Marktausblick für Lebensmittelsäuerungsmittel:

Der Markt für Lebensmittelsäuerungsmittel hatte im Jahr 2025 ein Volumen von 5,7 Milliarden US-Dollar und wird bis 2035 voraussichtlich 8,85 Milliarden US-Dollar übersteigen. Im Prognosezeitraum von 2026 bis 2035 wird das Marktvolumen mit einer jährlichen Wachstumsrate von über 4,5 % wachsen. Im Jahr 2026 wird das Branchenvolumen für Lebensmittelsäuerungsmittel auf 5,93 Milliarden US-Dollar geschätzt.

Der Grund für dieses Wachstum liegt vermutlich in den steigenden Investitionen in Lebensmittelproduktion und -technologien, die durch die gestiegene Nachfrage nach Lebensmittelsäuerungsmitteln ausgelöst werden. Diese spielen eine wichtige Rolle bei der Erhaltung der Frische von Lebensmitteln und werden in Lebensmitteln und Getränken zur Verhinderung von Bakterienwachstum sowie in zahlreichen anderen Branchen eingesetzt, darunter in der Kosmetik-, Pharma- und Milchindustrie. Laut den National Institutes of Health trägt die Lebensmittelproduktion in Entwicklungsländern etwa 2,1 % zum BIP bei.

Schlüssel Lebensmittelsäuerungsmittel Markteinblicke Zusammenfassung:

Regionale Highlights:

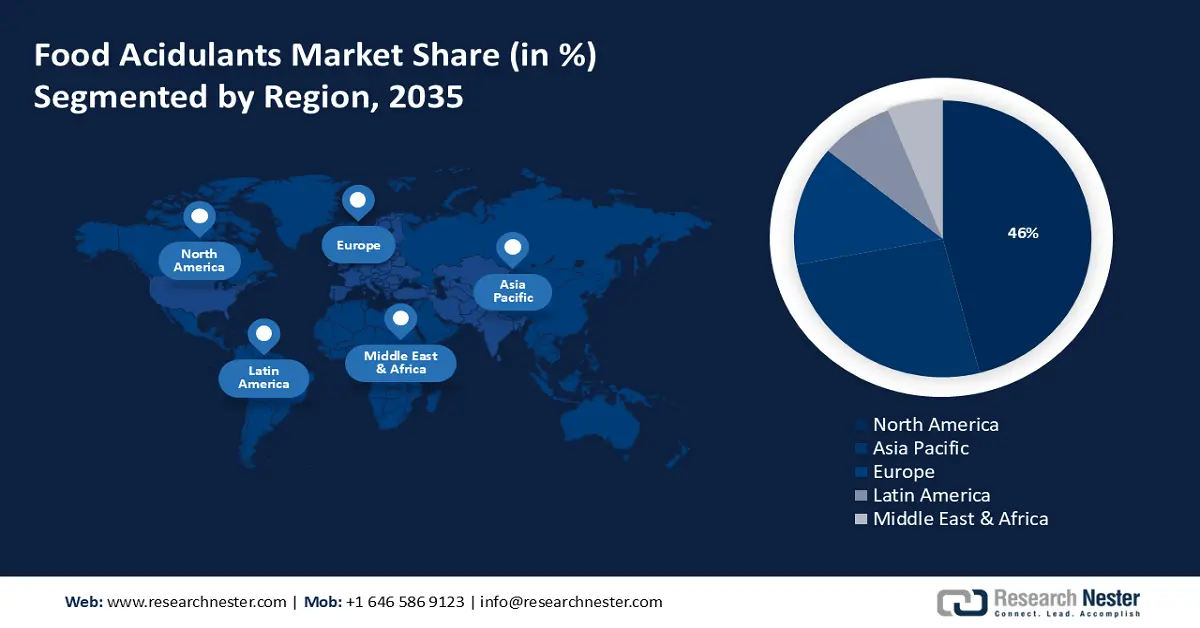

- Der nordamerikanische Markt für Lebensmittelsäuerungsmittel wird bis 2035 einen Marktanteil von über 46 % erreichen, angetrieben durch die steigende Nachfrage nach Fertiggerichten sowie verarbeitetem Obst und Gemüse.

