汽车塑料市场展望:

2025年汽车塑料市场规模为315.8亿美元,预计到2035年将达到549.7亿美元,在预测期内(即2026年至2035年)的复合年增长率约为5.7%。2026年,汽车塑料的行业规模估计为332亿美元。

预测期内推动市场增长的主要因素是汽车行业的快速扩张。最近的计算表明,到2030年,全球汽车行业的收入预计将达到近9万亿美元。

汽车制造商高度重视改进设计以减轻车辆重量。塑料易于生产,且可采用可再生材料,易于处理以改进设计。因此,汽车塑料在汽车行业中比其他材料更受青睐。汽车行业的快速增长也推动了该行业的就业率大幅上升。2018财年,印度汽车行业就业人数约为200万人。

关键 汽车塑料 市场洞察摘要:

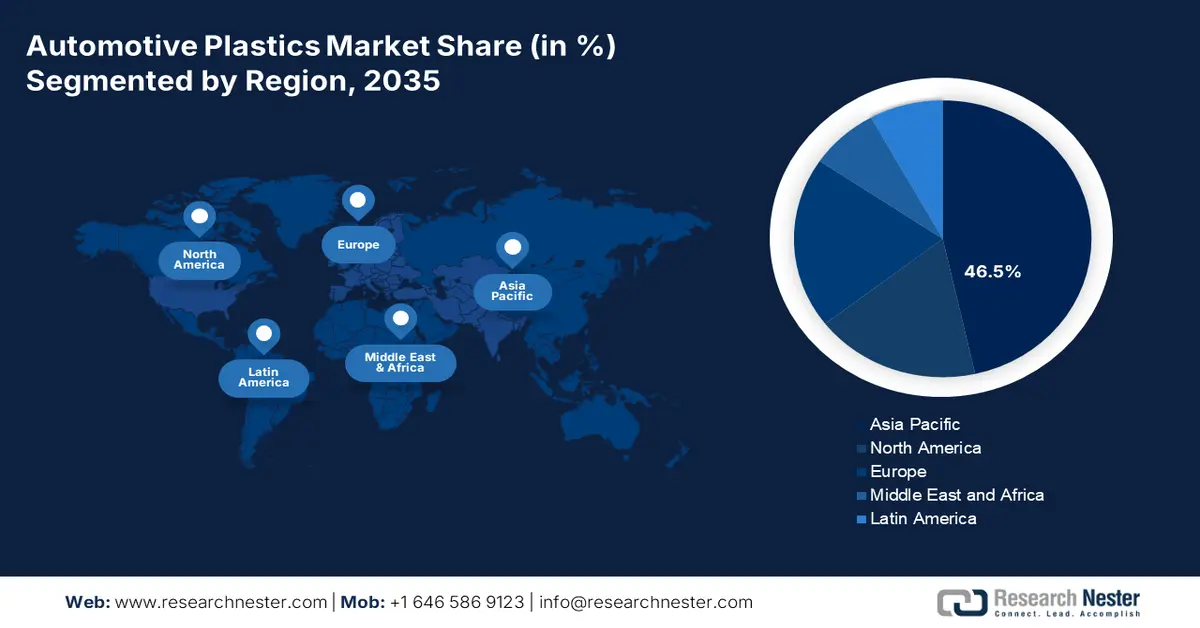

区域亮点:

- 预计到 2035 年,亚太地区汽车塑料市场将占据 46.5% 的市场份额,这得益于该地区人口增长、收入水平提高以及汽车产销量的强劲增长。

细分市场洞察:

- 预计到 2035 年,受全球乘用车需求增长的推动,传统汽车细分市场将在汽车塑料市场中占据最高市场份额。

主要增长趋势:

- 中等收入人口不断增加

- 汽车产量不断增加

主要挑战:

- 资本和基础设施成本高昂

- 对塑料可回收性的担忧日益加剧

主要参与者:阿科玛、巴斯夫、沙特基础工业公司、利安德巴塞尔工业公司、LG化学、杜邦公司、科思创股份公司、赢创工业股份公司、索尔维集团、北欧化工股份公司。

全球 汽车塑料 市场 预测与区域展望:

市场规模和增长预测:

- 2025年市场规模: 315.8亿美元

- 2026年市场规模: 332亿美元

- 预计市场规模:到 2035 年将达到 549.7 亿美元

- 增长预测: 5.7% 复合年增长率(2026-2035)

主要区域动态:

- 最大地区:亚太地区(到 2035 年占比 46.5%)

- 增长最快的地区:亚太地区

- 主要国家:中国、美国、德国、日本、印度

- 新兴国家:中国、印度、巴西、墨西哥、泰国

Last updated on : 10 September, 2025

汽车塑料市场的增长动力和挑战:

