Perspectives du marché des dispositifs de gestion du rythme cardiaque :

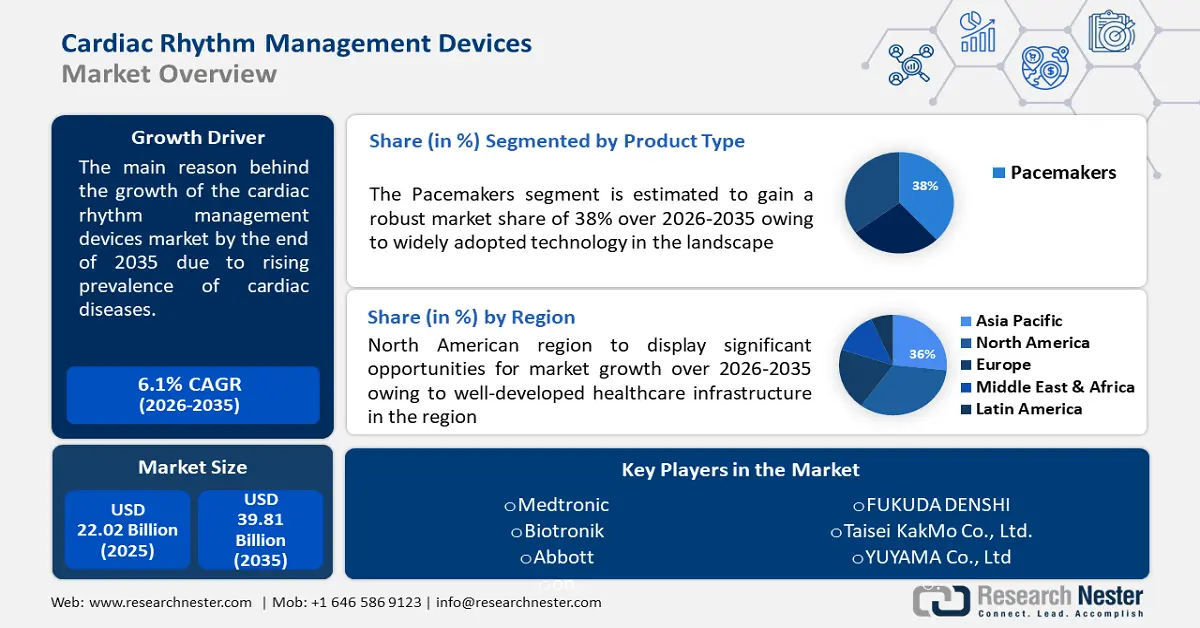

Le marché des dispositifs de gestion du rythme cardiaque était évalué à 22,02 milliards USD en 2025 et devrait atteindre 39,81 milliards USD d'ici 2035, soit un TCAC d'environ 6,1 % sur la période 2026-2035. En 2026, le marché des dispositifs de gestion du rythme cardiaque devrait peser 23,23 milliards USD.

Le besoin d'alternatives thérapeutiques efficaces s'est accru en raison de la prévalence croissante des troubles cardiovasculaires, notamment la fibrillation auriculaire, les arythmies cardiaques et l'insuffisance cardiaque. La Bibliothèque nationale de médecine a observé que 10 951 403 décès dus à une maladie cardiovasculaire (maladie cardiaque, dont 16,9 % d'accident vasculaire cérébral) sont survenus entre 2010 et 2022. Le vieillissement de la population, plus sujette aux maladies cardiaques, a également contribué à la croissance du marché des dispositifs de gestion du rythme cardiaque. Ce développement a également été considérablement favorisé par les avancées technologiques. La précision et l'efficacité de ces dispositifs ont augmenté grâce aux progrès de la communication sans fil, aux algorithmes intelligents et à la réduction de la taille des appareils. Le traitement des anomalies du rythme cardiaque a également été profondément transformé par l'avènement des stimulateurs cardiaques, des dispositifs de resynchronisation cardiaque (TRC) et des défibrillateurs automatiques implantables (DAI).

