Marktausblick für Dioctyladipat:

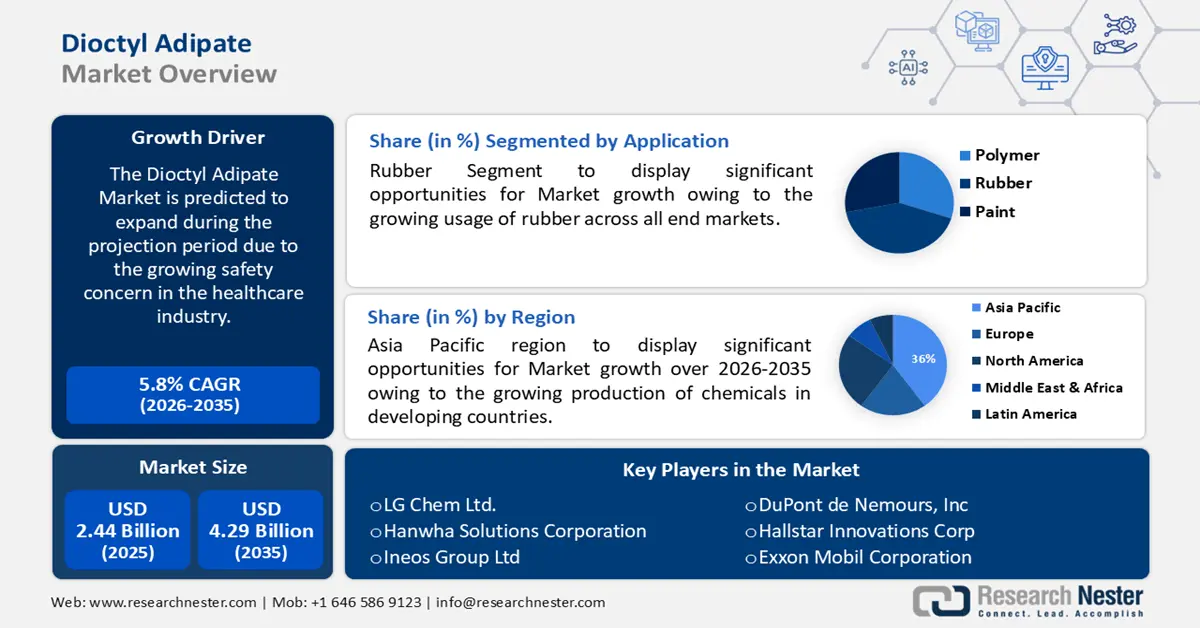

Der Markt für Dioctyladipat wurde 2025 auf 2,44 Milliarden US-Dollar geschätzt und wird voraussichtlich bis 2035 auf über 4,29 Milliarden US-Dollar anwachsen, was einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von über 5,8 % im Prognosezeitraum 2026–2035 entspricht. Für das Jahr 2026 wird der Markt für Dioctyladipat auf 2,57 Milliarden US-Dollar geschätzt.

Das Marktwachstum ist auf die zunehmenden Sicherheitsbedenken im Gesundheitswesen zurückzuführen. Krankenhäuser bergen aufgrund des hohen Infektionsrisikos und möglicher Behandlungsfehler zahlreiche versteckte Gefahren. Um die Fertigungsqualität medizinischer Geräte und Instrumente zu verbessern, wird Dioctyladipat (DOA) als bevorzugter Rohstoff im Gesundheitswesen eingesetzt. Als biologisch abbaubare Substanz findet es Verwendung in medizinischen Handschuhen, Schläuchen, Blutbeuteln und anderen Produkten. Da DOA zudem ein geeignetes Material für die Herstellung verschiedener medizinischer Schläuche ist, die in den Körper von Patienten eingeführt werden, gewinnt es zunehmend an Bedeutung. Laut Weltgesundheitsorganisation (WHO) erleiden weltweit bis zu vier von zehn Patienten Verletzungen bei der ambulanten und stationären Behandlung.