增长动力

- 中等收入人群不断增长——随着中等收入人群的增加,人们开始转向购买升级版车辆,以获得更舒适的驾乘体验。汽车塑料是制造轻量化、省油且道路性能更佳的车辆的有用部件,是人们的首选。因此,随着收入水平的提高,汽车塑料的普及率有望提高,汽车塑料市场也将随之扩张。根据世界银行的数据,全球中等收入人口总数将从2015年的55.1亿增加到2021年的58.6亿。

- 汽车产量升级——根据汽车制造商组织的数据,2021 年全球汽车产量为 8000 万辆。这比 2020 年的 7700 万辆有所增加。

- 人口对电动汽车的需求很高——国际能源署的最新报告指出,2021 年道路上的电动汽车数量为 1650 万辆。

- 全球道路上的车辆数量增加——最近的一份报告估计,到 2022 年第一季度末,全球道路上的车辆数量约为 20 亿辆。

挑战

- 资本和基础设施成本高昂

- 对塑料可回收性的日益关注

- 政府污染物排放政策不断出台

汽车塑料市场规模及预测:

| 报告属性 | 详细信息 |

|---|---|

|

基准年 |

2025 |

|

预测期 |

2026-2035 |

|

复合年增长率 |

5.7% |

|

基准年市场规模(2025年) |

315.8亿美元 |

|

预测年度市场规模(2035年) |

549.7亿美元 |

|

区域范围 |

|

汽车塑料市场细分:

车型细分分析

汽车塑料市场按车型细分,可分为传统汽车和电动汽车,并进行供需分析。其中,预计到2035年,传统汽车市场将占据最大市场份额,这得益于全球乘用车需求的增长。人口增长带来的汽车需求增长。国际汽车制造商组织 (OICA) 预计,2020年全球乘用车销量将达到5300万辆,产量将达到5500万辆。

影响市场增长的主要宏观经济指标

化学工业是经济的重要组成部分。根据美国经济分析局的数据,2020年美国化学产品增加值占GDP的1.9%左右。此外,根据世界银行的数据,2018年美国化学工业占制造业增加值的16.43%。随着最终用户需求的增长,预计未来化学产品市场将会增长。根据联合国环境规划署(UNEP)的数据,预计从2017年到2030年,化学品销售额将几乎翻一番。在目前的情况下,亚太地区是最大的化学品生产和消费地区。中国拥有世界上最大的化学工业,近年来年销售额约超过1.5万亿美元,约占全球销售额的三分之一以上。此外,庞大的消费群体和有利的政府政策也促进了对中国化学工业的投资。低成本原材料和劳动力的便捷获取,加上政府补贴和宽松的环境规范,使其成为全球主要供应商的生产基地。另一方面,根据印度工商联合会 (FICCI) 的数据,2019 年印度化学工业产值达 1630 亿美元,占全球化学工业总产值的 3.4%。印度在全球化学品产量中排名第六。这一统计数据表明,未来几年在亚太国家投资企业将拥有丰厚的回报。

我们对全球市场的深入分析包括以下几个部分:

按产品 |

|

按应用 |

|

按流程 |

|

按车辆类型 |

|

Vishnu Nair

全球业务发展主管根据您的需求定制此报告 — 联系我们的顾问,获取个性化见解和选项。

汽车塑料市场区域分析:

受人口增长、收入水平提升以及汽车产销量高企的推动,到2035年,亚太地区有望占据约46.5%的市场份额。根据国际汽车组织(OICA)发布的统计数据,2021年该地区汽车总产量为4600万辆,而总销量为4200万辆。此外,该地区领先的关键参与者和出口商的存在,预计将对汽车塑料市场产生积极影响。据估计,2021年,亚太地区中国商用车出口量约为40.2万辆,乘用车出口量约为200万辆。

汽车塑料市场参与者:

- 阿科玛

- 公司概况

- 商业策略

- 主要产品

- 财务表现

- 关键绩效指标

- 风险分析

- 近期发展

- 区域影响力

- SWOT分析

- 巴斯夫

- 沙特基础工业公司

- 利安德巴塞尔工业公司

- LG化学

- 杜邦公司

- 科思创股份公司

- 赢创工业股份公司

- 索尔维集团

- 北欧化工公司

最新发展

巴斯夫推出了造型聚合物 Luviset 360,它具有强力、灵活、持久的定型效果以及低剥落和抗污染特性,并可实现新的纹理。

阿科玛已决定收购高性能聚合物、特种聚酰胺和氟聚合物领域的领导者Agiplast。此次收购预计将增强公司在材料循环利用方面为客户提供全方位服务的能力。

- Report ID: 4501

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- 探索关键市场趋势和洞察的预览

- 查看样本数据表和细分分析

- 体验我们可视化数据呈现的质量

- 评估我们的报告结构和研究方法

- 一窥竞争格局分析

- 了解区域预测的呈现方式

- 评估公司概况与基准分析的深度

- 预览可执行洞察如何支持您的战略

探索真实数据和分析

常见问题 (FAQ)

版权所有 © 2026 Research Nester。保留所有权利。