Segmenteinblicke:

- Das Zitronensäuresegment im Markt für Lebensmittelsäuerungsmittel wird voraussichtlich bis 2035 einen Marktanteil von 26 % erreichen, angetrieben durch seine starken konservierenden und emulgierenden Eigenschaften.

Wichtige Wachstumstrends:

- Zunehmende Bedenken hinsichtlich der Gesundheit und Sicherheit von Lebensmitteln

- Technologische Fortschritte bei der Lebensmittelkonservierung

Große Herausforderungen:

- Zunehmende Besorgnis über die Umweltauswirkungen von Lebensmittelsäuerungsmitteln

Hauptakteure: Kemin Industries, Inc., Jungbunzlauer Suisse AG, Bartek Ingredients Inc., FBC Industries, Inc., Prinova Group LLC, Corbion NV, ADM WILD Europe GmbH & Co. KG, Fuerst Day Lawson Ltd., Batory Foods, Inc..

Global Lebensmittelsäuerungsmittel Markt Prognose und regionaler Ausblick:

Marktgröße und Wachstumsprognosen:

- Marktgröße 2025: 5,7 Milliarden USD

- Marktgröße 2026: 5,93 Milliarden USD

- Prognostizierte Marktgröße: 8,85 Milliarden USD bis 2035

- Wachstumsprognosen: 4,5 % CAGR (2026–2035)

Wichtige regionale Dynamiken:

- Größte Region: Nordamerika (46 % Anteil bis 2035)

- Am schnellsten wachsende Region: Asien-Pazifik

- Dominierende Länder: USA, China, Deutschland, Japan, Vereinigtes Königreich

- Schwellenländer: China, Indien, Japan, Südkorea, Thailand

Last updated on : 17 September, 2025

Wachstumstreiber und Herausforderungen auf dem Markt für Lebensmittelsäuerungsmittel:

Wachstumstreiber

- Wachsende Bedenken hinsichtlich der Lebensmittelgesundheit und -sicherheit – Das Bewusstsein der Verbraucher für die Sicherheit und Hygiene ihrer Lebensmittel wächst. In den letzten Jahren kam es zu zahlreichen Fällen von Lebensmittelkontamination und Lebensmittelvergiftung, die hauptsächlich auf unhygienische und unsichere Verarbeitungs- und Lagerungsbedingungen zurückzuführen sind. Dies führt zu einer wachsenden Besorgnis der Verbraucher hinsichtlich der Sicherheit und Sauberkeit ihrer Lebensmittel. Einem Bericht zufolge stieg der Anteil lebensmittelbedingter Erkrankungen von 2 % im Jahr 1990 auf 16 % im Jahr 2007.

- Risiko einer Lebensmittelkontamination – Schätzungen der Centers for Disease Control and Prevention (CDC) zufolge kommt es in den USA jährlich zu etwa 76 Millionen lebensmittelbedingten Erkrankungen, 325.000 Krankenhausaufenthalten und etwa 5.000 Todesfällen. Daher hat diese Nachfrage die Nachfrage nach Lebensmittelsäuerungsmitteln vorweggenommen, da sie das Risiko einer Lebensmittelkontamination wirksam verringern und die Sicherheit erhöhen können.

- Steigende Nachfrage nach natürlichen und biologischen Lebensmitteln – Darüber hinaus gelten biologische und natürliche Lebensmittel als gesündere und sicherere Alternativen zu verarbeitetem Obst und Gemüse . Diese steigende Nachfrage hat zu einer erhöhten Nachfrage nach natürlichen Konservierungstechniken wie Lebensmittelsäuerungsmitteln geführt. Diese natürlichen Techniken zur Konservierung von Gemüse und Obst gelten als sicherer und gesünder als künstliche, was die Nachfrage der Lebensmittelsäuerungsmittelindustrie zusätzlich vorangetrieben hat. Laut USDA ERS verkauften die US-amerikanischen Ranches und Farmen im Jahr 2021 Bioprodukte im Wert von rund 11 Milliarden US-Dollar.