Neben diesen Faktoren wird angenommen, dass die steigende Nachfrage nach Körperpflegeprodukten das Marktwachstum von Dioctyladipat ankurbelt. Beispielsweise hat das wachsende Bewusstsein der Verbraucher für Körperhygiene und Hautgesundheit zu einer erhöhten Nachfrage nach Körperpflegeprodukten geführt. Darüber hinaus ist Dioctyladipat in einer Reihe von Körperpflegeprodukten enthalten, darunter Sonnenschutzmittel, Bodylotion und Haarspülung, was voraussichtlich ein Marktwachstumspotenzial im Prognosezeitraum birgt.

Schlüssel Dioctyladipat Markteinblicke Zusammenfassung:

Regionale Highlights:

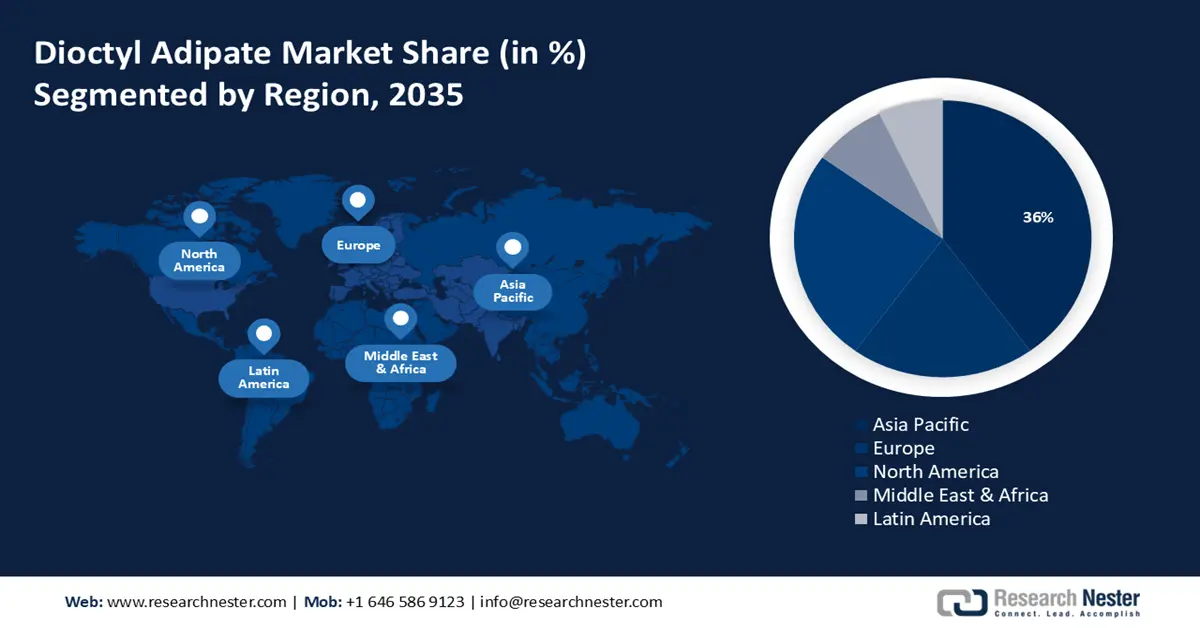

- Der asiatisch-pazifische Raum wird voraussichtlich bis 2035 einen Marktanteil von 36 % am Dioctyladipatmarkt erreichen, angetrieben durch die zunehmende chemische Produktion in den Entwicklungsländern.

- Es wird erwartet, dass Europa bis 2035 einen bedeutenden Marktanteil erreichen wird, da Dioctyladipat in regionalen Anstrichmitteln zunehmend eingesetzt wird.

Segmenteinblicke:

- Es wird erwartet, dass das Segment Kautschuk bis 2035 den größten Anteil am Dioctyladipat-Markt halten wird, was auf die breite Verwendung in verschiedenen Form- und Industriekautschukanwendungen zurückzuführen ist.

- Das Segment der Konsumgüter wird bis 2035 einen bedeutenden Anteil erreichen, was auf steigende globale verfügbare Einkommen zurückzuführen ist, die die Nachfrage nach Haushalts- und Lifestyle-Produkten auf DOA-Basis erhöhen.

