360 Degree Camera Market Outlook:

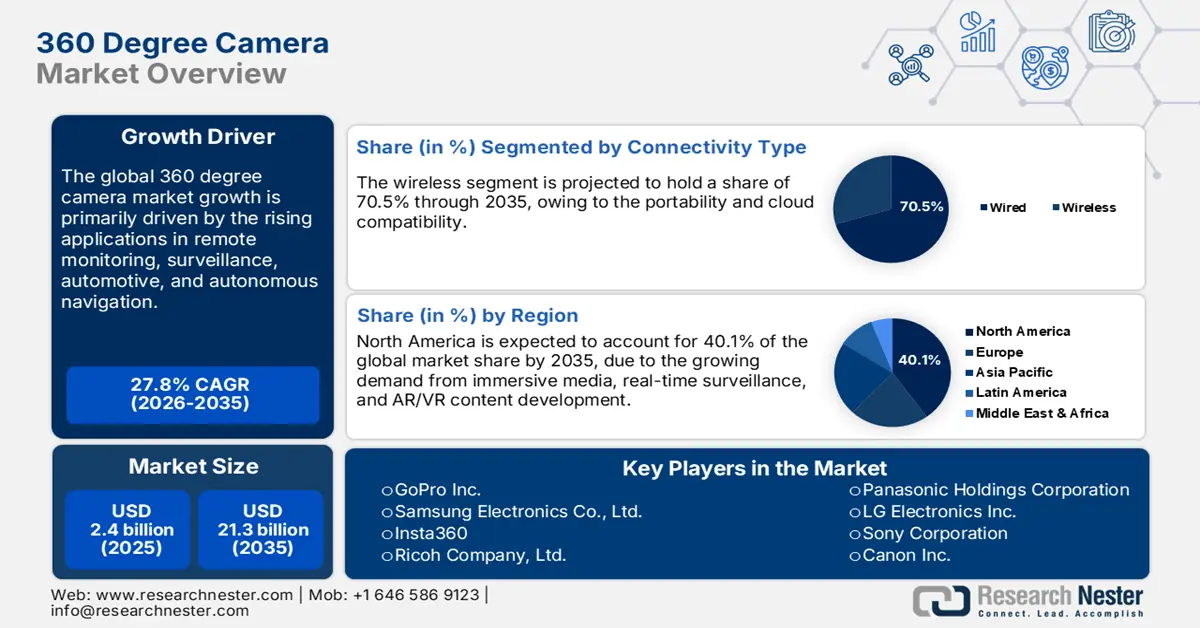

360 Degree Camera Market size was USD 2.4 billion in 2025 and is estimated to reach USD 21.3 billion by the end of 2035, expanding at a CAGR of 27.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of 360 degree camera is evaluated at USD 3 billion.

The construction and industrial sectors are anticipated to fuel the sales of 360-degree cameras in the years ahead. These cameras are becoming essential tools for site documentation, inspection, and walkthroughs. Labor shortages are emerging as prime issues that drive firms to invest in 360-degree cameras to enhance their inspection efficiency. For instance, according to the National Action Plans on Business and Human Rights, the global construction market is expected to increase by USD 4.5 trillion to USD 15.2 trillion in the next 10 years. China, India, the U.S., and Indonesia are estimated to capture 58.3% of this growth.

Content creators, influencers, and vloggers are also a fast-growing customer base for portable 360-degree cameras. The creator economy is now everywhere through platforms such as YouTube, Instagram, and TikTok. In July 2023, the U.S. Bureau of Labor Statistics disclosed that the influencer marketing economy rose in 2021, from nearly 2.0 billion to almost 13.8 billion, with around 50 million content creators. Latin America and Southeast Asia are high-growth zones for creators, with mobile-first content driving demand. Collaborations with influencers for product demos, tutorials, and platform-native editing are further set to accelerate the deployment of advanced 360-degree cameras.

