3D Imaging Market Outlook:

3D Imaging Market size was over USD 46.24 billion in 2025 and is projected to reach USD 274.6 billion by 2035, witnessing around 19.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of 3D imaging is evaluated at USD 54.36 billion.

3D imaging has a major application in IVF to monitor the early developmental stage of an implanted embryo or blastocyst. For instance, quantitative phase imaging (QPI) leverages the refractive index for minimally invasive and intrinsic imaging of the blastocysts. QPI 3D imaging eliminates the risk of photobleaching or phototoxicity. Unlike 2D transvaginal ultrasound, 3D imaging shows the coronal plane, along with the axial and sagittal planes of the uterus, thus, improving assessments. The increasing adoption of Assisted Reproduction Technology (ART) procedures is factoring the market expansion.

Key 3D Imaging Market Insights Summary:

Regional Highlights:

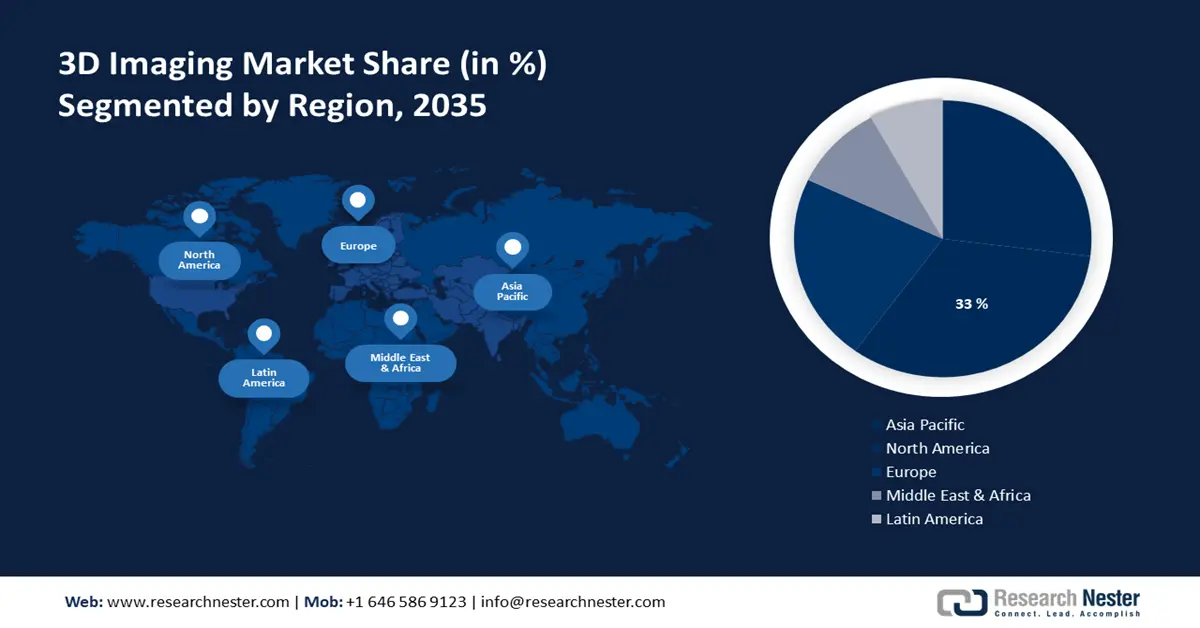

- The North America 3D imaging market will account for 33% share by 2035, driven by increasing demand for 3D imaging across all end-user industries.

- The Asia Pacific market will exhibit significant growth during the forecast timeline, driven by increasing penetration of smartphones and entertainment devices.

Segment Insights:

- The hardware segment in the 3d imaging market is anticipated to secure a 40.50% share by 2035, driven by the rising need for 3D imaging equipment in medical diagnostics such as MRI, CT, and ultrasound.

- The cloud segment in the 3d imaging market is anticipated to experience exponential growth till 2035, fueled by the adoption of cloud-based imaging solutions that enhance diagnostic accessibility and patient care.

Key Growth Trends:

- Increasing use of 3D imaging in the entertainment and media industry

- Leveraging 3D imaging for reefscape genomics

Major Challenges:

- High production, installation, and operational costs

- Lack of expertise

Key Players: Panasonic Corporation, Google Inc., Konica Minolta Inc., Agilent Technologies, TomTec Imaging Systems GMBH, Autodesk Inc..

Global 3D Imaging Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 46.24 billion

- 2026 Market Size: USD 54.36 billion

- Projected Market Size: USD 274.6 billion by 2035

- Growth Forecasts: 19.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (33% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 17 September, 2025

3D Imaging Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing use of 3D imaging in the entertainment and media industry - Virtual reality, and 3D movies are providing audiences with a captivating, and immersive viewing experience. 3D imaging technology in the entertainment sector makes viewers' experiences more memorable and engaging. For instance, Panasonic announced the latest flagship model of the LUMIX G Series of cameras, with advanced 3D imaging technology, and creative features. It provides high performance and primarily caters to the content creator community.

