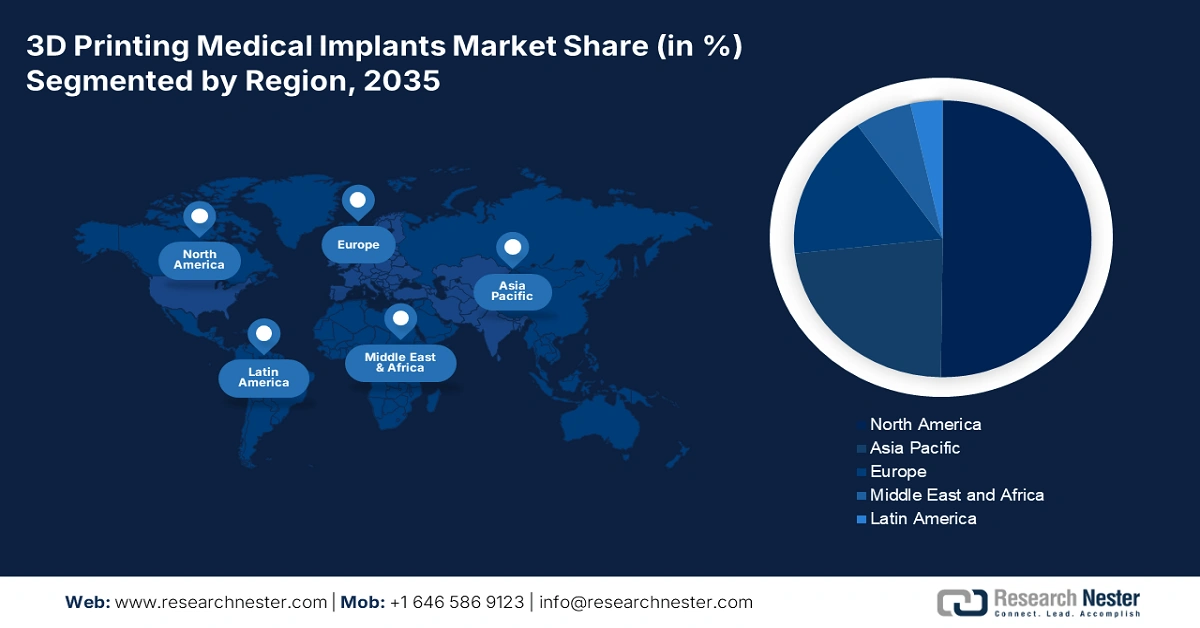

Regional Highlights:

- North America 3D printing medical implants market will dominate over 50.20% share by 2035, driven by advanced healthcare infrastructure, improved reimbursement policies, and ongoing MedTech innovations.

- Asia Pacific market projects significant growth during the forecast timeline, driven by the rapidly aging population, rising surgeries, and steady capital influx into the sector.

Segment Insights:

- The material segment in the 3d printing medical implants market is anticipated to achieve a 52.40% share by 2035, driven by the high volume requirement of raw materials in constructing medical implants.

- The hospitals segment in the 3d printing medical implants market is forecasted to secure a remarkable share by 2035, influenced by the presence of specialized facilities, skilled professionals, and broad patient bases.

Key Growth Trends:

- Penetration of tech-based surgical essentials

- Widening application in various medical disciplines

Major Challenges:

- Limitations in full-fledged commercialization

Key Players: Materialise NV, Stratasys Ltd., Renishaw plc, 3D Systems, Inc., Envisiontec, Inc., General Electric, SLM Solutions Group AG, Oxford Performance Materials, Bio 3d and Cyfuse Biomedical.

Global 3D Printing Medical Implants Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.6 billion

- 2026 Market Size: USD 2.98 billion

- Projected Market Size: USD 11.67 billion by 2035

- Growth Forecasts: 16.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (50.2% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 8 September, 2025

3D Printing Medical Implants Market Growth Drivers and Challenges:

Growth Drivers

-

Penetration of tech-based surgical essentials: With the increasing technological advancements and development in interventional approaches, the adoption in the 3D printing medical implants market is rising. Additionally, the ongoing research in orthopedics brings innovative concepts of customized tools such as bone identical implant and CT-bone, accelerating progression in this sector. For instance, in March 2025, Exactech secured the deployment of its Vantage Ankle 3D and 3D+ tibial implants at the Mayo Clinic. The new offering encompasses the capabilities of GPS Ankle navigation, delivering accuracy within 2mm and 2 degrees relative to CT-based surgical planning.

-

Widening application in various medical disciplines: The success and effectiveness in designing replicas of anatomy, nanomaterials, and polymer-based organs are dragging the focus of every healthcare specialist on utilizing products from the market. This sector is increasingly being prioritized by different medical departments, even the one dedicated to serving animals. On this note, in October 2024, VCA Animal Hospital inaugurated its cutting-edge 3D Printing Lab to provide better outcomes from orthopedic surgeries for pets. This innovative facility is intended to incur better recovery while treating canine hip dysplasia, elbow dysplasia, and angular limb deformities.

Challenges

-

Limitations in full-fledged commercialization: The market often faces difficulties with availability and resources. The shortage of skilled technicians and the absence of reimbursement policies in various underserved regions across the globe restrict the pace and scale of marketing 3D printing devices. Additionally, differentiation in compliance criteria may create uncertainty and delays in new launches, discouraging companies from investing in R&D and slowing progress in this field.

