Hybrid Vehicle Market Outlook:

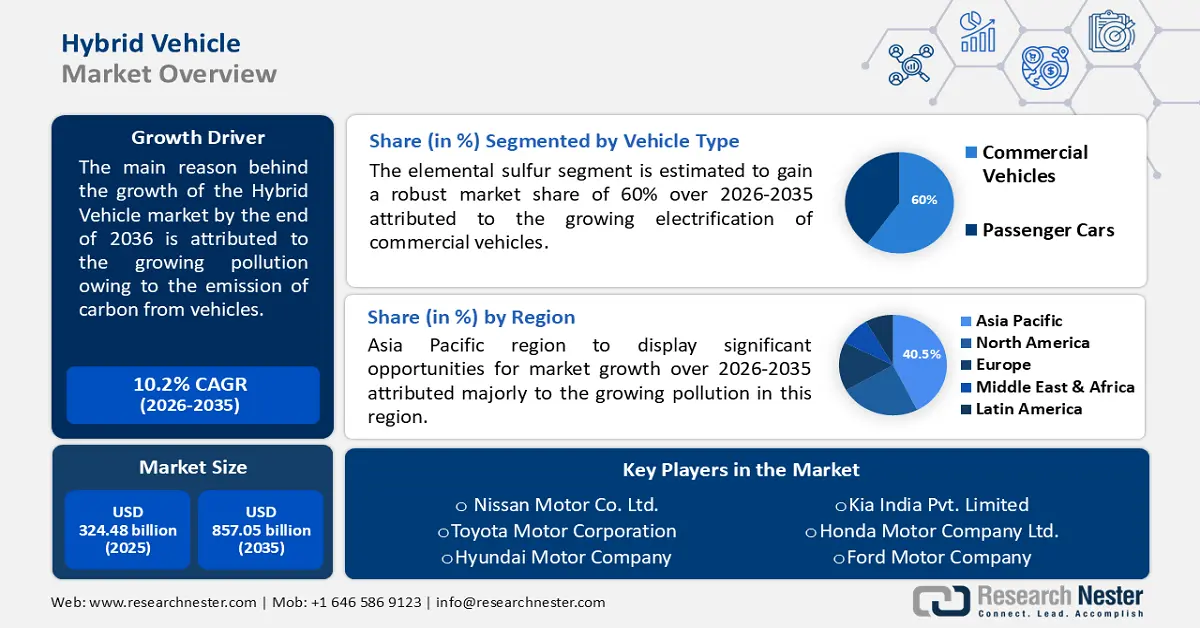

Hybrid Vehicle Market size was over USD 324.48 billion in 2025 and is anticipated to cross USD 857.05 billion by 2035, witnessing more than 10.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of hybrid vehicle is assessed at USD 354.27 billion.

The hybrid vehicle market is primarily driven by the strict emission regulations and environmental policies by regulatory authorities and pollution control boards. Governments worldwide are implementing strict emission norms to combat climate change and minimize air pollution. Regulatory bodies such as the U.S. Environmental Protection Agency (EPA), EU’s Euro 7 standards, China’s New Energy Vehicle (NEV) policy, and U.S. Corporate Average Fuel Economy (CAFÉ) standards have set aggressive carbon emission reduction targets, requiring automakers to develop cleaner alternatives. For instance, new pollution rules issued by the EPA in March 2024 are expected to reduce 7.2 billion tons of CO2 emissions by 2055 and save around USD 62 billion on fuel prices. Thus, the adoption of hybrid electric cars is seen as a practical bridge between traditional ICE cars and fully electric vehicles.

Government incentives such as tax rebates, subsidies, and lower registration fees encourage manufacturers and consumers to adopt hybrid vehicle. For instance, the Federal tax credits and state incentives offered to hybrid vehicle buyers in the U.S. play a key role in the adoption of hybrid vehicle. Additionally, the government of India has invested USD 1.43 billion as a part of the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME II) scheme to encourage electric vehicle sales and support manufacturing. Under this scheme, EV manufacturers in India received a subsidy of USD 637 million for selling over 11,79,669 electric vehicles in December 2023.