Wichtigste Wachstumstrends:

- Wachsende Lebensmittelverpackungsindustrie

- Steigende Nachfrage nach Elektrogeräten

Größte Herausforderungen:

- Verringerter Plastikverbrauch infolge eines gestiegenen Umweltbewusstseins

- Unfähigkeit, Hydrolysereaktionen zu widerstehen

Wichtige Akteure: Exxon Mobil Corporation, Hallstar Innovations Corp., DuPont de Nemours, Inc., Ineos Group Ltd., Chongqing Caifchem Co., Ltd., Hanwha Solutions Corporation, LG Chem Ltd., S&P Global Inc., Daihachi Chemical Industry Co., Ltd., Mitsubishi Chemical Holdings Corporation.

Global Dioctyladipat Markt Prognose und regionaler Ausblick:

Marktgröße und Wachstumsprognosen:

- Marktgröße 2025: 2,44 Milliarden US-Dollar

- Marktgröße 2026: 2,57 Milliarden US-Dollar

- Prognostizierte Marktgröße: 4,29 Milliarden US-Dollar bis 2035

- Wachstumsprognosen: 5,8 %

Wichtigste regionale Dynamiken:

- Größte Region: Asien-Pazifik (36 % Anteil bis 2035)

- Region mit dem schnellsten Wachstum: Nordamerika

- Dominierende Länder: USA, China, Deutschland, Japan, Südkorea

- Schwellenländer: Indien, Vietnam, Indonesien, Mexiko, Brasilien

Last updated on : 21 November, 2025

Dioctyladipat-Markt – Wachstumstreiber und Herausforderungen

Wachstumstreiber

- Wachsende Lebensmittelverpackungsindustrie – Aufgrund der weltweit steigenden Erwerbsbevölkerung wird ein weiteres Marktwachstum in den kommenden Jahren erwartet. Dioctyladipat wird unter anderem bei der Herstellung flexibler PVC-Folien für Lebensmittelverpackungen eingesetzt, was das Marktwachstum im Prognosezeitraum zusätzlich ankurbeln wird. Statistiken zufolge treten in Indien jährlich über 10 Millionen Menschen in den Arbeitsmarkt ein.

- Steigende Nachfrage nach Elektrogeräten – Die weltweit wachsende Zahl von Haushalten dürfte das Marktwachstum ankurbeln. Schätzungen zufolge entfallen über 10 % des weltweiten Endstromverbrauchs auf Haushaltsgeräte.

- Zunehmender Einsatz von Weichmachern – Dioctyladipat eignet sich aufgrund seines großen Molekülraums, seines hohen Siedepunkts und seines niedrigen Dampfdrucks hervorragend als Weichmacher. Es ist ein Premium-Weichmacher, der sich durch außergewöhnliche mechanische Festigkeit bei hohen Temperaturen und moderate Flüchtigkeit auszeichnet. In den nächsten Jahren wird der weltweite Verbrauch von Weichmachern jährlich um mehr als 3 % steigen.

- Steigende Nachfrage nach Kautschuk – Die wachsende Nachfrage nach Kautschuk in der Automobilindustrie und für Latexprodukte dürfte das Marktwachstum ankurbeln. Dioctyladipat (DOA) ist eine chemische Verbindung zur Herstellung von synthetischem Kautschuk und wird auch als wichtiger Bestandteil in vielen Anwendungen eingesetzt, darunter Reifen, Schuhsohlen und Schläuche. Darüber hinaus findet Kautschuk häufig Verwendung in flexiblen Materialien wie Platten, Drähten und Kabeln, was den Bedarf an DOA im Kautschuksektor erhöht. Im Jahr 2022 verbrauchte Indien über 0,7 Millionen Tonnen synthetischen Kautschuk.

Herausforderungen

- Verringerter Kunststoffverbrauch aufgrund gestiegenen Umweltbewusstseins – Das zunehmende Bewusstsein der Verbraucher für die Umweltauswirkungen des Kunststoffkonsums ist einer der Hauptfaktoren, der das Marktwachstum voraussichtlich verlangsamen wird. Beispielsweise werden zahlreiche Kunststoffe und Beschichtungsmaterialien aus Dioctyladipat hergestellt, was zu Umweltbelastungen führen kann.

