전자 보안 시장 전망:

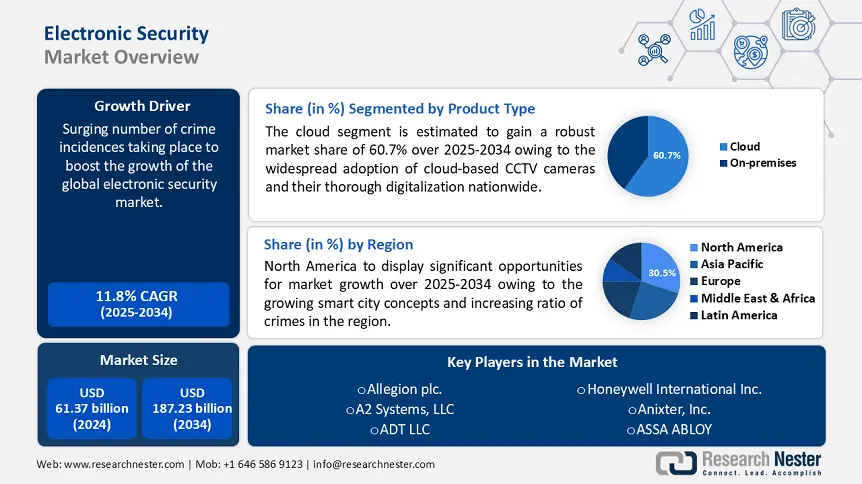

전자 보안 시장 규모는 2024년 613억 7천만 달러를 넘어섰으며, 2034년에는 1,872억 3천만 달러를 돌파할 것으로 예상됩니다. 2025년부터 2034년까지 예측 기간 동안 연평균 성장률(CAGR)은 11.8%를 넘을 것으로 예상됩니다. 2025년 전자 보안 산업 규모는 675억 3천만 달러로 추산됩니다.

시장 성장은 전 세계적으로 강도, 절도 등 범죄 발생률이 크게 증가한 데 기인합니다. 예를 들어 2022년 중반까지 미국의 폭력 범죄 비율은 주민 10만 명당 약 48.50명으로 증가했습니다.

전자 보안은 안전을 강화하고 인명과 물리적 자산을 보호하기 위해 전자 장치와 통합 기술을 사용하는 모든 시스템을 포괄합니다. 감시, 접근 제어, 침입 탐지, 경보 및 기타 보안 채널로 구성됩니다. 이러한 시스템은 경보, 출입 통제 및 CCTV(폐쇄 회로 텔레비전)로 구성되며 눈에 띄고 광범위하게 활용됩니다. 전자 보안은 사용자에게 귀중한 비디오 감시 이점을 제공합니다. 영상 감시는 집이나 회사의 진입점을 감독하는 데 도움이 됩니다.

정부 기관과 제조 업계에서 전자 보안 시스템을 채택하는 비중이 높아지는 것은 전자 보안 시장 수익을 증대시키는 중요한 요소입니다. 예를 들어, 2022년까지 경찰 기관의 약 44%가 디지털 도구를 사용하여 공공 보안을 개선하고 실시간 동영상 스트리밍 및 공유 워크플로와 같은 대체 솔루션 프레임워크를 사용할 것으로 예상됩니다.

키 전자 보안 시장 통찰 요약:

북미 시장 은 2037년까지 전자 보안 시장에서 가장 큰 점유율을 차지할 것으로 예상됩니다.

비디오 감시 시스템 부문은 예측 기간 동안 전자 보안 시장 점유율을 선도할 것으로 예상됩니다.

주요 성장 추세 :

안전 및 보안에 대한 인식 증대

절도 사건 급증

주요 플레이어:

ASSA ABLOY, Honeywell International Inc., A2 Systems, LLC., Axis Communications AB, ADT LLC, ALL-TAG Corporation, Anixter, Inc., Hangzhou Hikvision Digital Technology Co., Ltd., Hanwha TechwinCo., Ltd., Allegion plc.

글로벌 전자 보안 시장 예측 및 지역 전망:

- 2024년 시장 규모: 613억 7천만 달러

- 2025년 시장 규모: 675억 3천만 달러

- 예상 시장 규모: 2034년까지 1,872억 3천만 달러

- 성장 예측: 11.8% CAGR(2025-2034)

- 가장 큰 지역: 북미

- 가장 빠르게 성장하는 지역: 아시아 태평양

Last updated on : 16 June, 2025

전자 보안 시장 성장 동인 및 과제:

성장 동력

- 안전 및 보안에 대한 인식 제고 – 범죄 및 도난 사건이 나날이 증가함에 따라 보안 시스템을 설치하면 기업과 주거 거주자에게 안전과 보안에 대한 느낌을 줍니다. 그 결과 안전과 보안에 대한 사람들의 인식이 높아짐에 따라 이러한 전자 보안 구성 요소의 채택이 크게 증가했습니다. 예를 들어, 2019년 말까지 전 세계적으로 약 7억 7,300만 대의 보안 카메라가 설치되었습니다.