Key Hybrid Vehicle Market Insights Summary:

Regional Highlights:

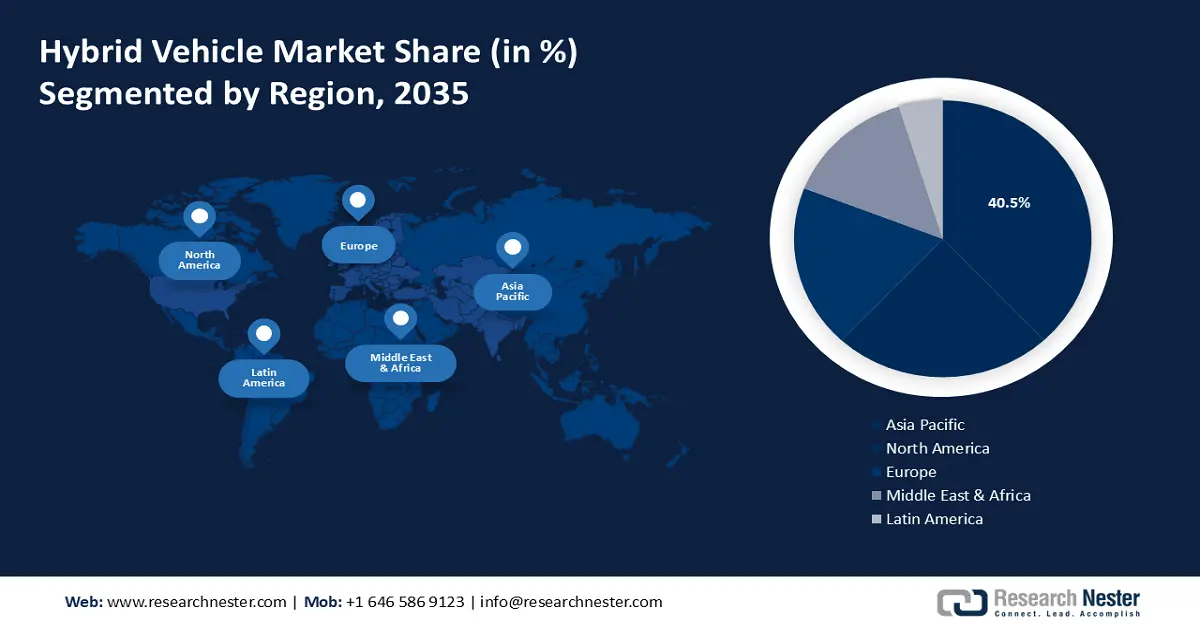

- Asia Pacific hybrid vehicle market is predicted to capture 40.50% share by 2035, driven by rising fuel prices, government incentives, and demand for fuel-efficient vehicles.

- North America hybrid vehicle market will account for significant revenue share by 2035, driven by rising consumer interest in sustainable transportation and stricter emission regulations.

Segment Insights:

- The passenger cars segment in the hybrid vehicle market is forecasted to capture a 60% share by 2035, driven by rising demand for fuel-efficient and environmentally friendly transportation.

Key Growth Trends:

- Rising fuel prices and cost savings

- Advancements in battery and hybrid technology

Major Challenges:

- High manufacturing costs

- Competition from fully electric vehicles

Key Players: BYD Co. Ltd., Chongqing Changan Automobile Co. Ltd., Ford Motor Co, Hyundai Motor Co, Li Auto Inc., Renault SAS.

Global Hybrid Vehicle Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 324.48 billion

- 2026 Market Size: USD 354.27 billion

- Projected Market Size: USD 857.05 billion by 2035

- Growth Forecasts: 10.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: Japan, United States, China, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Mexico

Last updated on : 10 September, 2025

Hybrid Vehicle Market Growth Drivers and Challenges:

Growth Drivers

- Rising fuel prices and cost savings: The fluctuating prices of crude oil significantly impact consumer vehicle choices. HEVs offer better fuel efficiency compared to ICE vehicles, making them an economically viable option. HEVs use regenerative braking which improves fuel economy by capturing energy lost during braking whereas plug-in hybrid vehicle allow users to switch between gasoline and electric power which reduces dependency on fossil fuels. In Australia, hybrid vehicles captured 16.7% of the market share in the third quarter of 2024, outperforming plug-in hybrids and pure electric vehicles. Consumers are turning to hybrids as fuel prices remain volatile making them a cost-effective choice for conscious buyers.

