2-Methylpropene Market Outlook:

2-Methylpropene Market size was over USD 14.33 billion in 2025 and is anticipated to cross USD 20.02 billion by 2035, witnessing more than 3.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of 2-methylpropene is assessed at USD 14.77 billion.

The increasing demand for butyl rubber in the automotive and tire industry drives the 2-methylpropene market. Butyl rubber, which is derived from isobutene, is widely used in tire inner liners due to its superior air retention and durability. Butyl rubber’s flexibility and waterproofing properties make it essential in adhesives, sealants, and roofing membranes. The booming construction industry and increased infrastructure development worldwide contribute to rising butyl rubber demand, thereby increasing isobutene consumption.

Further, halobutyl rubber (chlorobutyl and bromobutyl rubber) is a modified form of butyl rubber, offering superior heat and chemical resistance. It is widely used in pharmaceutical stoppers, medical closures, and industrial applications, creating additional demand for isobutene. Leading rubber manufacturers are expanding halobutyl rubber capacity, increasing the need for 2-methylpropene.

Sibur's Nizhnekamskneftekhim, a Russian petrochemicals firm, has completed the expansion of its halobutyl rubber (HBR) capacity, increasing it by one-third from 150 to 200 kt. Sibur accounts for 25% of global butyl rubber and HBR output, with Nizhnekamskneftekhim having the highest halobutyl rubber production capacity. The RUB 8 billion upgrading project included the installation of six new HBR production units and the refurbishment of 16 existing ones. The project was completed on time as part of the Company's contract with the Russian Ministry of Energy to construct and modernize petrochemical facilities.

Key 2-Methylpropene Market Insights Summary:

Regional Highlights:

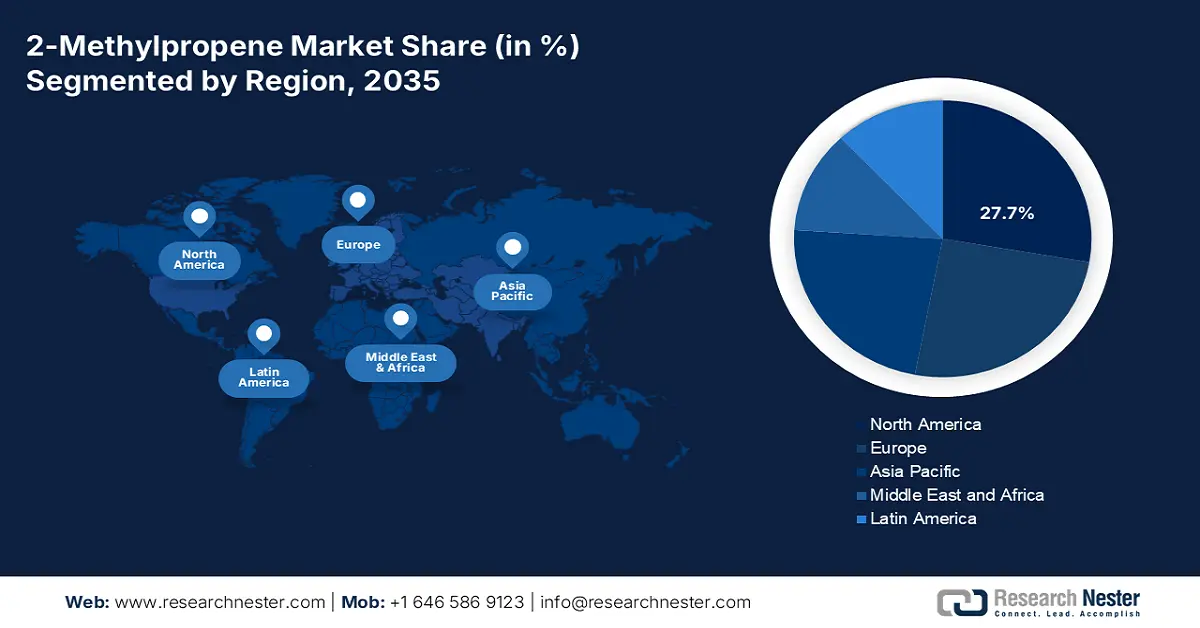

- North America leads the 2-Methylpropene Market with a 27.7% share, driven by strong automotive demand and rising electric vehicle production requiring 2-methylpropene derivatives, positioning it for growth through 2035.

- The 2-Methylpropene Market in Europe is set for substantial growth by 2035, driven by demand for cleaner-burning fuels and strict Euro 6 and Euro 7 emission standards.