Key 360 Degree Camera Market Insights Summary:

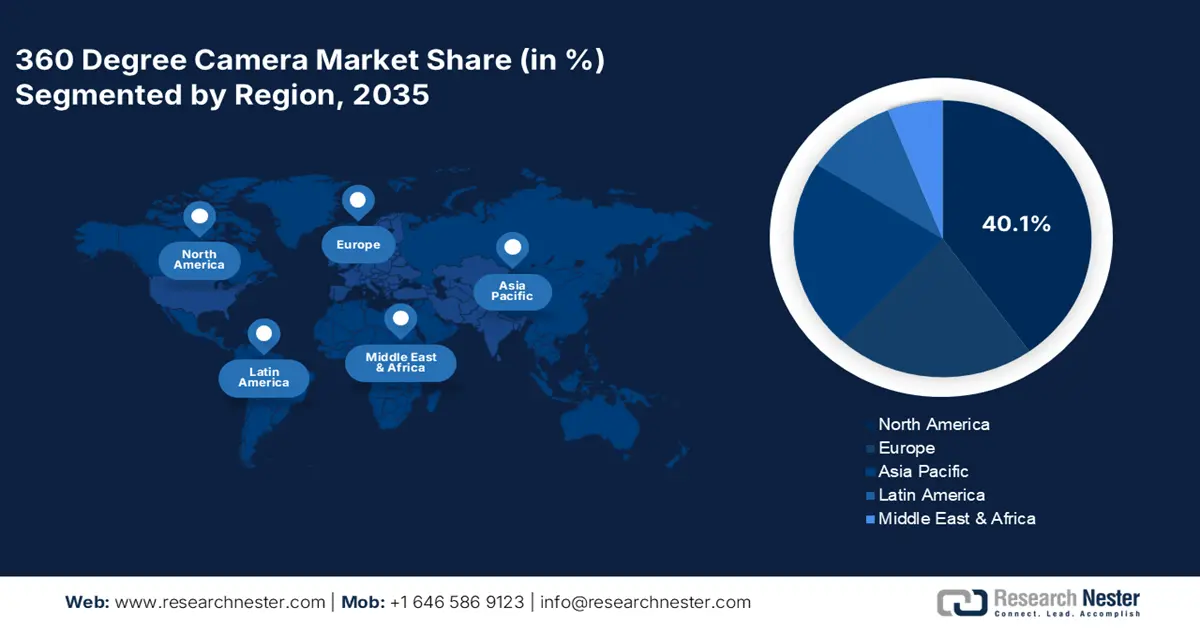

The North America 360 degree camera market is projected to contribute 40.1% to the global revenue share by 2035.

Europe is expected to maintain its position as the second-largest revenue contributor throughout the duration of the study.

The Asia Pacific 360 degree camera market is predicted to register the fastest CAGR between 2026 and 2035.

The wireless segment is forecasted to secure 70.5% of the global 360 degree market share by 2035.

The HD segment is expected to represent 69.5% of the total global market share over the forecast period.

Key Growth Trends:

- Surge in demand for immersive content

- Growth of remote monitoring and surveillance applications

Key Player:

- GoPro Inc., Samsung Electronics Co., Ltd., Insta360 (Shenzhen Arashi Vision), Ricoh Company, Ltd., Panasonic Holdings Corporation, LG Electronics Inc., Sony Corporation, Canon Inc., Garmin Ltd., Nikon Corporation, Xiaomi Corporation, Bubl Technology Inc., Vuze Camera (Humaneyes Technologies), Kodak PIXPRO (JK Imaging Ltd.)

Global 360 Degree Camera Market Forecast and Regional Outlook:

2025 Market Size: USD 2.4 billion

2026 Market Size: USD 3 billion

Projected Market Size: USD 21.3 billion by 2035

Growth Forecasts: 27.8% CAGR (2026-2035)

Largest Region: North America

Fastest Growing Region: Asia Pacific

Last updated on : 18 August, 2025

360 Degree Camera Market - Growth Drivers and Challenges

Growth Drivers

- Surge in demand for immersive content: The shift toward engaging content, especially in gaming, tourism, real estate, and virtual events, is expected to amplify the sales of advanced 360-degree cameras in the coming years. These technologies are most deployed, owing to their unique panoramic capture that enhances user experience in VR headsets, live event broadcasting, and remote inspections. Furthermore, in South Korea and Japan, the rise of metaverse platforms is boosting the application of 360° cameras in entertainment. The leading companies are also introducing prosumer-grade devices optimized for VR and live streaming. Immersive education and training programs are also leveraging HD 360° cameras. For example, NASA partnered with film producers to send custom 360° VR cameras to the International Space Station for a virtual experience with immersive views of space station life and research. Such developments are creating a profitable environment for 360-degree camera producers.

