Perspectives du marché des pièces de rechange pour avions commerciaux :

Le marché des pièces de rechange pour avions commerciaux était évalué à 44,4 milliards de dollars en 2025 et devrait dépasser les 76,56 milliards de dollars d'ici 2035, avec un taux de croissance annuel composé (TCAC) supérieur à 5,6 % sur la période 2026-2035. En 2026, la taille de ce marché était estimée à 46,64 milliards de dollars.

La demande croissante de pièces détachées pour avions commerciaux de la part des compagnies aériennes et des prestataires de services après-vente stimule considérablement la croissance du marché.

Les avions de dernière génération sont équipés de capteurs de conception nouvelle permettant de collecter et d'analyser les données en temps réel. L'utilisation de technologies avancées, telles que le big data et la numérisation, dans la fourniture de pièces de rechange a permis aux entreprises d'affiner leurs plans et de prendre des décisions stratégiques. Bien que l'efficacité des nouveaux avions puisse augmenter jusqu'à 20 % par rapport aux modèles précédents, la croissance de l'activité a historiquement dépassé les gains d'efficacité. Ces facteurs contribuent à l'essor du marché au cours de la période prévisionnelle.

Clé marché secondaire des avions commerciaux Résumé des informations sur le marché:

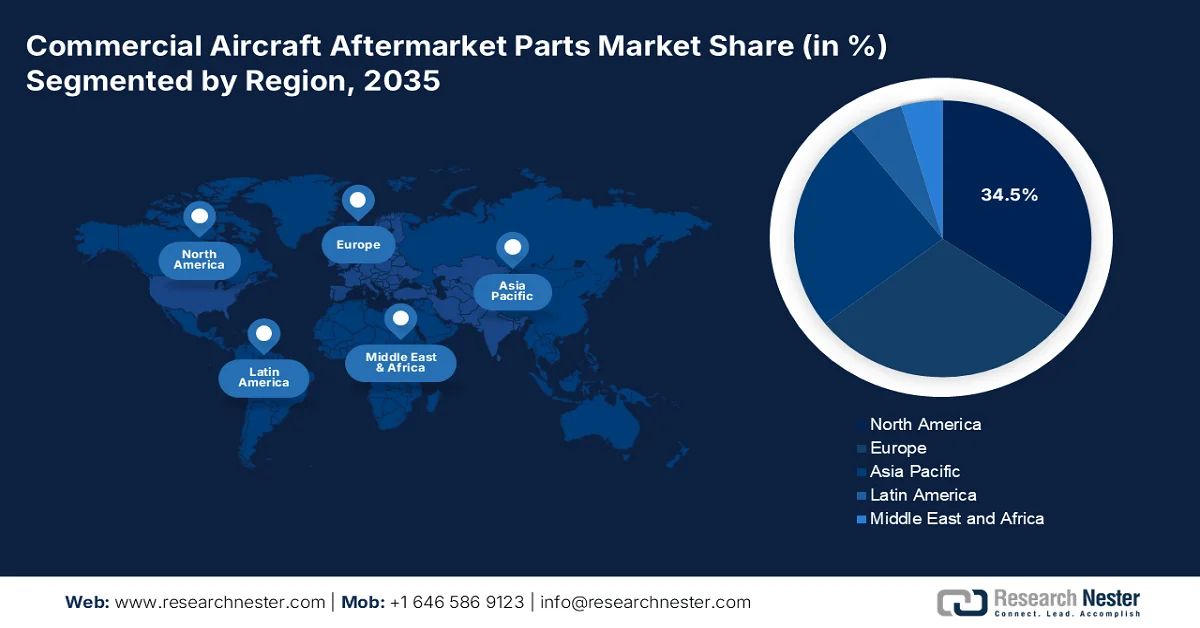

Региональные достопримечательности:

- К 2035 году доля рынка послепродажного обслуживания коммерческих самолетов в Северной Америке составит около 35%, что будет обусловлено ростом инвестиций в послепродажное обслуживание и развитыми сетями ТОиР.

- В прогнозируемый период на рынке Азиатско-Тихоокеанского региона будет наблюдаться значительный рост, обусловленный увеличением инвестиций в центры вторичного рынка запчастей и ужесточением экспортных правил.

Анализ сегмента:

- Прогнозируется, что к 2035 году доля сегмента технического обслуживания и ремонта (ТОиР) и замены ротационных компонентов достигнет 33%, что обусловлено растущей потребностью в современном техническом обслуживании воздушных судов и повышением эффективности активов ТОиР.

- Прогнозируется, что сегмент узкофюзеляжных самолетов на рынке запасных частей для коммерческих самолетов к 2035 году займет наибольшую долю, что объясняется ростом спроса на внутренние авиаперевозки и снижением расхода топлива.