Segment Insights:

- The Automotive segment of the 2-Methylpropene Market is expected to capture over 53.4% share by 2035, fueled by growing demand for butyl rubber in automotive applications.

Key Growth Trends:

- Technological advancements and bio-based alternatives

- Expanding packaging and adhesives industry

Major Challenges:

- Supply chain and logistics challenges

- Declining demand for MTBE in developed markets

- Key Players: SABIC, Dow, Royal Dutch Shell, INEOS, LG Chem, BASF, TotalEnergies, PTT Global Chemical, China Petroleum and Chemical Corporation, Gazprom, LyondellBasell.

Global 2-Methylpropene Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 14.33 billion

- 2026 Market Size: USD 14.77 billion

- Projected Market Size: USD 20.02 billion by 2035

- Growth Forecasts: 3.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (27.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Singapore, Russia, Brazil

Last updated on : 12 August, 2025

2-Methylpropene Market Growth Drivers and Challenges:

Growth Drivers

- Technological advancements and bio-based alternatives: Companies invest in bio-based isobutylene production using renewable feedstocks like sugar, biomass, and waste carbon sources. This reduces dependence on fossil fuels and meets growing sustainability regulations and consumer demand for eco-friendly products. Further innovations in catalytic cracking and dehydrogenation are improving yield, efficiency, and purity of isobutylene. New catalyst developments are enabling low-energy and cost-effective production processes.

Sustainable production of methyl tert-butyl ether (MTBE) and butyl rubber using bio-isobutylene enhances their adoption in fuel additives, tire manufacturing, and adhesives. It helps industries comply with strict environmental regulations on carbon emissions. Moreover, advances in waste-to-chemical technologies allow the conversion of industrial and agricultural waste into bio-isobutylene, reducing environmental impact. - Expanding packaging and adhesives industry: Polyisobutylene (PIB), a derivative of 2-methylpropene, is widely used in adhesives and sealants due to its flexibility, durability, and water resistance. Increasing demand for pressure-sensitive adhesives (PSAs) in labels, tapes, and packaging films is fueling PIB consumption. The shift towards lightweight, flexible, and recyclable packaging has increased the use of PIB-based films and resins. Growth in e-commerce and food packaging is further driving demand for PIB-based packaging materials. Global e-commerce sales will total USD 6.86 trillion in 2025, representing an 8.37% growth over 2024.

PIB enhances moisture and gas barrier properties in plastic films, extending the shelf life of food and pharmaceutical products. Rising regulations on food safety and demand for sustainable packaging boost the need for PIB-modified films.

Challenges

- Supply chain and logistics challenges: 2-methylpropene is highly inflammable and reactive, requiring specialized pressurized storage and transportation systems such as cryogenic tanks, pressurized railcars, and ISO containers. Compliance with hazardous material transportation regulations increases costs and limits supply chain flexibility. Moreover, isobutylene production depends on crude oil refining and petrochemical processing. Any disruption in oil supply such as OPEC decisions, refinery shutdowns, or natural disasters can lead to feedstock shortages and price spikes. Seasonal fluctuations in refinery output also impact isobutylene availability.

- Declining demand for MTBE in developed markets: MTBE is primarily used as a gasoline additive to enhance octane levels and reduce engine knocking. Any decline in MTBE consumption directly impacts isobutylene demand. Companies are shifting focus to alternative applications such as butyl rubber, PIB, and bio-based isobutylene to offset losses. Emerging economies like China, India, and the Middle East continue to drive regional demand, but long-term growth depends on diversification beyond MTBE.

2-Methylpropene Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.4% |

|

Base Year Market Size (2025) |

USD 14.33 billion |

|

Forecast Year Market Size (2035) |

USD 20.02 billion |

|

Regional Scope |

|

2-Methylpropene Market Segmentation:

End use (Automotive, Construction, Packaging, Consumer Products)

Automotive segment is likely to hold over 53.4% 2-methylpropene market share by the end of 2035. The automotive sector is a major consumer of 2-methylpropene (isobutylene) due to its role in manufacturing key materials like butyl rubber, PIB, and fuel additives. Butyl rubber, derived from isobutylene, is essential for tire inner liners due to its air retention, durability, and resistance to heat and oxidation. The growing automotive production in emerging economies is increasing tire demand, boosting isobutylene consumption. According to the European Automobile Manufacturers Association (ACEA), 85.4 million motor vehicles were produced worldwide in 2022, representing a 5.7% increase over 2021. The shift toward high-performance and fuel-efficient tires is further driving butyl rubber adoption.