- Technologische Fortschritte bei der Lebensmittelkonservierung – Da Verbraucher großen Wert auf Frische und Qualität ihrer Lebensmittel legen, investieren Lebensmittelhersteller ebenfalls in technologische Fortschritte, die ihnen helfen, Lebensmittel länger haltbar zu machen, ohne Geschmack und Konsistenz zu beeinträchtigen. Diese technologischen Fortschritte waren entscheidend für die Entwicklung neuer und verbesserter Lebensmittelsäuerungsmittel, die Lebensmittel länger haltbar machen, ohne Geschmack oder Qualität zu beeinträchtigen. Diese Fortschritte haben der Branche zu Erfolgen verholfen und Herstellern die Entwicklung effektiverer Lösungen ermöglicht.

- Ständiger Wandel des Lebensstils – Der Lebensmittelsektor verzeichnete in den letzten Jahren ein deutliches Wachstum. Dies ist auf veränderte Lebensstile, steigende verfügbare Einkommen und die zunehmende Nutzung verarbeiteter Lebensmittel und Getränke zurückzuführen, was die Nachfrage nach Säuerungsmitteln in Lebensmitteln erhöht hat. Einem Bericht zufolge ist der Anteil der Agrarexporte an den Lebensmittelexporten von 13,7 % im Jahr 2014/15 auf 25,6 % im Jahr 2022/23 gestiegen.

Herausforderungen

- Zunehmende Besorgnis über die Umweltauswirkungen von Lebensmittelsäuerungsmitteln – Lebensmittelsäuerungsmittel werden hauptsächlich aus Säuren gewonnen und produzieren bei ihrer Herstellung und Entsorgung CO2-Gas als Nebenprodukt. Bei unsachgemäßer Handhabung oder Entsorgung können viele Säuren in die Umwelt gelangen und Gewässer, Böden und verschiedene andere natürliche Quellen verunreinigen. Dies hat zu Bedenken hinsichtlich der zunehmenden Verwendung von Lebensmittelsäuerungsmitteln geführt und ein weiteres Wachstum der Landschaft verhindert.

Darüber hinaus haben das zunehmende Umweltbewusstsein und die zunehmenden Umweltvorschriften dazu geführt, dass Lebensmittelhersteller bei der Verpackung ihrer Produkte und Dienstleistungen mehr Wert auf die Verpackung legen und Maßnahmen zur Verringerung ihrer Umweltbelastung ergreifen. - Regelmäßige Wirksamkeitsprüfungen für Lebensmittelsäuerungsmittel. Aufgrund der zunehmenden Konkurrenz durch alternative Konservierungstechniken wie Sterilisation und andere natürliche Konservierungstechniken sind die Kosten für Arbeitskräfte und Rohstoffe, die zur Herstellung von Lebensmittelsäuerungsmitteln benötigt werden, gestiegen, was diese weniger kosteneffizient macht und das Wachstum behindert.

Marktgröße und Prognose für Lebensmittelsäuerungsmittel:

| Berichtsattribut | Einzelheiten |

|---|---|

|

Basisjahr |

2025 |

|

Prognosezeitraum |

2026–2035 |

|

CAGR |

4,5 % |

|

Marktgröße im Basisjahr (2025) |

5,7 Milliarden US-Dollar |

|

Prognostizierte Marktgröße im Jahr 2035 |

8,85 Milliarden US-Dollar |

|

Regionaler Geltungsbereich |

|

Marktsegmentierung für Lebensmittelsäuerungsmittel:

Typsegmentanalyse

Es wird erwartet, dass der Marktanteil von Zitronensäure im Lebensmittelsäuerungsmittelsegment bis Ende 2035 mehr als 26 % betragen wird. Das Wachstum dieses Segments ist auf die hohen konservierenden und emulgierenden Eigenschaften zurückzuführen, da Zitronensäure aus Zitrusfrüchten gewonnen und hauptsächlich in verschiedenen Lebensmitteln und Getränken verwendet wird. Zitronensäure ist ein starkes Konservierungsmittel, das das Risiko von Bakterienwachstum wirksam reduzieren und Lebensmittelverderb verhindern kann.

Darüber hinaus ist es äußerst wirksam bei der Erhaltung von Farbe, Textur und Geschmack von Lebensmitteln. Darüber hinaus wird es häufig in Kombination mit anderen Konservierungsmitteln wie Sorbinsäure oder Natriumbenzoat verwendet, um eine bessere Konservierungswirkung zu erzielen. Einem Bericht zufolge wird ein Drittel aller weltweit produzierten Lebensmittel verschwendet oder geht verloren, was einem Wert von über 35 Milliarden US-Dollar pro Jahr entspricht.