Основные тенденции роста:

- Повышенные требования к своевременному техническому обслуживанию самолетов

- Увеличение количества списанных самолетов для упрощения утилизации отработанных материалов (USM)

Основные проблемы:

- Растущая обеспокоенность по поводу стоимости запасов среди авиакомпаний

- Проблемы, связанные с управлением объектами, нарушат цепочку поставок

Ключевые игроки: Leonardo SpA, Aventure International Aviation Services, Honeywell International Inc, Airbus SE, Parker Hannifin Corporation.

Mondial marché secondaire des avions commerciaux Marché Prévisions et perspectives régionales:

Прогнозы размера и роста рынка:

- Объем рынка в 2025 году: 44,4 млрд долларов США

- Объем рынка в 2026 году: 46,64 млрд долларов США

- Прогнозируемый размер рынка: 76,56 млрд долларов США к 2035 году.

- Прогнозы роста: среднегодовой темп роста 5,6% (2026-2035)

Ключевая региональная динамика:

- Крупнейший регион: Северная Америка (доля 35% к 2035 году)

- Самый быстрорастущий регион: Азиатско-Тихоокеанский регион

- Доминирующие страны: США, Китай, Германия, Великобритания, Франция

- Развивающиеся страны: Китай, Индия, Япония, Сингапур, Бразилия

Last updated on : 8 September, 2025

Facteurs de croissance et défis du marché des pièces de rechange pour avions commerciaux :

Moteurs de croissance

- Exigence accrue d'une maintenance aéronautique rapide – La maintenance des porte-avions peut coûter des milliards ; il est donc impératif de disposer d'un système de maintenance performant et régulier permettant de réaliser des économies de temps et d'argent. Par exemple, en Afrique, en 2017, 27 % de la demande en matière de maintenance, de réparation et de révision (MRO) des avions concernait la maintenance des composants. Par conséquent, la préoccupation croissante pour une maintenance rapide, essentielle à la prévention des accidents aériens, stimule la croissance du marché, les exploitants d'aéronefs privilégiant la réparation des pièces dans les délais impartis.

- Vieillissement de la flotte aérienne : afin d’éviter l’endettement lié à l’achat de nouveaux appareils, de nombreux petits exploitants du secteur aérien utilisent des avions anciens. Dans le but de maintenir la sécurité de leur flotte, la croissance du marché est stimulée par les préoccupations des opérateurs concernant le vieillissement de leurs appareils. Ces derniers envisagent des solutions de remplacement, de modification et d’adaptation à moindre coût, afin d’assurer la navigabilité des avions. Ce facteur devrait accélérer la croissance du marché au cours de la période de prévision.

- L'augmentation du nombre d'avions retirés du service favorise la valorisation des pièces détachées usagées (USM) : les compagnies aériennes restructurent leurs flottes afin de faire face à l'impact financier de la crise en anticipant la mise hors service de certains appareils. Par conséquent, depuis 2020, le démantèlement et le recyclage des avions de ligne ont connu une forte croissance. Ce facteur accroît la demande en pièces détachées usagées (USM). Le marché des USM devrait progresser significativement, avec un taux de croissance de 68,2 % d'ici 2022, malgré une baisse importante en 2020. Par ailleurs, les gouvernements de nombreuses régions encouragent l'utilisation de carburants d'aviation durables afin de réduire les émissions de carbone. Les pièces détachées usagées contribuent également de manière significative à la croissance de ce marché.

Défis

- Préoccupations croissantes des compagnies aériennes concernant les coûts de stockage : la hausse des coûts liés au stockage des pièces détachées perturbe leurs dépenses opérationnelles. Par ailleurs, d’autres facteurs, tels que l’augmentation du prix du carburant et la hausse des dépenses opérationnelles supplémentaires, incitent les compagnies aériennes à minimiser leurs coûts. Ces facteurs pourraient freiner la croissance du marché.

- Les problèmes liés à la gestion des installations perturberont la chaîne d'approvisionnement.

- Pénurie de ressources

Taille et prévisions du marché de l'après-vente des avions commerciaux : Taille et prévisions du marché des pièces détachées :

| Attribut du rapport | Détails |

|---|---|

|

Année de base |

2025 |

|

Période de prévision |

2026-2035 |

|

TCAC |

5,6% |

|

Taille du marché de l'année de référence (2025) |

44,4 milliards de dollars américains |

|

Taille du marché prévisionnelle pour l'année 2035 |

76,56 milliards de dollars américains |

|

Portée régionale |

|

Segmentation du marché des pièces de rechange pour avions commerciaux :

Analyse des segments de pièces

Le segment des pièces de rechange et de la maintenance, réparation et révision (MRO) devrait détenir la plus grande part de marché (33 %) au cours de la période de prévision. Cette croissance est alimentée par la demande croissante d'aéronefs modernisés et le besoin accru d'une maintenance régulière pour ces appareils de pointe. De plus, la gestion des actifs MRO contribue à réduire les besoins en espace de stockage. Grâce à une stratégie de maintenance industrielle moderne, les propriétaires d'aéronefs peuvent gérer plus efficacement les garanties. Tous ces facteurs stimulent la croissance du marché des pièces MRO.

