Posted Date : 18 September 2025

Posted by : Sanya Mehra

The international transportation industry is experiencing modifications, with electric bus readily emerging as the vital player in the transition towards sustainable mobility. Besides, cities are grappling with rising fuel expenses, climate change, and the population worldwide, and this is where the concept of electric bus provides an efficient and cleaner alternative to conventional diesel-based fleets.

As per the International Energy Agency (IEA), there has been an increase in the total number of existing electric buses to more than 650,000 on the road as of 2023. China is deliberately leading the implementation, which is followed by North America and Europe. Transit and government agencies are increasingly making investments in electric bus infrastructure, fueled by strict innovation and emission regulations in battery technology.

In this blog, we will explore the evolution of electric bus and its economic along with environmental benefits, challenges in implementation, and future tendencies shaping the overall industry.

The International Transition Towards Electric Bus

Explosive Growth in Adoption

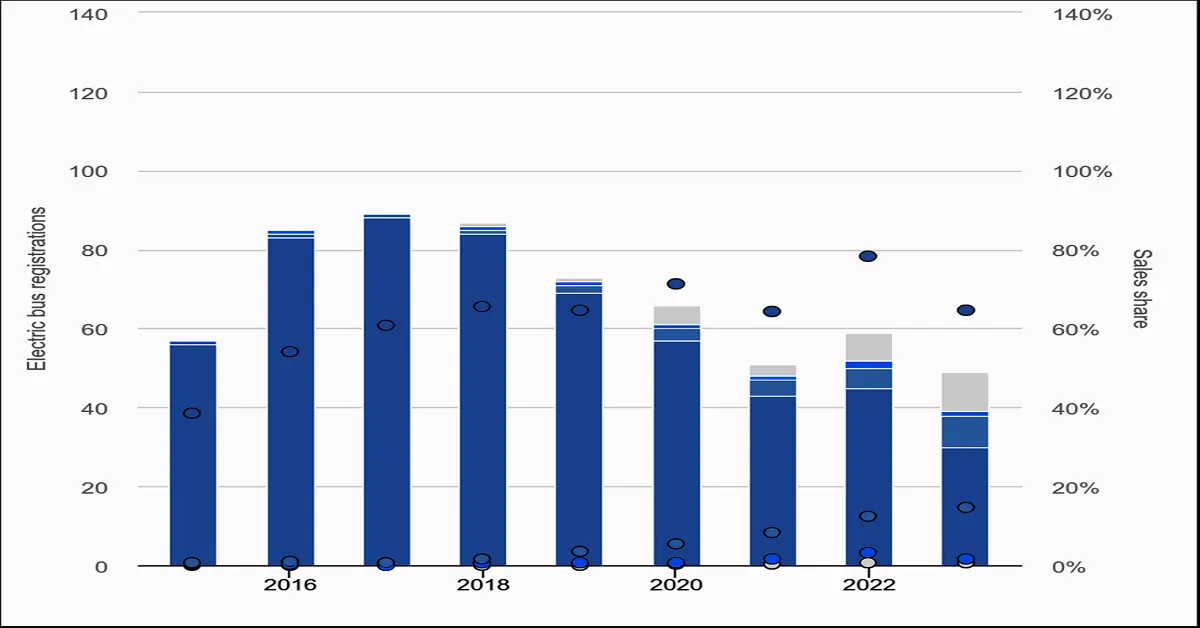

Electric bus is no longer considered a niche technology; instead, it has rapidly emerged as a mainstream innovation. As per the 2023 BloombergNEF article, electric buses cater to more than 55% of the latest buses commercialization in China as of 2022. In addition to this, the country is readily dominating the market, with the existence of over 500,550 electric buses in operation since 2023. Not to forget, Europe is also barging in with an increased adoption, particularly in countries such as France, Germany, and the UK, all are absolutely committed to adapting to electric public transit by 2020 and 2024. When it comes to the U.S., the number of electric buses has increased by more than 5,200 since 2023, with New York and Los Angeles effectively transitioning their fleets. Besides, as stated in the 2024 IEA report, Switzerland, Belgium, Norway, People’s Republic of China gained sales share more than 50% as of 2023, thus increasing the availability of electric buses.