Clé Dispositifs de gestion du rythme cardiaque Résumé des informations sur le marché:

Points forts régionaux :

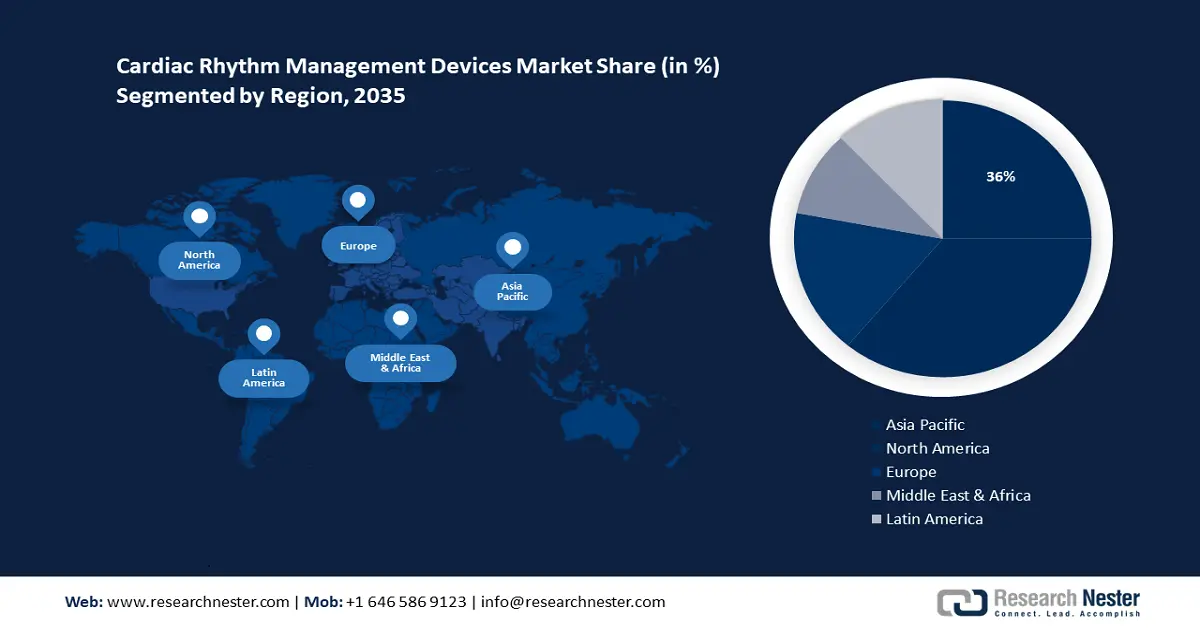

- Le marché nord-américain des dispositifs de gestion du rythme cardiaque atteindra 36 % d’ici 2035, grâce à une infrastructure de santé bien développée et à une forte adoption de dispositifs cardiovasculaires avancés.

- Le marché Asie-Pacifique connaîtra une croissance significative entre 2026 et 2035, alimentée par la hausse des dépenses de santé, l’amélioration des établissements de santé et une sensibilisation croissante aux maladies cardiovasculaires.

Analyses sectorielles :

- Le segment des stimulateurs cardiaques devrait représenter 38 % du marché des dispositifs de gestion du rythme cardiaque d'ici 2035, grâce aux avancées technologiques et à la prévalence croissante de la bradycardie.

- Le segment hospitalier devrait connaître une croissance significative du marché des dispositifs de gestion du rythme cardiaque d'ici 2035, grâce à la présence d'établissements cardiaques de pointe et de spécialistes qualifiés.

Principales tendances de croissance :

- Sensibilisation croissante à la santé cardiovasculaire

- Adoption croissante des technologies portables et des applications mobiles de santé

Défis majeurs :

- Coût élevé de la maintenance

- Manque de professionnels qualifiés

Acteurs clés :Vitatron Holding B.V., Medtronic, Biotronik, Abbott, ABIOMED, Stryker Corporation, Amiitalia., © BPL Medical Technologies, OSYPKA MEDICAL, MicroPort Scientific Corporation.

Mondial Dispositifs de gestion du rythme cardiaque Marché Prévisions et perspectives régionales:

Taille du marché et projections de croissance :

- Taille du marché 2025 : 22,02 milliards USD

- Taille du marché 2026 : 23,23 milliards USD

- Taille du marché projetée : 39,81 milliards USD d'ici 2035

- Prévisions de croissance : TCAC de 6,1 % (2026-2035)

Dynamiques régionales clés :

- Plus grande région : Amérique du Nord (part de 36 % d’ici 2035)

- Région à la croissance la plus rapide : Asie-Pacifique

- Pays dominants : États-Unis, Allemagne, Japon, Chine, France

- Pays émergents : Chine, Inde, Japon, Corée du Sud, Thaïlande

Last updated on : 17 September, 2025

Moteurs de croissance et défis du marché des dispositifs de gestion du rythme cardiaque :

Moteurs de croissance

Sensibilisation croissante à la santé cardiovasculaire – La sensibilisation accrue du public à la santé cardiovasculaire, grâce à la couverture médiatique, aux programmes éducatifs et aux campagnes de santé, est un facteur majeur de croissance du marché mondial des dispositifs de gestion cardiaque. On commence à prendre conscience de l'importance de réaliser des examens cardiaques réguliers et d'intervenir précocement. Selon les données des CDC, entre 2008 et 2014, le taux ajusté d'adultes sachant qu'il faut appeler le 911 en cas de crise cardiaque est passé respectivement de 91,8 % à 93,4 % en 2014 et à 94,9 % en 2017.