Darüber hinaus gilt Zitronensäure als sicherere Alternative zu verschiedenen anderen Konservierungsmitteln wie Natriumbenzoat, Kaliumsorbat, Kaliumdichromat und vielen anderen. Sie gilt auch als eine der sichereren Alternativen, da sie nicht hochgiftig ist und keine giftigen Rückstände im Endprodukt hinterlässt. Dies hat Zitronensäure zu einem attraktiveren Konservierungsmittel für Lebensmittelhersteller gemacht und ist auch ein wichtiger Wachstumstreiber für den Marktwert von Lebensmittelsäuerungsmitteln.

Anwendungssegmentanalyse

Das Getränkesegment im Markt für Lebensmittelsäuerungsmittel dürfte in Kürze einen beachtlichen Marktanteil gewinnen und aufgrund seiner hohen Verwendung in einer Vielzahl von Getränken wie Fruchtsäften, Tees, Limonaden, Bier und vielen mehr voraussichtlich das zweitgrößte Anwendungssegment für Lebensmittelsäuerungsmittel bleiben. In diesen Getränken werden Lebensmittelsäuerungsmittel auch eingesetzt, um das Bakterienwachstum zu hemmen und vor allem die Haltbarkeit des Produkts zu verlängern. Laut einer Studie von WRAP kann eine Verlängerung der Haltbarkeit um einen Tag etwa 0,2 Millionen Tonnen Lebensmittelabfälle in Haushalten reduzieren.

Da die Verbraucher zunehmend gesundheitsbewusster werden, steigt der Konsum von natürlichen und biologischen Getränken wie Fruchtsäften, Tee und Limonaden. Auch bei der Bierherstellung werden Säuerungsmittel eingesetzt, da sie Bakterienwachstum und Verderb wirksam verhindern können.

Unsere eingehende Analyse des Marktes für Lebensmittelsäuerungsmittel umfasst die folgenden Segmente:

Typ |

|

Anwendung |

|

Bilden |

|

Funktion |

|

Vishnu Nair

Leiter - Globale GeschäftsentwicklungPassen Sie diesen Bericht an Ihre Anforderungen an – sprechen Sie mit unserem Berater für individuelle Einblicke und Optionen.

Regionale Marktanalyse für Lebensmittelsäuerungsmittel:

Einblicke in den nordamerikanischen Markt

Schätzungen zufolge wird die nordamerikanische Industrie bis 2035 mit 46 % den größten Umsatzanteil erzielen. Das Marktwachstum in der Region wird aufgrund der steigenden Nachfrage nach Fertiggerichten sowie verarbeitetem Obst und Gemüse für unterwegs erwartet. Während diese Branche auf eine längere Haltbarkeit setzt, stellt sie die Unternehmen gleichzeitig vor die Herausforderung, Geschmack und Aromen zu erhalten. Neben Lebensmitteln werden in diesem Sektor auch Getränke verwendet.

Laut USDA Foreign Agricultural Services wird die Nachfrage nach verarbeiteten Lebensmitteln voraussichtlich um 11 % steigen und auch die Exportchancen erhöhen. Dieser enorme Anstieg deutet darauf hin, dass sich die Branche weiterentwickelt, um natürliche Zutaten bereitzustellen, die die benötigten Nährstoffe mit dem gewünschten Geschmack vereinen. Diese Nachfrage wird voraussichtlich die Nachfrage nach Lebensmittelsäuerungsmitteln in der Region beeinflussen.

Die steigende Nachfrage nach Convenience Food und Fertiggerichten treibt die Nachfrage nach Säuerungsmitteln in den USA an. Laut USDA werden in Haushalten, in denen alle Erwachsenen berufstätig sind, etwa 12 % weniger Fertiggerichte gekauft, und in Full-Service-Restaurants werden mehr als 70 % der Lebensmittel weniger gekauft.