Source: IEA

Source: IEA

Government Policies Driving Change

The participation of governments in integrating policies to stage out fossil fuel-based buses is equally recommendable. For example, the Clean Vehicles Directive initiative by the Europe Union has mandated that an estimated 27% of the newest public buses need to be composed of zero-emission vehicles that have been purchased by 2025. Additionally, the 2021 U.S. Infrastructure Bill has made an allocation of USD 5.3 billion for zero-emission bus facilities, along with charging infrastructure. Last, but not the least, the FAME II scheme in India has successfully subsidized the electric bus component by targeting approximately 50,500 electric buses by the end of 2030. Therefore, all these policies genuinely put focus on the worldwide commitment to diminishing carbon emissions from the public transport sector.

Benefitting the Air for a Greener Tomorrow

There’s no secret that conventional diesel buses are highly responsible for major pollution in cities. In fact, the transportation industry solely accounts for almost 27% of international carbon dioxide emissions. That really is a staggering data, particularly when it comes to considering the aspect of public transit. However, to combat this circumstance, electric bus steps in as the ultimate climactic hero.

How Much Cleaner Are Electric Buses?

The U.S. Department of Energy has stated that a single electric bus diminishes carbon dioxide emissions by approximately 65 to 85 tons every year. This is like taking away almost 15 gas-guzzling cars off the road for each bus. Now imagine if the entire U.S. transit fleet underwent electric- then the global population will be witnessing a boosted 2.5 million tons of emissions on a yearly basis, which is equivalent to planting 38 million trees annually. Besides, it is not just about the emission, diesel buses, in fact, discharged black carbon, which is a super-pollutant that has escalated global warming. Hence, it can be openly determined that electric buses constitute zero tailpipe emissions any day.

The Ripple Effect on Climate Goals

The existence of cities, including London and Los Angeles, has already dedicated themselves to almost 100% electric bus fleets by the end of 2030. This is a huge step, proving that large-scale modification is absolutely possible. Just imagine the international impact if the majority of the cities followed this suit, making this world pollution-free, denoting a small step towards maintaining sustainability.

Diesel Exhaust as the Silent Killer

Diesel-specific buses don’t just pollute the planet; they poison the air people breathe in. Their exhaust is always packed with nitrogen oxide which usually triggers lung disease and asthma. Not to forget, the presence of particulate matter, which is PM2.5, constitutes tiny particles that affect the lungs, which eventually lead to premature death and heart illnesses. Regarding this, the World Health Organization (WHO) has estimated that 4.5 million people die every year from external air pollution, the majority of which is generated from traffic and diesel buses.

Revolution in Public Health

The sudden transition to electric bus is not just about environmental victory, but it is to support and urge for cleaner lungs and longer lives. Electric buses in London have cut down nitrogen oxide emissions by almost 92%, as mentioned in the 2022 Transport for London report. This means that the city has combated a few asthma attacks, emergency visits, and a surge in healthy children. Likewise, in Shenzhen, China, which is considered the primary region for the first-ever electric bus fleet, also witnessed a reduction in air pollution by 50%. So, one can only imagine walking down a street in the city with the absence of contaminants that will no longer irritate one’s throat.

The Economic Bonus

When it comes to air pollution, it just doesn’t affect the lungs, but also drains economies, be it developed or developing. The OECD has proclaimed that pollution-driven healthcare expenses have exceeded USD 5.5 trillion across every nation yearly. Therefore, by reducing the existence of diesel-infused buses, all cities can save millions in terms of lost productivity and essentially for hospital bills. With this saving, the money can be invested in developing parks, schools, and other required infrastructure, especially in low and middle-income regions.

Tackling the Challenges Head-On

Electric bus is the ultimate future, and from a realistic point of view, the future is not always easy. While every nation is striving to adapt to electric buses, there are certain speed bumps on the road that limit the overall electric transit system. Let us break down the challenges and see for ourselves how innovators are tackling these.