- Unfähigkeit, Hydrolysereaktionen zu widerstehen

- Alternative Materialien stellen eine ernsthafte Bedrohung dar

Marktgröße und Prognose für Dioctyladipat:

| Berichtsattribut | Einzelheiten |

|---|---|

|

Basisjahr |

2025 |

|

Prognosejahr |

2026–2035 |

|

CAGR |

5,8 % |

|

Marktgröße im Basisjahr (2025) |

2,44 Milliarden US-Dollar |

|

Prognostizierte Marktgröße (2035) |

4,29 Milliarden US-Dollar |

|

Regionaler Geltungsbereich |

|

Marktsegmentierung für Dioctyladipat:

Anwendungssegmentanalyse

Der globale Markt für Dioctyladipat wird nach Anwendungsgebieten in Polymere, Gummi, Farben und Sonstiges segmentiert und hinsichtlich Angebot und Nachfrage analysiert. Von diesen vier Segmenten wird erwartet, dass das Gummisegment im Prognosezeitraum den größten Marktanteil erzielen wird. Das Wachstum dieses Segments ist auf den steigenden Einsatz von Gummi in allen Endmärkten zurückzuführen. Gummi lässt sich beispielsweise leicht in verschiedene Formen und Größen bringen. Darüber hinaus wird Gummi in Rohrleitungen, Gartengeräten usw. verwendet. Er findet auch in einer Vielzahl von Produkten Verwendung, darunter Schläuche, Reifen, Spielzeug, Kleidung, Auto- und Flugzeugreifen, medizinische Geräte, OP-Handschuhe und Industrieprodukte. Dioctyladipat ist zudem ein wichtiger Bestandteil von Weichmachern in der Gummiindustrie. Es verleiht Produkten eine bemerkenswerte Geschmeidigkeit bei niedrigen Temperaturen. Außerdem wird es als Additiv im Herstellungsprozess von Gummi eingesetzt. Bis 2023 wird der weltweite Verbrauch von Naturkautschuk voraussichtlich über 15 Millionen Tonnen erreichen.

Endnutzersegmentanalyse

Der globale Markt für Dioctyladipat wird nach Endverbrauchern in die Segmente Verpackung, Kabel und Leitungen, Konsumgüter, Medizinprodukte, Wand- und Bodenbeläge sowie Sonstige unterteilt und hinsichtlich Angebot und Nachfrage analysiert. Von diesen sechs Segmenten wird dem Konsumgütersegment ein signifikanter Marktanteil zugeschrieben. Dieses Wachstum ist auf das weltweit steigende verfügbare Einkommen der Verbraucher zurückzuführen. In Konsumgütern wird Dioctyladipat als nicht brennbares Lösungsmittel eingesetzt und findet sich in einer Vielzahl von Fertigprodukten wie Schläuchen, Bodenbelägen, Farben, Lacken, wasserdichten Membranen und PVC-Sohlen für Schuhe und Hausschuhe. Darüber hinaus ist Dioctyladipat ein wichtiger Bestandteil von PVC-Außenrohren, Kunstpapier, Fußmatten und Kunstleder .

Unsere detaillierte Analyse des globalen Marktes umfasst die folgenden Segmente:

Nach Reinheitstyp |

|

Durch Bewerbung |

|

Vom Endbenutzer |

|

Vishnu Nair

Leiter - Globale GeschäftsentwicklungPassen Sie diesen Bericht an Ihre Anforderungen an – sprechen Sie mit unserem Berater für individuelle Einblicke und Optionen.

Dioctyladipat-Markt – Regionale Analyse

Einblicke in den APAC-Markt

Die Industrie im asiatisch-pazifischen Raum wird bis 2035 voraussichtlich einen Umsatzanteil von 36 % erreichen. Dieses Marktwachstum ist maßgeblich auf die steigende Chemieproduktion in Entwicklungsländern wie China und Indien zurückzuführen. China ist seit jeher der größte Chemieproduzent der Welt und führt diese Position weiterhin an. Niedrige Arbeitskosten, schnelle Investitionen, günstige Regierungsbedingungen und der einfache Zugang zu Rohstoffen haben China zum weltweit führenden Akteur in der chemischen Industrie gemacht. Darüber hinaus ist China der weltweit größte Exporteur, Produzent und Konsument von Dioctyladipat. Der Großteil des Exports geht in die USA, nach Bangladesch und Indonesien. Schätzungen zufolge stieg Chinas Marktanteil am weltweiten Chemieabsatz im Jahr 2018 um mehr als 30 %.