- Growth of remote monitoring and surveillance applications: The security and surveillance enterprises are expected to boost the sales of advanced 360-degree cameras to cover wide areas with fewer blind spots. In smart cities and critical infrastructure monitoring, 360 cameras offer operational efficiency by reducing the number of units needed, which directly increases their adoption rates. The 360-degree units are becoming a standard in public safety and retail sectors. Hikvision is one of the leaders in the 360 security cameras market, known for its panoramic lineup with AI integration for diverse environments. Thus, 360 cameras are set to register high demand in security and surveillance.

- Automotive and autonomous navigation applications: The automakers are increasingly integrating 360-degree cameras into vehicles for parking assist, situational awareness, and V2X (vehicle-to-everything) systems. The COPS grants program and its impact on supporting technology acquisition and use by police agencies are also poised to fuel the trade of 360-degree cameras in the years ahead. Auto manufacturers are entering into strategic partnerships with COP agencies to offer them highly surveilled vehicles. For example, Tesla is leading in the autonomous car delivery. It has installed cameras in its Full Self-Driving (Supervised) model that offer a full 360-degree view around the vehicle. Overall consistent development in autonomous vehicles is likely to propel the sales of 360-degree cameras during the forecast period.

Challenges

- Infrastructure gaps and bandwidth limitations: The lack of proper infrastructure is poised to hamper the sales of 360-degree cameras to some extent. The high-speed connectivity and significant storage infrastructure are often less accessible in some parts of the developing countries. The International Telecommunication Union (ITU) reveals that more than 35.0% of the global population lacks access to the internet. This is expected to limit the sales of 360-degree cameras in some areas of developing regions in the coming years.

- High component costs: The 360-degree cameras are manufactured using high-performance sensors, precision stitching software, and strong build quality, which directly uplifts their final prices. The higher upfront prices than traditional security or DSLR cameras are hindering their adoption rates in the mid-tier or price-sensitive markets. Suppliers often struggle with channel margins and choose between profitability and penetration. To stay competitive, the pricing structure or model is expected to be effective.

360 Degree Camera Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

27.8% |

|

Base Year Market Size (2025) |

USD 2.4 billion |

|

Forecast Year Market Size (2035) |

USD 21.3 billion |

|

Regional Scope |

|

360 Degree Camera Market Segmentation:

Connectivity Type Segment Analysis

The wireless segment is projected to capture 70.5% of the global 360 degree market share by 2035. The wireless 360-degree cameras are gaining traction, owing to their portability and cloud compatibility. The widespread rollout of 5G and Wi-Fi 6E is also contributing to the growing demand for wireless 360-degree cameras. In Europe, the readiness for 5G, supporting outdoor and mobile usage across sports, events, and security, is fueling the demand for advanced cameras. The reduced setup cost and mobility are also other factors fueling the sales of wireless cameras.

Resolution Segment Analysis

The HD segment is anticipated to account for 69.5% of the global 360 degree market share throughout the forecast period. Affordability, balanced file sizes, and compatibility with mobile and web platforms are the prime factors boosting the sales of HD-resolution 360-degree cameras. Most of the enterprises and consumers prefer investing in HD over 4K, due to lower bandwidth and storage requirements. The booming content creation trend across the world is also promoting the adoption of HD-resolution 360-degree cameras. In addition, the public-safety agencies are deploying HD 360° cameras for broad coverage and situational awareness.

Our in-depth analysis of the global 360 degree camera market includes the following segments:

|

Segment |

Subsegments |

|

Connectivity Type |

|

|

Resolution |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

360 Degree Camera Market - Regional Analysis

North America Market Insights

The North America 360 degree camera market is expected to hold 40.1% of the global revenue share through 2035, driven by the growing demand from immersive media, real-time surveillance, and AR/VR content development. The increasing investments in 5G infrastructure and traffic management are likely to accelerate the installation of 360-degree cameras. The NTIA’s Broadband Equity, Access, and Deployment (BEAD) program and the Innovation, Science and Economic Development Canada’s (ISED) rural broadband deployment initiatives are also contributing to the increasing production and commercialization of advanced camera technologies.