Further, EVs require high-quality tires with low rolling resistance, boosting the demand for butyl rubber-based inner liners. Advanced adhesives and sealants are used in EV battery packs, thermal management systems, and lightweight components. The push for longer battery life and efficiency is driving innovation in PIB-based insulation materials.

Application (Polymerization, Chemical Intermediates, Additives)

The polymerization segment in 2-methylpropene market is poised to garner a significant share during the assessed period. Polymerization of 2-methylpropene plays a key role in driving market growth by expanding its applications across multiple industries. The growing demand for rubbers, lubricants, adhesives, and fuel additives is fueling the need for polymerized isobutylene derivatives. Polymerization of isobutylene with other monomers forms thermoplastic elastomers (TPEs). TPEs are used in hot-melt adhesives for packaging, construction, and footwear industries. It provides flexibility, weather resistance, and high elongation properties.

Our in-depth analysis of the global 2-methylpropene market includes the following segments:

|

Application |

|

|

End use |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

2-Methylpropene Market Regional Analysis:

North America Market Forecast

North America in 2-methylpropene market is expected to capture over 27.7% revenue share by 2035. North America has a strong automotive sector, with high demand for butyl rubber, a key derivative of isobutylene used in tire manufacturing. The increasing production of electric vehicles is boosting the need for synthetic rubber and fuel additives, which rely on 2-methylpropene. PIB, used in lubricants, fuel additives, and adhesives, is also in high demand.

The U.S. is a global leader in petrochemical production, supporting the growth of isobutylene-based fuel additives like MTBE and alkylate fuels. Stricter emission regulations and demand for cleaner-burning fuels are driving the use of isobutylene in fuel blending. Further, construction and packaging industries are increasing demand for PIB-based adhesives and sealants due to their flexibility and durability. The growth of e-commerce and flexible packaging is boosting demand for polyisobutylene adhesives in sealing applications.

Canada has a well-developed oil and gas industry, supporting demand for isobutylene-derived products like MTBE for cleaner-burning gasoline. Government policies promoting low-emission fuels and higher fuel efficiency standards are driving demand for fuel additives.

Europe Market Analysis

The 2-methylpropene market in Europe is expected to experience substantial growth during the projected period. The refining industry in the region is driving demand for isobutylene-based fuel additives such as alkylate fuels and MTBE. The push for cleaner-burning and high-octane fuels to meet Euro 6 and Euro 7 emissions standards is boosting 2-methylpropene market growth. Moreover, the region has strict environmental regulations promoting the use of bio-based and sustainable alternatives to traditional polymers.

Germany has one of the largest pharmaceutical sectors in Europe, increasing the demand for butyl rubber in medical stoppers, vials, and IV bags. Government investments in biopharmaceuticals and medical research are supporting the growth of high-performance elastomers in medical applications.

The UK is shifting towards electric vehicles, increasing demand for synthetic rubber, lubricants, and adhesives derived from isobutylene. The country is committed to net-zero targets, promoting the use of bio-based and sustainable materials in polymers and rubber. Regulations under REACH and the UK Green Industrial Revolution are driving innovation in low-carbon polyisobutylene and sustainable butyl rubber.

Key 2-Methylpropene Market Players:

- ExxonMobil

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- SABIC

- Dow

- Royal Dutch Shell

- INEOS

- LG Chem

- BASF

- TotalEnergies

- PTT Global Chemical

- China Petroleum and Chemical Corporation

- Gazprom

- LyondellBasell

Major companies play a crucial role in the 2-methylpropene market by leveraging advanced technologies, expanding production capacity, and driving demand through various applications. Key players invest in new production facilities and capacity expansions to meet rising global demand. Additionally, leading manufacturers focus on improving polymerization processes to produce high-performance PIB, butyl rubber, and fuel additives.

Recent Developments

- In December 2024, BASF formally opened its new Catalyst Development and Solids Processing Center in Ludwigshafen, Germany. This research facility will be a central location for the development of new solids processing technologies and will also serve as a hub for pilot-scale synthesis of chemical catalysts, allowing BASF to provide its global customers with faster access to cutting-edge technologies.

- In June 2022, Toray Industries, Inc. announced the formation of a joint venture with LG Chem, Ltd., in which Toray and LG Chem each own a 50% stake, after the revelation on October 27, 2021 that Toray had agreed to launch a battery separator film joint venture in Hungary.

- Report ID: 7272

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

2-Methylpropene Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.