Einblicke in den nordamerikanischen Markt

Der nordamerikanische Markt für Dioctyladipat wird im Prognosezeitraum voraussichtlich das höchste jährliche Wachstum (CAGR) aller Regionen verzeichnen. Dieses Wachstum ist vor allem auf die steigende Nachfrage der Elektronikindustrie zurückzuführen. Aufgrund der extrem niedrigen Temperaturen in der Region wird Dioctyladipat dort als Isoliermaterial für Kabel und Leitungen eingesetzt. Darüber hinaus dürfte der expandierende Gesundheitssektor der Region das Marktwachstum im Prognosezeitraum zusätzlich ankurbeln.

Einblicke in den europäischen Markt

Darüber hinaus wird erwartet, dass der europäische Markt bis Ende 2035 den größten Marktanteil im Vergleich zu allen anderen Regionen halten wird. Das Marktwachstum ist vor allem auf die steigende Nachfrage nach Farben in der Region zurückzuführen. Beispielsweise steigt die Nachfrage nach Architekturfarben in Westeuropa aufgrund des großen Interesses der Verbraucher an Inneneinrichtung. Dioctyladipat (DOA) dient in Farben als Lösungsmittel, Dispersionsmittel und Verdickungsmittel. Zudem hat sich gezeigt, dass Dioctyladipat verschiedene organische Lösungsmittel in Farben erfolgreich ersetzen kann. Auch der expandierende Gesundheitssektor der Region und die steigende Nachfrage nach Kosmetika dürften das Marktwachstum im Prognosezeitraum weiter ankurbeln.

Marktteilnehmer im Bereich Dioctyladipat:

- Exxon Mobil Corporation

- Unternehmensübersicht

- Geschäftsstrategie

- Wichtigste Produktangebote

- Finanzielle Leistung

- Wichtigste Leistungsindikatoren

- Risikoanalyse

- Aktuelle Entwicklung

- Regionale Präsenz

- SWOT-Analyse

- Hallstar Innovations Corp.

- DuPont de Nemours, Inc.

- Ineos Group Ltd.

- Chongqing Caifchem Co., Ltd.

- Hanwha Solutions Corporation

- LG Chem Ltd.

- S&P Global Inc.

- Daihachi Chemical Industry Co., Ltd.

- Mitsubishi Chemical Holdings Corporation

Neueste Entwicklungen

Die Mitsubishi Chemical Holdings Corporation nahm Beiträge für die KAITEKI Challenge entgegen, die den nachhaltigen Konsum im Alltag, die Forschung nach innovativen Technologien für alternative Proteine, das Recycling von Kunststoffabfällen und die Vermeidung von Lebensmittelverlusten und -verschwendung fördern soll.

Die Exxon Mobil Corporation hat ihre Produktionskapazitäten für Rohstoffe, die in medizinischen Masken und Schutzkitteln verwendet werden, erhöht, um diesem dringenden Bedarf gerecht zu werden und die Gesundheit und Sicherheit von medizinischem Fachpersonal, Krankenschwestern und Ersthelfern zu unterstützen.

- Report ID: 4081

- Published Date: Nov 21, 2025

- Report Format: PDF, PPT

- Entdecken Sie eine Vorschau auf die wichtigsten Markttrends und Erkenntnisse

- Prüfen Sie Beispiel-Datentabellen und Segmentaufgliederungen

- Erleben Sie die Qualität unserer visuellen Datendarstellungen

- Bewerten Sie unsere Berichtsstruktur und Forschungsmethodik

- Werfen Sie einen Blick auf die Analyse der Wettbewerbslandschaft

- Verstehen Sie, wie regionale Prognosen dargestellt werden

- Beurteilen Sie die Tiefe der Unternehmensprofile und Benchmarking

- Sehen Sie voraus, wie umsetzbare Erkenntnisse Ihre Strategie unterstützen können

Entdecken Sie reale Daten und Analysen

Häufig gestellte Fragen (FAQ)

Dioctyladipat Umfang des Marktberichts

Die kostenlose Stichprobe umfasst aktuelle und historische Marktgrößen, Wachstumstrends, regionale Diagramme und Tabellen, Unternehmensprofile, segmentweise Prognosen und mehr.

Kontaktieren Sie unseren Experten

Urheberrecht © 2026 Research Nester. Alle Rechte vorbehalten.