In Kanada steigt die Nachfrage gesundheitsbewusster Kunden nach kalorienarmen und biologischen Produkten. Einem Bericht zufolge sind über 45 % der Kanadier bestrebt, neue Wege zur Verbesserung ihrer Gesundheit zu finden.

Einblicke in den APAC-Markt

Bis 2035 wird der Markt für Lebensmittelsäuerungsmittel im asiatisch-pazifischen Raum voraussichtlich einen Umsatzanteil von über 24 % erreichen und aufgrund der zunehmenden Übernahme westlicher Ernährungsgewohnheiten und der damit einhergehenden Nachfrage nach verarbeiteten und verpackten Lebensmitteln und Getränken den zweiten Platz einnehmen. Dies trägt im Zuge der Urbanisierung zu Fertiggerichten bei: ihre Textur, ihr Geschmack, ihr Aroma und ihre Nährstoffe für eine gesunde Ernährung. Einem Bericht zufolge soll der Umsatzanteil von Fertiggerichten bis 2028 eine durchschnittliche jährliche Wachstumsrate von etwa 6,8 % verzeichnen.

Darüber hinaus besteht für die Länder auch die Notwendigkeit, den Bedarf der Bevölkerung zu decken. Heutzutage werden bestimmte organische und natürliche Zutaten verwendet, die den Markt für Lebensmittelsäuerungsmittel ankurbeln und zu einem Wachstum von Angebot und Nachfrage beitragen.

Laut OEC World exportierte China Zitronensäure im Wert von über 2,18 Milliarden US-Dollar und war damit im Jahr 2022 der weltweit größte Exporteur.

Marktteilnehmer für Lebensmittelsäuerungsmittel:

- JMD Food Group

- Unternehmensübersicht

- Geschäftsstrategie

- Wichtige Produktangebote

- Finanzielle Leistung

- Wichtige Leistungsindikatoren

- Risikoanalyse

- Jüngste Entwicklung

- Regionale Präsenz

- SWOT-Analyse

- Kemin Industries, Inc.

- Jungbunzlauer Suisse AG

- Bartek Ingredients Inc.

- FBC Industries, Inc.

- Prinova Group LLC

- Corbion NV

- ADM WILD Europe GmbH & Co. KG

- Fürst Day Lawson Ltd.

- Batory Foods, Inc.

Die meisten dieser Unternehmen arbeiten kontinuierlich zusammen, expandieren, schließen Vereinbarungen und gehen gemeinsame Unternehmungen ein, um ihren Umsatzanteil zu steigern. Sie gelten als die wichtigsten Akteure in diesem Bereich.

Neueste Entwicklungen

- JDM Food Group – gab seine Zusammenarbeit mit dem US-amerikanischen Unternehmen Henry Broch Foods (HBF) zur Gründung einer neuen Muttergesellschaft, Jardin and Broch, bekannt.

- Kemin Industries, Inc. – gab seine Expansion in Mittelamerika und Mexiko durch die Eröffnung mehrerer neuer Vertriebszentren und Büros in Mexiko mit Sitz in Jalisco und Guadalajara bekannt.

- Report ID: 6086

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Entdecken Sie eine Vorschau auf die wichtigsten Markttrends und Erkenntnisse

- Prüfen Sie Beispiel-Datentabellen und Segmentaufgliederungen

- Erleben Sie die Qualität unserer visuellen Datendarstellungen

- Bewerten Sie unsere Berichtsstruktur und Forschungsmethodik

- Werfen Sie einen Blick auf die Analyse der Wettbewerbslandschaft

- Verstehen Sie, wie regionale Prognosen dargestellt werden

- Beurteilen Sie die Tiefe der Unternehmensprofile und Benchmarking

- Sehen Sie voraus, wie umsetzbare Erkenntnisse Ihre Strategie unterstützen können

Entdecken Sie reale Daten und Analysen

Häufig gestellte Fragen (FAQ)

Lebensmittelsäuerungsmittel Umfang des Marktberichts

Die kostenlose Stichprobe umfasst aktuelle und historische Marktgrößen, Wachstumstrends, regionale Diagramme und Tabellen, Unternehmensprofile, segmentweise Prognosen und mehr.

Kontaktieren Sie unseren Experten

Urheberrecht © 2026 Research Nester. Alle Rechte vorbehalten.