Grâce à ces connaissances accrues, les patients et les professionnels de santé adoptent une approche proactive en matière de santé cardiaque et mettent en œuvre des dispositifs de gestion cardiaque de pointe. Le diagnostic précoce, le traitement et le développement du marché des dispositifs de gestion du rythme cardiaque en bénéficient tous.Adoption croissante des technologies portables et des applications mobiles de santé – La prolifération des technologies portables, telles que les montres connectées , les trackers d'activité et les applications mobiles de santé, offre de nouvelles possibilités de surveillance cardiaque continue et de gestion personnalisée de la santé. Les appareils portables équipés de capteurs intégrés peuvent suivre les signes vitaux, la variabilité de la fréquence cardiaque et les niveaux d'activité, fournissant ainsi des données précieuses pour évaluer la santé cardiovasculaire et détecter les premiers signes d'anomalies cardiaques.

Selon le National Heart, Lung and Blood Institute des États-Unis, un tiers des Américains utilisent des objets connectés pour suivre leur santé et leur activité physique. Plus de 80 % d'entre eux partageraient les données de leurs appareils avec leur médecin pour un suivi médical.Numérisation et intégration des données de santé – L'expansion du marché des dispositifs de gestion du rythme cardiaque offre des perspectives d'intégration de solutions de santé numériques. La télésurveillance, la télémédecine et l'analyse de données permettent une surveillance continue et des soins individualisés, améliorant ainsi l'efficacité de la gestion cardiaque.

La transition vers la santé numérique crée des opportunités de collaboration entre les entreprises technologiques et les fabricants d'appareils. Comme observé, les logiciels d'intégration de données sont utilisés par environ 45 % des services de santé dans le monde.

Défis

Coût élevé de la maintenance – Le coût élevé des dispositifs de gestion cardiaque avancés, incluant l'implantation initiale et la maintenance continue, constitue un défi majeur. L'accès à ces technologies vitales, notamment dans les régions où les budgets de santé sont sous pression, peut être limité par des problèmes d'accessibilité financière.

Manque de professionnels qualifiés – Il existe une pénurie de professionnels de santé et de médecins possédant l'expertise nécessaire pour manipuler les dispositifs de surveillance cardiaque, notamment les ECG, les nouveaux stimulateurs cardiaques et les défibrillateurs implantés chez les patients souffrant de troubles du rythme cardiaque ou d'insuffisance cardiaque congestive. Cette pénurie est répandue dans la plupart des pays et risque d'avoir un impact sur le marché des dispositifs de surveillance du rythme cardiaque.

Taille et prévisions du marché des dispositifs de gestion du rythme cardiaque :

| Attribut du rapport | Détails |

|---|---|

|

Année de base |

2025 |

|

Période de prévision |

2026-2035 |

|

TCAC |

6,1% |

|

Taille du marché de l'année de référence (2025) |

22,02 milliards USD |

|

Taille du marché prévue pour l'année (2035) |

39,81 milliards USD |

|

Portée régionale |

|

Segmentation du marché des dispositifs de gestion du rythme cardiaque :

Analyse des segments de types de produits

Le segment des stimulateurs cardiaques devrait dominer le marché des dispositifs de gestion du rythme cardiaque avec plus de 38 % de parts de marché d'ici 2035. Cette croissance est due à l'adoption généralisée de technologies. Les stimulateurs cardiaques sont une technologie reconnue et largement utilisée. En 2022, leur chiffre d'affaires s'élevait à environ 5 milliards de dollars américains. Ils traitent depuis longtemps diverses anomalies du rythme cardiaque et ont démontré leur efficacité pour améliorer les résultats des patients.

Les stimulateurs cardiaques assurent un rythme cardiaque régulier et adapté grâce à une surveillance fiable et continue des signaux électriques cardiaques. La bradycardie étant de plus en plus fréquente, le vieillissement de la population et l'amélioration constante de la technologie des stimulateurs cardiaques, la demande pour ces dispositifs est toujours forte. Plus d'un million de stimulateurs cardiaques sont installés chaque année dans le monde.