3D Printing Medical Implants Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

16.2% |

|

Base Year Market Size (2025) |

USD 2.6 billion |

|

Forecast Year Market Size (2035) |

USD 11.67 billion |

|

Regional Scope |

|

3D Printing Medical Implants Market Segmentation:

Component Segment Analysis

The material segment, with a 52.4% share, is expected to dominate the 3D printing medical implants market by the end of 2035. This segment’s leadership is pledged by the necessity of a significant volume of raw material for constructing different structures. Replacement and transplantation surgeries often involve the use of heavy and expensive materials such as titanium and gold. Thus, in opposite to the sporadic cash flow pattern for device manufacturers and service providers, this category’s revenue-generating aspect is more continuous and higher in proportion. Currently, many cost-effective and clinically efficient materials, such as polymethyl methacrylate (PMMA), are being explored to offer more affordable alternatives, which can be testified by the USD 1.5 billion worth of worldwide trade of this allogenic component in 2023: OEC.

End user Segment Analysis

Based on end user, the hospitals segment is predicted to register a remarkable share in the 3D printing medical implants market over the assessed period. The presence of specialized operating rooms, dedicated professionals, and broad consumer bases indicates a greater contribution of these organizations to revenue generation for this sector. The increasing adoption of associated technologies among large-scale hospitals is also evidence of its proprietorship. For instance, in April 2025, the University Hospital Basel utilized 3D Systems’ EXT 220 MED for producing a Medical Device Regulation (MDR)-compliant 3D-printed PEEK facial implant. This printer, in combination with Evonik's VESTAKEEP i4 3DF PEEK, can simplify workflows and personalize production right on the hospital premises.

Our in-depth analysis of the global 3D printing medical implants market includes the following segments:

|

Component |

|

|

Implementation Technology |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

3D Printing Medical Implants Market Regional Analysis:

North American Market Insights

The North America 3D printing medical implants market is projected to show dominance by capturing the largest share of 50.2% by 2035. Besides the well-established healthcare infrastructure across the region, improvement in reimbursement policies and technological advancements are solidifying its leadership. Furthermore, with the heightening local surge, coupled with ongoing MedTech innovations and investments, this landscape is becoming a lucrative opportunity for global participants. For instance, in June 2024, Restor3d secured a series A funding of USD 55.0 million and a debt financing of USD 15.0 million. This empowered the company’s future plans in escalating product & technology innovation, integration of automation, and promotional campaigns in this field.

According to the estimations published by ScienceDirect in June 2023, the U.S. incidences of revision total hip arthroplasty (rTHA) & revision total knee arthroplasty (rTKA) are poised to account for 43,514 & 115,147 by 2040. Further, by 2060, the same is projected to be 61,764 & 286,740 while exhibiting an annual growth rate of 1.7%. This demography indicates the presence of a large consumer base for the market. Additionally, the increasing investments for the development of healthcare infrastructure in the nation, followed by the support of the government in funding R&D activities, is anticipated to drive the growth of this merchandise.

APAC Market Insights

Asia Pacific is predicted to register a significant CAGR in the 3D printing medical implants market throughout the discussed timeframe. The rapidly aging population, who are highly prone to developing OA, and the continuously emphasizing economy is ensuring a stable capital influx in this sector. The heightening epidemiology of related surgeries is evidence of this scenario. A ScienceDirect study from January 2023 concluded that the approximate number of knee arthroplasties in Japan for the age group between 40 and 75 to reach 1,14,369 by 2030 (both male and female). The same nationwide number of hip arthroplasties is calculated to be 1,24,667 by 2030. Moreover, the region’s fast propagation is also testified by the global placement of South Korea and China as the top exporter and importer of PMMA in 2023 (OEC).

India is emerging as an innovation hub for the market under government influence and with academic excellence. For instance, in December 2023, a group of researchers at the Indian Institute of Technology Madras introduced 3D-printed face implants to control the nationwide outbreak of black fungus. In collaboration with ZorioX Innovation Labs, this initiative utilized the groundbreaking production technology of metal 3D Printing to support the government's goal to increase access of patients from economically weaker sections to advanced healthcare. Such innovations are promoting the adoption of fast and efficient methods, such as additive manufacturing, procuring new business opportunities.

3D Printing Medical Implants Market Players:

- Materialise NV

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Stratasys Ltd.

- Renishaw plc

- 3D Systems, Inc.

- Envisiontec, Inc.

- General Electric

- SLM Solutions Group AG

- Oxford Performance Materials

- Bio 3D and Cyfuse Biomedical KK

- Restor3d Inc.

- Exactech Pvt. Ltd.

Key players in the 3D printing medical implants market are currently cultivating pathways to implement technological advancements. Their strategic movements are forming new scopes of business and beneficial partnerships, magnifying the field’s emphasis on developing innovative solutions. For instance, in August 2024, CollPlant Biotechnologies collaborated with Stratasys to commence a pre-clinical study on 200cc commercial-sized regenerative implants for breasts. This R&D team focused on developing and utilizing a bioprinting system, the Stratasys Origin 3D printer, to escalate the fabrication of natural breast tissue. The success of this trial is expected to bring a USD 3.0 billion worth of market opportunity for both companies. This cohort of pioneers includes:

Recent Developments

- In April 2025, Restor3d raised a capital of USD 38.0 million to boost the commercialization of its four fully 3D-printed product lines. This cohort includes the Veritas Reverse Total Shoulder System, iTotal Identity 3DP Porous Cementless Total Knee System, Kinos Modular Stem Total Ankle System, and Velora 3DP Porous Acetabular System.

- In February 2024, Materialise launched its Personalized TMJ Total Arthroplasty System for temporomandibular joint (TMJ) arthroplasty. This unique solution combines implants, guides, and digital planning to streamline the patient-specific TMJ treatment, improving the quality of life, pain levels, satisfaction, and eating ability after surgery.

- Report ID: 2447

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

3D Printing Medical Implants Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.