생선 단백질 가수분해물 시장 – 역사적 데이터(2019-2024), 글로벌 동향 2025, 성장 예측 2037

2025년 생선단백질 가수분해물 시장은 2억 5,676만 달러로 평가됩니다. 전 세계 시장 규모는 2024년 약 2억 4,575만 달러였으며 CAGR 5.6% 이상 성장하여 2037년에는 매출 4억 9,903만 달러를 넘어설 것으로 예상됩니다. 유럽은 애완동물 입양 증가와 어류 부산물 생산 증가에 힘입어 2037년까지 1억 7,466만 달러를 확보할 것으로 예상됩니다.

시장 성장은 동물성 단백질, 특히 생선에서 추출한 단백질에 대한 수요 증가에 기인할 수 있습니다. 생선 단백질 가수분해물은 단백질 공급원으로서 생선에 대한 수요가 증가함에 따라 향후 몇 년 동안 상당한 성장을 경험할 것으로 예상됩니다. 전 세계적으로 20억 명이 넘는 개인이 생선을 통해 1인당 동물성 단백질의 약 20%를 섭취하며, 약 30억 명이 같은 양을 섭취합니다.

또한, 생선 단백질 가수분해물의 생선 단백질 가수분해물 시장 성장을 촉진하는 것으로 여겨지는 요인에는 생선 가공 산업에서 발생하는 폐기물 발생의 증가가 포함됩니다. 아미노산, 단백질, 항산화제 및 펩타이드의 좋은 공급원은 머리, 피부, 내장, 뼈 및 간과 같은 생선 가공 폐기물에서 추출된 FPH입니다. 전 세계적으로 매년 바이오매스의 약 60%가 수산물 가공 부문에서 생성되고 폐기될 것으로 예상됩니다.

생선 단백질 가수분해물 시장: 성장 동인 및 과제

성장 동력

- 부흥하는 양식 산업– 양식 생산량이 증가함에 따라 어류의 수와 부산물의 양도 증가합니다. 유엔식량농업기구(FAO) 통계에 따르면 2020년에는 코로나19 팬데믹(세계적 대유행)에도 불구하고 전 세계 양식 산업의 성장이 지속됐다. 또한 인간이 섭취할 수 있는 전 세계 수생 동물 생산량은 총 8,750만 톤에 달했습니다.

- 단백질 보충제에 대한 수요 증가– 생선 단백질 분말(FPP)은 실제 생선보다 1회 제공량당 더 많은 단백질을 함유하는 건조된 고형 생선 제품이며 비건 단백질 보충제에 사용됩니다. 미국인 중 약 46%, 즉 2인당 1명이 정기적으로 단백질이 풍부한 음료와 스무디를 섭취합니다. 또한 대다수의 미국인은 필요한 것보다 두 배 더 많은 단백질을 섭취합니다.

- 유당 불내증을 앓고 있는 인구 증가 – 생선 단백질은 유당 불내증 인 사람들을 위한 단백질 공급원 역할을 합니다. 우유가 포함되어 있지 않으며 우유 알레르기가 있는 사람에게도 안전해야 합니다.

도전과제

- 생선 유래 단백질과 관련된 건강 위험- 생선을 먹는 것은 건강상의 이점이 있지만 몇 가지 위험도 있습니다. 물고기가 먹는 음식과 그들이 사는 물에는 모두 유해한 오염 물질이 포함되어 있을 수 있습니다. 시간이 지남에 따라 신체에는 PCB 및 수은과 같은 오염 물질이 많이 생성될 수 있습니다. 다량의 PCB와 수은이 뇌와 신경계에 영향을 미칠 수 있으므로 유독한 생선으로 만든 제품을 섭취해서는 안 됩니다. 더욱이 유아와 태아는 신체가 가장 성장하는 단계에 있기 때문에 수은의 영향에 특히 취약합니다.

- 원자재 부족

- 생산 비용이 높습니다.