Analyse du segment d'utilisation finale

D'ici 2035, le secteur hospitalier devrait représenter la plus grande part de marché des dispositifs de gestion du rythme cardiaque . Les hôpitaux offrent une prise en charge cardiaque complète, incluant les soins postopératoires, le diagnostic et la thérapie. Ils assurent une prise en charge globale des patients grâce à des services et des spécialistes dédiés à la gestion du rythme cardiaque.

Cette catégorie dispose d'installations de pointe, telles que des unités de soins intensifs, des blocs opératoires et des laboratoires de cathétérisme cardiaque, tous équipés des outils nécessaires à la réalisation d'interventions et de chirurgies cardiaques complexes. Les hôpitaux attirent des cardiologues et des électrophysiologistes qualifiés, spécialisés dans le diagnostic et le traitement des anomalies du rythme cardiaque. Ces experts jouent un rôle essentiel dans le choix, l'implantation et le suivi des dispositifs de contrôle du rythme cardiaque.

Analyse des segments d'application

Le segment des arythmies devrait s'adjuger une part de marché majoritaire. Ce phénomène est principalement lié à la prévalence mondiale croissante des crises cardiaques et des taux d'arythmies récurrentes provoqués par des facteurs tels que la sédentarité. Par exemple, selon les Centres pour la prévention et le contrôle des maladies (CDC), 12,1 millions d'Américains devraient souffrir de fibrillation auriculaire (FA) d'ici 2030. De plus, la FA a été citée comme cause sous-jacente de décès dans 26 535 des 183 321 décès survenus en 2019, selon les certificats de décès.

Notre analyse approfondie du marché des dispositifs de gestion du rythme cardiaque comprend les segments suivants :

Type de produit |

|

Application |

|

Utilisation finale |

|

Vishnu Nair

Responsable du développement commercial mondialPersonnalisez ce rapport selon vos besoins — contactez notre consultant pour des informations et des options personnalisées.

Analyse régionale du marché des dispositifs de gestion du rythme cardiaque :

Aperçu du marché nord-américain

L'Amérique du Nord devrait dominer le marché des dispositifs de gestion du rythme cardiaque avec plus de 36 % de parts de marché d'ici 2035. La croissance du marché dans la région est également due à une infrastructure de santé bien développée. La disponibilité d'experts de santé hautement qualifiés et d'installations de diagnostic et de traitement de pointe a conduit à une adoption notable desdispositifs cardiovasculaires avancés dans la région. Les États-Unis sont le plus grand marché mondial pour les stimulateurs cardiaques, représentant environ 50 % du total des ventes. La domination de l'Amérique du Nord sur le marché est également attribuée à la présence d'acteurs importants et aux avancées technologiques continues.

Selon les statistiques des Centres pour la prévention et le contrôle des maladies (CDC), en 2020, les maladies cardiaques étaient la principale cause de décès aux États-Unis , avec environ 697 000 décès. De plus, elles représentent un lourd fardeau pour le pays, coûtant environ 229 milliards de dollars américains par an entre 2017 et 2018. Par conséquent, l'important fardeau des maladies, la prévalence élevée et le taux de mortalité devraient stimuler la croissance du marché dans la région.

L'incidence croissante des maladies cardiovasculaires, la fréquence élevée des facteurs de risque de MCV comme le diabète, l'hypertension et d'autres maladies, ainsi que le recours croissant aux interventions minimalement invasives sont les principaux facteurs qui stimulent l'expansion du marché au Canada . Les maladies cardiovasculaires sont les plus courantes au pays. Par exemple, selon les données publiées par la Fondation des maladies du cœur et de l'AVC du Canada en février 2022, 750 000 Canadiens souffrent d'insuffisance cardiaque, et 100 000 nouveaux cas de cette maladie mortelle sont signalés à l'organisation chaque année.

Selon la même source, un Canadien sur trois a souffert d'insuffisance cardiaque, soit directement, soit par l'intermédiaire d'un proche. La demande de diagnostics cardiovasculaires est donc accrue par la prévalence croissante des maladies cardiovasculaires au pays, ce qui devrait stimuler le marché des dispositifs de gestion du rythme cardiaque tout au long de la période de prévision.

Perspectives du marché APAC

La région Asie-Pacifique devrait enregistrer une croissance significative d'ici 2035 et occupera la deuxième position en raison de l'expansion rapide de la zone, attribuable à une augmentation des dépenses de santé, à des améliorations dans les établissements de santé et à une sensibilisation croissante aux maladies cardiovasculaires.