The sales of 360 degree cameras in the U.S. are increasing at a high pace, owing to the government-backed ICT initiatives. The high consumer demand for immersive content and enterprise use in surveillance, retail analytics, and remote monitoring is further accelerating the trade of 360-degree cameras. The New York State Society of Certified Public Accountants reveals that the global social media industry is worth USD 250 billion, employs millions of workers, serves billions of users, and has its own trade groups and training programs. In the U.S., online creators and content makers supported around 390,000 full-time jobs in 2022, which is four times the number of jobs at General Motors, the country’s largest car manufacturer. Thus, the content creation sector is substantially fueling the demand for next-gen 360-degree cameras in the country.

Europe Market Insights

The Europe 360 degree camera market is estimated to account for the second-largest revenue share throughout the study period. The 360-degree cameras are widely used in surveillance, VR content creation, automotive safety, and industrial inspection in the region. Government ICT budgets supporting smart infrastructure and digitization are also fueling the trade of 360-degree cameras. Germany, the UK, and France are the leading marketplaces for 360-degree camera manufacturers. The strong presence of autonomous automakers is further accelerating the deployment of 360-degree cameras.

Germany leads the sales of 360-degree cameras, owing to the swift rise in industrial digitization, increasing registration of autonomous vehicles, and the growing demand for advanced surveillance. The World Economic Forum (WEF) states that various small funds to incentivize AV programmes, such as €290 million distributed among 70 projects in the country, are set to advance vehicle autonomy. Such developments are directly reflecting a positive influence on the adoption of 360-degree cameras.

APAC Market Insights

The Asia Pacific 360 degree camera market is foreseen to increase at the fastest CAGR from 2026 to 2035, owing to rapid digitalization and immersive media demand. The hefty investments in surveillance and security are set to increase the installation of advanced camera systems. The automotive testing, live-streaming, healthcare, and industrial monitoring needs are also contributing to the increasing sales of 360-degree cameras. In addition, the growing content creation trend is further increasing the adoption of next-gen camera systems.

The market in India is expected to increase at a high pace during the projected timeframe. Industrial automation and safety needs are accelerating the installation of 360-degree cameras. The smart city initiatives and traffic management efforts are further fueling the deployment of 360-degree cameras. The India Brand Equity Foundation (IBEF) study estimates that the country's entertainment and media industry is projected to register a growth of 9.7% annually in revenues to reach USD 73.6 billion by FY27. The booming entertainment industry is also opening lucrative doors for the key players in the years ahead.

Key 360 Degree Camera Market Players:

- GoPro Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Samsung Electronics Co., Ltd.

- Insta360 (Shenzhen Arashi Vision)

- Ricoh Company, Ltd.

- Panasonic Holdings Corporation

- LG Electronics Inc.

- Sony Corporation

- Canon Inc.

- Garmin Ltd.

- Nikon Corporation

- Xiaomi Corporation

- Bubl Technology Inc.

- Vuze Camera (Humaneyes Technologies)

- Kodak PIXPRO (JK Imaging Ltd.)

- Huawei Technologies Co., Ltd.

The global market is characterized by the presence of gigantic companies and the increasing emergence of start-ups. Leading companies are employing both organic and inorganic marketing strategies to earn lucrative returns. The key players are investing heavily in research and development activities to introduce advanced solutions and attract a tech-savvy consumer base. Industry giants are also employing mergers, acquisitions, and digital marketing strategies to stand out in the crowd. They are also entering developing markets to earn hefty gains from untapped opportunities. The competition is expected to intensify as the companies headquartered in APAC are introducing cost-effective models.

Here is a list of key players operating in the global market:

Recent Developments

- In July 2025, Insta360 introduced its latest camera, the Insta360 X5. This 360-degree camera offers excellent image quality, high durability, and AI-powered ease of use.

- In February 2025, GoPro, Inc. launched new 360-degree camera products, including an updated MAX 360 camera. This camera records in 5.6K resolution, has a longer-lasting MAX Enduro Battery, and comes with an improved mounting system.

- Report ID: 385

- Published Date: Aug 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

360 Degree Camera Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.