-

Leveraging 3D imaging for reefscape genomics - Genome-wide sequencing integrated with 3D imaging has provided new opportunities to understand the unexplained diversity of aquatic environments. Seascape genomics uses seafloor characterization georeferencing, and in situ phenotyping to implement adaptive measures to conserve, translocate, and restore aquatic habitat. The National Centers for Coastal Ocean Science (NCCOS) and Florida Keys National Marine Sanctuary (FKNMS) are collaboratively working to study and restore coral reefs using micro-sized autonomous underwater vehicles (AUVs). These AUVs use 3D imaging to identify the health, density, and distribution of coral species.

Challenges

-

High production, installation, and operational costs - High-quality materials are used in the production of 3D imaging technology. In addition, the requirement for high-quality scans, the complexity of the machinery, and the expense of research & development are the other several factors contributing to the excessive cost of 3D imaging technology.

-

Lack of expertise - Advanced 3D technology requires trained operators for quicker security screening. However, there is a lack of knowledge among people about advanced 3D technology operations. Therefore, it is expected to restrain market growth in the upcoming years.

3D Imaging Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

19.5% |

|

Base Year Market Size (2025) |

USD 46.24 billion |

|

Forecast Year Market Size (2035) |

USD 274.6 billion |

|

Regional Scope |

|

3D Imaging Market Segmentation:

Component Segment Analysis

Hardware segment in the 3D imaging market is set to exhibit share of around 40.5% by 2035. This is attributed to the rising need for 3D imaging equipment in the medical field for MRI, CT, X-ray, and ultrasound systems. Hardware components in the 3D imaging equipment produce high-quality images allowing healthcare providers to visualize and explain the medical condition to patients.

End User Industry Segment Analysis

The healthcare & life science segment in the 3D imaging market is expected to account for substantial share by 2035. Modern developments in 3D imaging enable radiologists and orthopedic surgeons to collaborate effectively and treat patients with musculoskeletal disorders. With 3D imaging, healthcare professionals find good resolutions and gain a better understanding of the body parts, along with reducing the radiation dosage for patients. As of a 2018 survey conducted by an American non-profit firm, over 40% of United States hospitals had 3D imaging technology for radiology.

Deployment Mode Segment Analysis

Cloud segment in the 3D imaging market is set to register exponential growth till 2035. Companies are serving cloud-based imaging solutions to enable users to review diagnostic images. For instance, on June 27, 2022, Philips announced the expansion of cloud-based imaging with IntelliSpace Radiology on Amazon Web Series (AWS) to enhance patient care. As a result, companies can store, scan, and analyze cloud data that helps them to assess patient conditions.

Our in-depth analysis of the global market includes the following segments:

|

Component |

|

|

Organization Size |

|

|

Deployment Mode |

|

|

Application |

|

|

End User Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

3D Imaging Market Regional Analysis:

North America Market Insights

North America industry is predicted to account for largest revenue share of 33% by 2035. The presence of the top companies in the region provides end users with customized solutions, for instance, 3D modelling and animation. For example, in November 2020, enterprise imaging platform Visage Imaging Inc. unveiled an enhanced version of Visage 7 Live Connect that allows end users to communicate seamlessly in real time.

The market in the United States is anticipated to grow on account of increasing demand for 3D imaging across all end-user industries as high-resolution images are used by industry professionals for remote monitoring.

The government authorities in Canada are supporting investment in research and development to boost market growth. The need for medical imaging is growing faster than the overall population due to an increase in the aging population, which supports the market's expansion. Canada healthcare facilities have been implementing 3D imaging technology in recent years to improve the precision and effectiveness of their diagnostic procedures.

APAC Market Insights

3D imaging market size for Asia Pacific region is projected to observe significant growth by the end of 2035. The major factor boosting market growth in the region is the increasing penetration of smartphones and other entertainment devices. Smartphone scanners and other 3D imaging apps make it simple for users to take pictures of objects and turn them into digital representations. Furthermore, the growing number of cancer patients in countries like China is driving demand for 3D imaging. In the year 2022, 2.5 million cancer cases were recorded in China. This has impelled China's government to spend money on cutting-edge imaging technologies like nuclear imaging.

Demand in India has been bolstered by the increasing use of 3D imaging technologies by medical research institutes. Furthermore, a variety of end users are adopting this technology at an increasing rate due to government initiatives like Digital India.

Increasing utilization of smartphones and other electronic gadgets is expected to drive market growth in Japan. Furthermore, the growth of the manufacturing, media and entertainment, healthcare, and automation sectors are the main drivers of the market's expansion in Japan.

3D Imaging Market Players:

- E-Cenetial Robotics

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- GE Healthcare Inc.

- Philips Healthcare Informatics Inc.

- Hewlett Packard Company

- Panasonic Corporation

- Google Inc.

- Konica Minolta Inc.

- Agilent Technologies

- TomTec Imaging Systems GMBH

- Autodesk Inc.

The global 3D imaging landscape is characterized by a fragmented competitive landscape, with numerous key players operating both globally and regionally. To increase their respective product portfolios and establish a strong presence in the worldwide market, major players are involved in strategic alliances and product development.

Recent Developments

- Autodesk announced in October 2023 that it has acquired Flexism to incorporate operational efficiency analysis and factory simulation into its industrial design toolkit.

- eCential Robotics and SIGNUS Medizintechnik GmbH formed a partnership in September 2021 to offer an improved spine surgical solution that integrates robotics, navigation, and implant technologies.

- Report ID: 6277

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

3D Imaging Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.