La région Asie-Pacifique, qui représentera plus de 20 % des dépenses mondiales de santé d'ici 2030, sera celle qui connaîtra la croissance la plus rapide en matière de dépenses de santé. Compte tenu de leur vaste population de patients, de la croissance de leur population âgée et de la hausse des taux de troubles du rythme cardiaque, des pays comme la Chine, l'Inde et le Japon connaissent une expansion considérable de leur marché.

Pour stimuler la fabrication nationale de dispositifs médicaux, le gouvernement chinois a lancé la loi sur les achats basés sur le volume (VBP) en 2020. Selon l'article de janvier 2022 « Les achats basés sur le volume bouleversent le marché des dispositifs médicaux de grande valeur en Chine », les fournitures médicales de grande valeur ont été soumises au VBP en Chine, à commencer par les stents coronaires.

Lutter contre la hausse des prix des fournitures médicales haut de gamme. Par conséquent, l'initiative du gouvernement chinois devrait offrir des opportunités au segment des stents, ce qui devrait stimuler l'expansion du marché des dispositifs de gestion du rythme cardiaque.

L'intensification des activités de recherche et développement, ainsi que le lancement de nouveaux dispositifs et les initiatives de diverses organisations, devraient stimuler la croissance du marché en Corée. Par exemple, en février 2021, l'hôpital universitaire national de Séoul a implanté un stimulateur cardiaque sans fil chez des patients souffrant d'arythmie en Corée, démontrant ainsi le potentiel de croissance du segment sur la période de prévision.

En mars 2022, Rampart IC a signé un accord de distribution exclusif avec Japan Lifeline (JLL), garantissant ainsi la distribution sur le marché japonais. Ce partenariat devrait accroître l'adoption des dispositifs cardiovasculaires au Japon et stimuler la croissance du marché des dispositifs de gestion du rythme cardiaque.

Acteurs du marché des dispositifs de gestion du rythme cardiaque :

- Vitatron Holding BV

- Présentation de l'entreprise

- Stratégie d'entreprise

- Offres de produits clés

- Performance financière

- Indicateurs clés de performance

- Analyse des risques

- Développement récent

- Présence régionale

- Analyse SWOT

- Medtronic

- Biotronik

- Abbott

- ABIOMED

- Société Stryker

- Amiitalie.

- © BPL Medical Technologies

- OSYPKA MEDICAL

- MicroPort Scientific Corporation

Le marché des dispositifs de gestion du rythme cardiaque est dominé par des acteurs clés du marché qui gagnent du terrain sur le marché en adoptant plusieurs stratégies, notamment les fusions et acquisitions.

Développements récents

- Le système d'ablation en champ pulsé (PFA) PulseSelect de Medtronic a été approuvé par la Food and Drug Administration (FDA) américaine pour le traitement de la fibrillation auriculaire (FA) paroxystique et persistante, selon une annonce de l'entreprise. Après l'obtention du marquage CE (Conformité Européenne) européen du système PulseSelect PFA en novembre, il s'agit de la première technologie PFA à être approuvée par la FDA.

- Abbott a annoncé que la Food and Drug Administration (FDA) américaine avait approuvé le moniteur cardiaque implantable AssertIQ™, offrant ainsi aux médecins une nouvelle option pour l'évaluation diagnostique et le suivi à long terme des patients présentant des arythmies cardiaques. Cette autorisation s'appuie sur la gamme de dispositifs médicaux connectés d'Abbott, qui permettent aux médecins de mieux prendre en charge et traiter leurs patients à distance.

- Report ID: 6044

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Découvrez un aperçu des principales tendances du marché et des insights

- Passez en revue des tableaux de données d’échantillon et des analyses par segment

- Découvrez la qualité de nos représentations visuelles de données

- Évaluez la structure de notre rapport et notre méthodologie de recherche

- Jetez un coup d’œil à l’analyse du paysage concurrentiel

- Comprenez comment les prévisions régionales sont présentées

- Évaluez la profondeur des profils d’entreprise et du benchmarking

- Visualisez comment des insights exploitables peuvent soutenir votre stratégie

Explorez des données et des analyses réelles

Questions fréquemment posées (FAQ)

Dispositifs de gestion du rythme cardiaque Portée du rapport de marché

L’échantillon gratuit comprend la taille actuelle et historique du marché, les tendances de croissance, des graphiques et tableaux régionaux, des profils d’entreprises, des prévisions par segment, et plus encore.

Contactez notre expert

Droits d’auteur © 2026 Research Nester. Tous droits réservés.