- 절도 절도 사건 급증 – 연방수사국(Federal Bureau of Investigation)에 따르면 2019년 미국에서 절도 사건이 5,086,096건으로 추정되는 것으로 나타났습니다.

- 새로운 테러 공격 – 예를 들어 전 세계 테러 관련 사망자 중 놀랍게도 50%가량을 차지하는 사하라 이남 아프리카는 세계 테러의 중심지로 떠오르고 있습니다.

- 도시화 확대 - 세계 경제 포럼에 따르면 현재 55%인 세계 인구의 80%가 2050년까지 도시 지역에 거주할 것으로 추정됩니다.

- Wi-Fi 보급률 증가 - 현재 전 세계적으로 약 53억 5천만 명이 인터넷에 연결되어 있습니다.

도전과제

- 전자 보안 시스템과 관련된 높은 비용

- 보안 제품에 대한 소비자의 인식 부족

- 전자 보안 시스템 사용을 위한 기술 지식 부족

전자 보안 시장: 주요 통찰력

| 보고서 속성 | 세부정보 |

|---|---|

|

기준 연도 |

2024년 |

|

예측 연도 |

2025년부터 2034년까지 |

|

연평균 성장률 |

11.8% |

|

기준 연도 시장 규모(2024년) |

613억 7천만 달러 |

|

예측 연도 시장 규모(2034년) |

1,872억 3천만 달러 |

|

지역 범위 |

|

전자 보안 시장 세분화:

제품 유형 세그먼트 분석

영상 감시 시스템 부문은 전 세계적으로 범죄 건수가 증가하고 감시 시스템 채택이 증가함에 따라 예측 기간 동안 전자 보안 시장 점유율의 대부분을 차지할 것으로 예상됩니다. 예를 들어 2019년까지 전 세계적으로 약 7억 8천만 대의 감시 카메라가 설치되었으며, 그 중 중국이 56%를 차지했습니다.

글로벌 전자 보안 시장에 대한 심층 분석에는 다음 세그먼트가 포함됩니다.

|

제품 유형별 |

|

|

배포 모드별 |

|

|

연결 기준 |

|

|

애플리케이션별 |

|

|

최종 사용자 작성 |

|

Vishnu Nair

글로벌 비즈니스 개발 책임자이 보고서를 귀하의 요구에 맞게 맞춤화하세요 — 맞춤형 인사이트와 옵션을 위해 당사의 컨설턴트와 상담하십시오.

전자 보안 시장 지역별 통찰력:

범죄율 증가, 스마트 시티 개념의 급증, 지역 내 소매점 및 시설 수의 지속적인 증가로 인해 2037년 말까지 북미 시장이 전자 보안 시장의 대부분을 차지할 것으로 예상됩니다. 예를 들어 2020년에는 미국에 소매점이 거의 110만 개에 달했습니다.

전자보안 시장을 장악하는 기업들

- 아사 아블로이

- 회사 개요

- 비즈니스 전략

- 주요 제품 제공 사항

- 재무 성과

- 핵심성과지표

- 위험 분석

- 최근 개발

- 지역적 입지

- SWOT 분석

- 하니웰 인터내셔널 Inc.

- A2 시스템즈, LLC.

- Axis Communications AB

- ADT LLC

- ALL-TAG Corporation

- Anixter, Inc.

- 항저우 Hikvision 디지털 기술 유한 회사

- 한화테크윈(주)

- Allegion plc.

최근 동향

- ASSA ABLOY는 단독 및 다가구 건물을 위한 실내 스테이션 및 스마트폰 제어 IP 도어 인터컴을 생산하는 독일 제조업체인 Bird Home Automation GmbH('DoorBird')를 인수했습니다.

- Axis Communications AB는 다양한 요구 사항을 충족하는 여러 제품 버전을 제공하는 AXIS A12 네트워크 도어 컨트롤러 시리즈를 발표했습니다. AXIS A12 도어 컨트롤러는 열쇠 구멍 장착 플레이트와 DIN 레일 마운트 지원을 통해 빠르고 쉽게 벽에 설치할 수 있습니다.

- Report ID: 344

- Published Date: Jun 16, 2025

- Report Format: PDF, PPT

- 주요 시장 트렌드 및 인사이트 미리보기를 탐색하세요

- 샘플 데이터 테이블 및 세그먼트 분류를 검토하세요

- 시각적 데이터 표현의 품질을 경험해 보세요

- 보고서 구조 및 연구 방법론을 평가하세요

- 경쟁 환경 분석을 살짝 엿보세요

- 지역별 전망이 어떻게 제시되는지 이해하세요

- 기업 프로파일링 및 벤치마킹의 깊이를 평가하세요

- 실행 가능한 인사이트가 전략을 어떻게 지원할 수 있는지 미리 살펴보세요

실제 데이터와 분석을 탐색하세요

자주 묻는 질문 (FAQ)

전자 보안 시장 보고서 범위

무료 샘플에는 현재 및 과거 시장 규모, 성장 추세, 지역별 차트 및 표, 기업 프로필, 세그먼트별 전망 등이 포함되어 있습니다.

전문가와 상담하기

저작권 © 2026 리서치 네스터. 모든 권리 보유.