생선 단백질 가수분해물: 주요 통찰력

| 보고서 속성 | 세부정보 |

|---|---|

|

기준 연도 |

2024년 |

|

예측 연도 |

2025년부터 2037년까지 |

|

CAGR |

5.6% |

|

기준연도 시장 규모(2024년) |

2억 4,575만 달러 |

|

예측 연도 시장 규모(2037년) |

4억 9,903만 달러 |

|

지역 범위 |

|

생선 단백질 가수분해물 분할

적용(동물 사료, 양식업, 애완동물 사료)

생선 단백질 가수분해물 시장의 동물 사료 부문은 2037년에 가장 큰 수익 점유율을 기록할 예정입니다. 부문 성장은 가금류 사육 증가와 돼지 개체수 증가에 영향을 받습니다. 가금류 사료, 돼지 사료 등을 포함한 다양한 영양학적 응용 분야에서 어류 단백질 가수분해물의 장점을 뒷받침하는 핵심 요소 중 하나는 높은 아미노산 농도입니다. 2021년 기준 전 세계 돼지 사육두수는 약 6억7760만두다. 같은 해 세계 최대 돼지 생산국인 중국에는 약 4억600만두의 돼지가 있었다. 이 외에도 UN 식량 농업 기구에 따르면 2020년 전 세계에는 330억 마리가 넘는 닭이 살고 있습니다. 이 중 아시아가 약 46%를 차지했습니다.

공급원(틸라피아, 참치, 멸치, 정어리, 갑각류, 연체동물, 대서양 연어, 대구)

참치 부문의 생선 단백질 가수분해물 시장은 2037년에 상당한 점유율을 차지할 것으로 예상됩니다. 전 세계적으로 참치 생산량이 증가함에 따라 부문의 성장이 촉진됩니다. 유엔 통계에 따르면, 참치 및 참치와 유사한 종은 전 세계적으로 연간 700만 톤이 넘게 어획됩니다. 이러한 이동성 참치 종은 국제적으로 거래되는 모든 해산물의 8% 이상을 차지하고 모든 해양 포획 어업 가치의 20%를 차지합니다. 이 외에도 참치의 높은 영양가도 시장 성장을 촉진할 것으로 예상된다. 무엇보다도 참치는 오메가-3 함량이 높고 미네랄, 단백질, 비타민 B12의 좋은 공급원입니다.

글로벌 생선 단백질 가수분해물 시장에 대한 심층 분석에는 다음과 같은 부문이 포함됩니다.

|

신청 |

|

|

소스 |

|

Vishnu Nair

글로벌 비즈니스 개발 책임자이 보고서를 귀하의 요구에 맞게 맞춤화하세요 — 맞춤형 인사이트와 옵션을 위해 당사의 컨설턴트와 상담하십시오.