- Advancements in battery and hybrid technology: The efficiency and performance of HEVs have improved significantly due to advancements in battery technology, electric motors, and energy management systems. Innovations in hybrid powertrains contribute to higher energy efficiency through lightweight battery materials and better thermal management. It leads to longer battery life with lithium-ion and solid-state battery developments reducing replacement costs. For instance, in March 2025, Toyota expanded its European electric vehicle lineup by introducing the electric C-HR Plus and updating the bZ4X model. The C-HR Plus offers two battery options i.e., a 57.7 kWh battery with a 455 km range and a 77-kWh battery providing a 600 km range. These advancements in battery technology enhance the capabilities of hybrid and electric vehicles.

- Expanding charging infrastructure and consumer awareness: The global push for EV charging infrastructure is indirectly benefiting HEVs, especially plug-in hybrid vehicle. According to the IBEF Report 2024, the Ministry of Heavy Industries approved a capital subsidy of USD 96.13 million to establish 7,432 Electric Vehicle Public Charging Stations in India under the FAME India scheme. With more charging stations, stronger policy support, and awareness of HEV benefits, consumers and businesses are embracing hybrid technology. The rising awareness also led to an increase in demand for hybrid vehicle. According to the European Automobile Manufacturer’s Association Report of February 2025, new EU registrations of hybrid-electric cars increased by 18.4% in January. This boost marked about 290,014 units registered in the very first month of 2025, accounting for 34.9% of the total EU market share.

Challenges

- High manufacturing costs: Hybrid vehicle require advanced technology including dual powertrains which increases production costs. Moreover, battery production is expensive due to the use of rare materials like lithium, cobalt, and nickel. This is expected to hamper overall sales of hybrid EVs to a certain extent during the forecast period.

- Competition from fully electric vehicles: As EV technology improves and charging infrastructure expands, HEVs face competition from all-electric models. Consumers prefer fully electric models over hybrids due to long-term operating costs and environmental benefits. Hence, HEVs are often seen as a transitional technology rather than a long-term solution. Additionally, the decreasing cost of lithium-ion batteries makes EVs more affordable reducing the price gap between HEVs and EVs. These factors may stand as a limitation posing a threat for the market to grow.

Hybrid Vehicle Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.2% |

|

Base Year Market Size (2025) |

USD 324.48 billion |

|

Forecast Year Market Size (2035) |

USD 857.05 billion |

|

Regional Scope |

|

Hybrid Vehicle Market Segmentation:

Vehicle Type Segment Analysis

Passenger cars segment is estimated to capture hybrid vehicle market share of over 60% by 2035, owing to the rising demand for fuel-efficient and environmentally friendly transportation. The passenger cars segment is dominated by sedans, hatchbacks, and SUVs which offer a balance between performance, cost savings, and low emissions. The increasing urbanization, government incentives, and stricter emission regulations further boost the adoption of hybrid passenger cars. According to a report by the European Automobile Manufacturer’s Association 2023, China dominated the passenger cars production sector by manufacturing 34% of the 69 million cars manufactured worldwide every year, followed by Europe (19%), and North America (15%). Further, advancements in hybrid technology continue to enhance fuel efficiency and driving range, making HEVs an affordable alternative to conventional gasoline-powered vehicles.

Propulsion Segment Analysis

The full HEVs segment in hybrid vehicle market is likely to capture a notable share through 2035 as full hybrid vehicle offer a combination of an internal combustion engine and an electric motor for improved fuel efficiency and reduced emissions. These vehicles can operate on electric power alone for short distances enhancing efficiency in urban driving conditions. Further, the regenerative braking technology in full HEVs optimizes energy use, making full HEVs a real-world alternative to conventional gasoline-powered cars.

Our in-depth analysis of the global hybrid vehicle market includes the following segments:

|

Vehicle type |

|

|

Propulsion |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hybrid Vehicle Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific hybrid vehicle market is expected to capture revenue share of over 40.5% by 2035, due to strict emission regulations, government incentives, and increasing consumer demand for fuel-efficient vehicles. India, China, and Japan lead the market with automakers such as Toyota, Honda, and Hyundai expanding their hybrid offerings. Rising fuel prices and urban air pollution concerns further boost HEV adoption in the region.