Analyse du segment des aéronefs

Les avions monocouloirs détiennent la plus grande part de marché grâce à la demande croissante de vols intérieurs, notamment de la part des compagnies charters à bas prix. CFM International, de loin le plus grand motoriste mondial, détenait 71 % du marché des moteurs pour avions monocouloirs en mai 2019. L'augmentation du nombre de vols intérieurs entraîne une hausse des prestations de maintenance aéronautique. Par ailleurs, la largeur des sièges à bord des avions monocouloirs offre un confort supérieur à celui des avions gros-porteurs. Enfin, la consommation de carburant des avions monocouloirs est inférieure à celle des gros-porteurs, ce qui devrait stimuler la croissance de ce marché.

Notre analyse approfondie du marché mondial comprend les segments suivants :

Composant |

|

Aéronef |

|

Parties |

|

Vishnu Nair

Responsable du développement commercial mondialPersonnalisez ce rapport selon vos besoins — contactez notre consultant pour des informations et des options personnalisées.

Analyse régionale du marché des pièces de rechange pour avions commerciaux :

Aperçu du marché nord-américain

Par région, le marché nord-américain devrait représenter 35 % des revenus au cours de la période de prévision. Cette croissance est attribuable aux prestataires de services de maintenance, de réparation et de révision (MRO) qui investissent de plus en plus dans les services après-vente aux États-Unis et au Canada. De plus, les entreprises américaines disposent d'un réseau d'approvisionnement solide pour les services MRO et les pièces aéronautiques. Enfin, la croissance du marché sera stimulée par la normalisation croissante des processus PMA aux États-Unis pour l'homologation des fabricants de pièces.

Perspectives du marché APAC

Le secteur des pièces détachées automobiles en Asie-Pacifique devrait connaître une croissance significative d'ici 2035. On observe une augmentation des investissements dans la création de plateformes de distribution de pièces détachées dans des régions comme le Japon, Singapour et la Chine. En Chine, le marché des pièces détachées devrait croître rapidement. Par ailleurs, la réglementation gouvernementale en matière d'exportation et d'importation a fortement contribué à cette croissance.

Acteurs du marché des pièces de rechange pour avions commerciaux :

- Leonardo SpA

- Présentation de l'entreprise

- Stratégie d'entreprise

- Principaux produits proposés

- Performance financière

- Indicateurs clés de performance

- Analyse des risques

- Développements récents

- Présence régionale

- Analyse SWOT

- Aventure International Aviation Services

- Honeywell International Inc

- Airbus SE

- Société Parker Hannifin

Développements récents

- Aventure International Aviation Services a annoncé l'acquisition d'un Boeing 777-200ER auprès de Delta Airlines. Selon le vice-président senior de la société, la cellule est actuellement démantelée par Tarmac Aerosave et les pièces récupérées, remises à neuf et recertifiées, seront mises à la disposition des utilisateurs finaux ultérieurement.

- Honeywell International Inc. a signé un accord de 10 ans avec ST Engineering pour la fourniture de composants MRO et de services de réparation sous garantie aux opérateurs de la région Asie-Pacifique.

- Report ID: 2239

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Découvrez un aperçu des principales tendances du marché et des insights

- Passez en revue des tableaux de données d’échantillon et des analyses par segment

- Découvrez la qualité de nos représentations visuelles de données

- Évaluez la structure de notre rapport et notre méthodologie de recherche

- Jetez un coup d’œil à l’analyse du paysage concurrentiel

- Comprenez comment les prévisions régionales sont présentées

- Évaluez la profondeur des profils d’entreprise et du benchmarking

- Visualisez comment des insights exploitables peuvent soutenir votre stratégie

Explorez des données et des analyses réelles

Questions fréquemment posées (FAQ)

marché secondaire des avions commerciaux Portée du rapport de marché

L’échantillon gratuit comprend la taille actuelle et historique du marché, les tendances de croissance, des graphiques et tableaux régionaux, des profils d’entreprises, des prévisions par segment, et plus encore.

Contactez notre expert

Droits d’auteur © 2026 Research Nester. Tous droits réservés.