생선 단백질 가수분해물 산업 - 지역 개요

유럽 시장 통계

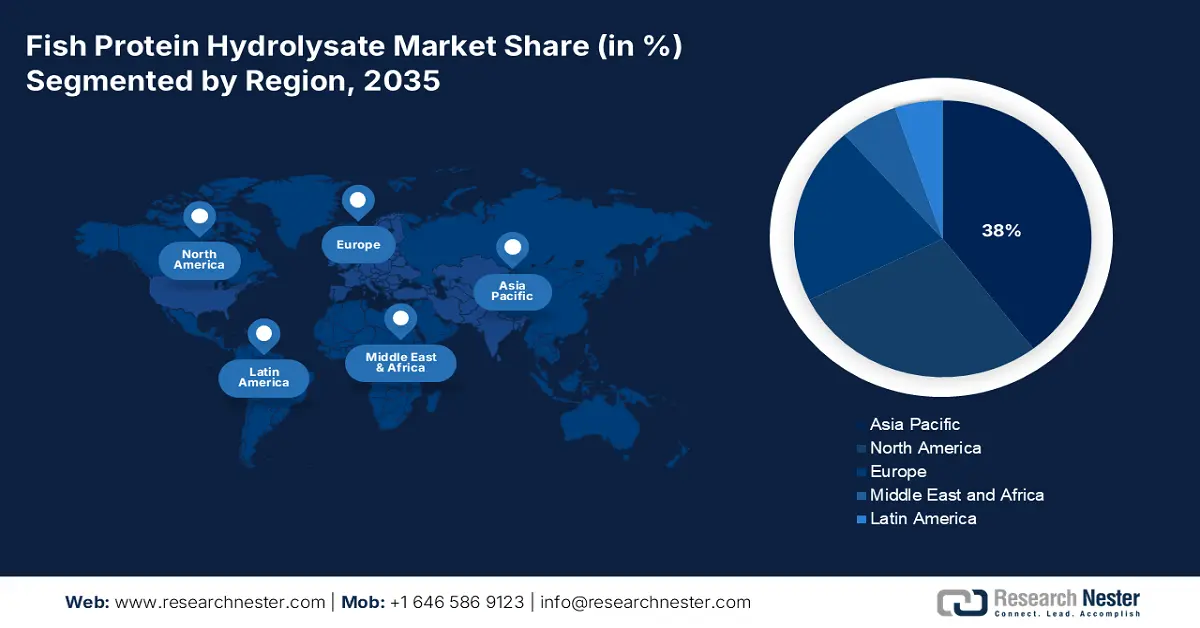

유럽의 생선 단백질 가수분해물 시장은 2037년까지 약 35%의 점유율로 가장 큰 시장이 될 것으로 예상됩니다. 시장 성장은 주로 애완동물 입양 증가에 기인합니다. 유럽 연합에서는 8,400만 마리 이상의 고양이와 7,300만 마리 이상의 개를 애완동물로 사육하고 있습니다. 또한 장식용 새는 약 3,400만 마리, 다양한 소형 포유류는 2,200만 마리에 달했습니다. 한편, 수산물 부산물의 생산량 증가도 이 지역의 시장 성장을 촉진할 것으로 예상됩니다. 어업 부문에서 발생하는 폐기물은 유럽 연합에서 연간 약 500만 톤에 이릅니다.

북미 시장 전망

북미 생선 단백질 가수분해물 시장은 2037년까지 주목할만한 점유율을 기록할 예정입니다. 시장 성장은 주로 닭고기와 칠면조를 포함한 가금류 생산량 증가에 기인할 수 있습니다. 미국 농무부의 통계에 따르면 2020년 총 92억 2천만 마리의 육계가 생산되었는데, 이는 2019년에 비해 소폭 증가한 수치입니다. 2019년에 생산된 74억 7천만 파운드와 달리 2020년에 생산된 칠면조의 총량은 73억 2천만 파운드였습니다. 식이보충제에 대한 수요 증가로 인해 이 지역의 생선 단백질 가수분해물 시장 성장도 가속화될 것으로 예상됩니다.

생선 단백질 가수 분해물 시장을 지배하는 회사

- 베르단

- 회사 개요

- 비즈니스 전략

- 주요 제품 제공 사항

- 재무 성과

- 핵심성과지표

- 위험 분석

- 최근 개발

- 지역적 입지

- SWOT 분석

- 소프로페체

- Symrise 아쿠아 피드

- 코팔리스 씨 솔루션

- Scanbio Marine Group AS

- Bio-marine Ingredients Ireland Ltd.

- 심천 타이어

- Great Pacific BioProducts Ltd.

- 브라운스피시 제네시스

- Dramm Corporation

최근 동향

- Bio-Marine Ingredients Ireland, Ltd.는 생선에서 단백질, 칼슘, 기름을 추출하여 식품 성분과 동물 사료에 사용하는 아일랜드의 선도적인 회사입니다. 회사는 500만 유로의 자금을 확보했으며 2024년에는 그 규모가 400억 달러에 이를 것으로 예상됩니다.

- Verdane은 선도적인 어류 폐기물 관리 회사인 Scanbio Marine Group AS에 투자하기 위해 Pioneer Point Partners LLP와 협력한다고 발표했습니다. 이번 협력은 고부가가치 최종 제품 생산을 위한 최고의 양식 폐기물 관리 서비스 제공업체가 되는 것을 목표로 이루어졌습니다.

- Report ID: 4765

- Published Date: May 08, 2025

- Report Format: PDF, PPT

- 주요 시장 트렌드 및 인사이트 미리보기를 탐색하세요

- 샘플 데이터 테이블 및 세그먼트 분류를 검토하세요

- 시각적 데이터 표현의 품질을 경험해 보세요

- 보고서 구조 및 연구 방법론을 평가하세요

- 경쟁 환경 분석을 살짝 엿보세요

- 지역별 전망이 어떻게 제시되는지 이해하세요

- 기업 프로파일링 및 벤치마킹의 깊이를 평가하세요

- 실행 가능한 인사이트가 전략을 어떻게 지원할 수 있는지 미리 살펴보세요

실제 데이터와 분석을 탐색하세요

자주 묻는 질문 (FAQ)

생선 단백질 가수분해물 시장 보고서 범위

무료 샘플에는 현재 및 과거 시장 규모, 성장 추세, 지역별 차트 및 표, 기업 프로필, 세그먼트별 전망 등이 포함되어 있습니다.

전문가와 상담하기