The hybrid vehicle market in China is expanding rapidly driven by government policies, rising fuel prices, and increasing demand for fuel-efficient transportation. Automakers such as BYD, Toyota, and Honda are investing in hybrid technology to cater to consumers seeking alternatives to fully electric vehicles. China leads the global space in adopting hybrid vehicle. In the first two months of 2025, car sales increased by 1.3% compared to the same period in 2024 driven by customer subsidies and a developing price war in the smart electric vehicle market. In February 2025, passenger vehicle sales surged by 26.1% year on year following a 12% decrease in January. Notably, new energy vehicles i.e., EVs comprised nearly 48.8% of total car sales in February reflecting China's strong push towards electrification.

The hybrid vehicle market in South Korea is expanding as consumers seek fuel-efficient and eco-friendly alternatives amid rising fuel costs and stricter emission regulations. Leading automakers such as Hyundai and Kia are investing in hybrid technology offering popular models such as Hyundai Sonata and Kia Sorento Hybrid. Moreover, government incentives and tax benefits further encourage HEV adoption. According to data from the transport ministry in 2025, the total number of hybrid vehicles registered reached 2,024,481 in 2024 touching over 2 million units for the first time. This rise in the adoption of hybrid vehicles reflects a shift in consumer behavior contributing to a steady growth of the HEV market in South Korea.

North America Market Insights

North America region is anticipated to observe substantial growth through 2035 owing to increasing demand for fuel efficiency, stricter emission regulations, and rising consumer interest in sustainable transportation. Automakers such as Ford, Toyota, and General Motors are investing in hybrid technology, particularly in the SUV and pickup truck segments. Government incentives and stringent Corporate Average Fuel Economy (CAFÉ) standards are also key reasons for HEV adoption. According to the U.S Energy Information Administration Report 2024, electric vehicle sales and hybrid sales surpassed 16% of total light-duty vehicle sales in the U.S. This increase in the electric and hybrid vehicle market share was primarily due to hybrid vehicle (HEV) sales, which increased by 30.7% year over year.

The hybrid vehicle market in the U.S. is expanding as consumers look for fuel-efficient options without fully transitioning to electric vehicles. According to a report by the U.S. Department of Energy 2024, the sale of hybrid vehicle in the U.S. witnessed a 53% increase from 2022 recording 1.2-million-unit sales. Additionally, automakers are investing in next-generation hybrid powertrains to meet stricter fuel economy standards. Further, the tax incentives provided by the Biden Administration including a USD 7500 tax credit for EV purchases drive the adoption of hybrid vehicles

The hybrid vehicle market in Canada is poised to rise as consumers seek fuel-efficient options suited for the country's diverse climate and long driving distances. Government incentives and stricter emissions regulations are encouraging automakers such as Toyota, Honda, and Ford to expand their hybrid lineups. For instance, in April 2024, Honda announced its plan to invest approximately USD 15 billion to expand its EV chain in Canada, with an EV and a battery plant in Ontario. This expansion by top automaker showcases opportunities for growth in the country especially for Hybrid SUVs and all-wheel drive models.

Hybrid Vehicle Market Players:

- General Motors Co

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Mercedes Benz Group AG

- AB Volvo

- Bayerische Motoren Werke AG

- BYD Co. Ltd.

- Chongqing Changan Automobile Co. Ltd.

- Ford Motor Co.

- Hyundai Motor Co.

- Li Auto Inc.

- Renault SAS

- SAIC Motor Corp. Ltd.

- Stellantis NV

- Volkswagen AG

- Zhejiang Geely Holding Group Co. Ltd

- Tata Sons Pvt. Ltd.

The hybrid vehicle market is highly competitive, led by automakers such as Toyota, Honda, and Nissan. The top automakers are innovating to enhance fuel efficiency and battery technology to boost adoption. As regulations tighten and consumer preferences shift, competition among these industry leaders is growing. Thus, with technological advancements and strategic partnerships, competition in the HEV sector is expected to intensify.

Given below are some leading players in the hybrid vehicle market:

Recent Developments

- In January 2025, Hyundai Motor Group revealed its plan to increase domestic investment by 19% to USD 16.7 billion in South Korea. This investment will mainly focus on research and development for next-generation technology, and the electrification of vehicles, and product

- In November 2024, Mahindra & Mahindra invested USD 4.5 billion to develop two new electric vehicle brands from scratch. This investment is part of the USD 1.6 billion budget the company has set aside for its electric vehicle business between FY22-27. The company based in Mumbai is setting up production at its Chakan plant aiming to manufacture 90,000 units per year of its new Born Electric models i.e., BE 6e and XEV 9e.

- Report ID: 4772

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hybrid Vehicle Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.