- High costs and infrastructure gaps: Electric buses do come with an expensive price tag. In comparison to a diesel bus, which costs approximately USD 500,200, an electric bus usually ranges between USD 750,500 to USD 1.5 million. This denotes almost a 55% to 100% premium, excluding charging stations. Electric buses require customized charging facilities, which include opportunity and depot charging services. Hence, developing this infrastructure is not simple. However, with a drop in prices, battery expenses have reduced by 85.5% since previous years, thus suitable for development.

- Cold weather and range anxiety: Electric buses are accustomed to mild weather conditions rather than freezing temperatures. In such severe weather conditions, the battery range usually drops by 25% to 35%, and the charging speed also slows down. However, most cities are pre-heating batteries before departure, along with adopting indoor heated depots to combat cold soak, and ensure innovation in battery chemistries, such as solid-state, to achieve better performance.

- The electricity crunch: The International Energy Agency (IEA) has warned regarding the replacement of all diesel buses with electric buses, since there will be an increase in the overall electricity need by an estimated 8% to 14%. The solution to this lies in adopting off-peak charging, solar-driven depots, and implementing Vehicle-to-grid (V2G) technology, wherein buses have the capability to store and feed energy.

The Electric Bus Revolution: What’s Next?

The electric bus movement is not only gaining speed, but is also radically evolving at a rapid pace. This movement primarily commenced as a clean alternative option over diesel, which currently has now converted into a high technological aspect. So, what does the future hold for electric buses?

The Rise of Self-Driving Transit

The aspect of digitalization has forced us to imagine entering into a bus with no pedals and wheels, just a silent, self-driving, and smooth electric transport. This definitely sounds scientific, but in reality, it is happening worldwide. For example, BYD has been evaluating autonomous electric buses in Singapore and China, with artificial intelligence integration that can cater to complicated urban traffic. Meanwhile, self-driving electric buses of Volvo are readily trialed in Sweden by utilizing cameras and lidar to ensure safe navigation.

The End of Charging Delays by Battery Breakthroughs

Presently, lithium-ion batteries are decent, but solid-state batteries are on the next level. These provide 3 to 5 times energy density with a long range of almost more than 550 miles per charge, rapid charging facility within 15 to 20 minutes, and safety maintenance. Organizations, such as Toyota and QuantumScape, are racing to introduce these to the market, based on which electric buses will outperform diesel in every possible way. Besides, the battery-swap technology by NIO is being readily adapted, along with FAW Group in China has initiated pilot programs where a bus can switch batteries within 5 minutes. This can eventually combat delays in charging, making the electric bus concept flexible.

Emerging Economies in the Global Domination

The U.S., Europe, and China are deliberately leading, but the next wave of adoption is poised to originate from Chile, wherein Santiago has made plans to provide more than 90% of electric buses by 2040. Similarly, in Cape Town, South Africa, electric buses have been tested to reduce dependency on diesel imports. Likewise, in Colombia, Bogotá comprises the largest electric bus fleet outside of China. Not to overlook, India is equally booming, with more than 10 times expected by the end of 2030, along with the presence of government subsidies, and organizational contributions.

A Fully Electric Future

Experts have predicted that North America and Europe collectively will account for 100% of electric buses between 2035 and 2040. Meanwhile, in China, there have already been more than 52% electric bus sales, which is further projected to be converted by 2030. Based on these instances, the international tipping point accounts for 85% of the latest buses, which will be electric by 2030.

It's Time to Board the Electric Bus

The electric bus revolution is not on its way; it is already here, soundlessly soaring through streets that were once filled with diesel fumes. With manufacturers and the government bolstering the adoption, the transition towards zero emissions is not even a question at present. Of course, there will be obstacles, including battery quirks and charging barriers, but innovation is successfully crushing them. Within almost a decade, electric buses will not be just an alternative; they will be the actual norm that will rewrite urban mobility and cut down emissions. The road is clear with quiet streets, clean air, and smart cities, and what remains outdated is diesel.

Contact Us